Why you need to work ON your practice, not just in it, if it is to be an attractive asset.

In Part I we talked about the EBITDA(BC) formula, multiples and the wild fluctuation in practice valuations over the years.

Now it’s time for some tough love.

The two main reasons practices owners sell below their price expectation

1. The Practice Owner(s) are not financially literate.

Owners do not understand and regularly monitor their key numbers, the bottom line and how they work or fit into a practice owner investment portfolio. They make the fatal mistake of leaving it to their accountant (some less ‘medically experienced’ financial advisers struggle to simply explain their numbers to their client). The blind unknowingly ends up leading the blind.

2. Succession planning is a reluctant ‘afterthought’. Not a ‘planned thought’. This is the most common mistake overlooked when setting up a practice.

Unfortunately for most people, your accountant and lawyers are used only for tax returns and not succession planning purposes. Often, the way a practice is structured can instantly dilute the value of the business. These initial cost savings you may have asked for, usually do more harm than good in the long run.

It is not unusual to see a practice owned by a tax driven family or unit trust. This can create significant but avoidable difficulty and cost at the time of sale. Especially when the numbers and business models do not make sense. I have seen many sales lost due to a lack of openness, transparency and ownership transferability.

From day one, practices MUST be built on commercial grounds that embrace what you want, so you can successfully stay open, monitor and eventually be easily saleable whether you are ready or not.

Ensuring you understand (without having to always ask your lawyer or accountant) that you have the right structures, practice agreements, systems and people in place is a useful start. It is not hard. It is a big mistake to bury your head in the sand and then complain later.

Ultimately, it is your responsibility. You cannot blame anyone else. If you want to, then you should probably resign as an owner for legal reasons. Being an honest fool is not a legal defence, especially when it comes to not acting with a duty of care. Negligence can be a criminal offence.

A good GP holistically educates their patient on their health, similarly your advisers should be there to educate you on your wealth. If you still do not understand your numbers you may have a serious problem/opportunity. New ‘cloud’ technology platforms and services have made understanding your numbers and business much easier to achieve in a manner that is cost-effective and easily accessible.

Valuing your practice is like valuing a child who should stand on their own feet

A high valuation is driven by a number of key “feet standing factors”.

For practice owners, significant blood, sweat and tears are involved in setting up and running a successful practice. Wanting a child to grow up fast can be an emotionally and financially draining exercise. In the end, the process may either hurt or impress you. Ultimately it is something you want to feel proud of and feel a sense of satisfaction too.

To be of value, your practice must demonstrate that it can continue to make a profit without you. It is the ultimate recognition. It is your way to leave your mark and legacy when you are able to pass it to the next generation in at least a ‘going concern’ position. The price should be fair and should reward you for the fruits of your labour and allow those that succeed you to continue your vision. Some of my single site clients have been operating continuously for over 60 years with the intention and vision of continuing indefinitely.

The right practice focus is key

Ultimately, a medical practice owner’s clinical workload should be a choice by design and should be enjoyed. It should set a good example to encourage aspirational owners to buy into and encourage the next generation of young doctors to pursue a pathway in primary care.

Practices where owners earn while they sleep are highly sought after and valued. The GP owners should not be living hand to mouth.

They should not be solely relying on seeing that one additional patient just to meet their overheads. A ball and chain wrapped in red tape is not attractive.

Practice owners should encourage and mentor other providers to help out, not fight for patients. There is plenty of demand around. Practices with more than one owner and providers are worth more. The banks and investors love the shared security of multiple GP owners who put their own houses and livelihoods on the line should one fall ill or die. A lower flight risk of practitioners and patients increases the value of the practice.

In my experience, it is easy to spot the smart ones. These owners make time to research and work ON their practice and not just IN the practice. One day a week to be precise. They have a strong and committed management team. They see being penny wise but pound foolish is not where the smart money is. They understand, there is no point the patient survives but the practice dies. Everyone loses at that point.

They use their time wisely. They are not busy just chasing high-volume consults and saving patient lives. They know that it is not sustainable in the long run without risking burnout, a Medicare audit or one serious medicolegal problem that could wipe them out!

Smart owners are hungry to see and act on the bigger picture. They are in control and want to shape their own future, with a smart internal and external team. They play the long ‘infinite’ game, leverage their time and strategically invest in doing things the right way the first time.

By working smarter and not harder, they can focus on the practice’s future and not just their own. Ultimately, it is about responsibly handing over the baton for the next generation to take over in a safe, sustainable and financial responsible manner.

What should I be doing now?

Should I be doing anything now as a practice owner? The answer is ABSOLUTELY!

Always be ‘ready for sale’ should you ever have to. Selling your practice for a fair value is a long term (3 to 5 year) process. It is not just an event. If your practice is in dying, you will not realise its full value. Nobody wants to buy tickets to the Titanic. Everyone wants to watch a movie with a happy ending.

Ask the right questions, then ask for the right answers in writing!

When it comes to business arrangements and talking to your accountant/lawyer, push your advisers a little harder for some holistic and not just piecemeal advice.

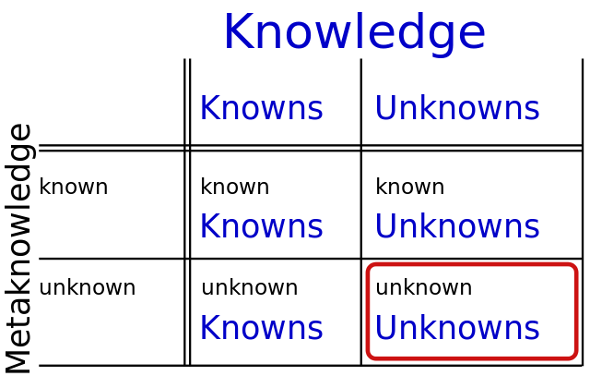

Unfortunately, in my experience, I often hear from advisors “you did not ask me, so I did not tell you”, or “you were on a budget so we did not address that”. This may feel frustrating and unhelpful. You thought that was part of their job. This is made even harder as you do not know what you don’t know.

Donald Rumsfeld famously spoke of the “known unknowns” and “unknown unknowns”.

Be clear about what you need and want

In my experience, I have seen a desperate practice owner give away their practice to a GP on a family holiday trip. The new GP owner did regret taking on!

Some need to get rid of their practice to pay off debts, others sell because they want to retire or strategically secure a new doctor.

At short notice, you should be able to quickly take out and show future doctor owners a solid practice owners agreement along with financial statements that speak for themselves. The documentation should align with your business model and structure. Most owner agreements and structures are fragmented, poorly drafted and inconsistent, so if you are organised, you are already ahead of your competitors. Most purchase offers are time sensitive so you need to be organised.

The practice agreement is like preparing your living will. It should set out the buy in process, decision making procedures, profit sharing and exit arrangements. It should address those tricky issues upfront. It is easier to make an agreement when you are friends and it is impossible if you become enemies.

I often tell my clients that going into business with someone is comparable to marriage. Remember after marriage, the second most important decision you make in life is who you go into business with. Both are expensive in a divorce! These days the process is much easier with templates combined with experienced and qualified advisors. It should pay for itself.

In my experience, it is impossible to negotiate a good deal on the 11th hour especially when you have to change your structures as a result of horrendous tax and legal consequences. It takes time to coordinate your team and advisers.

The process will pay for itself even if you are not planning on selling. You will immediately add more value and create a more sustainable and attractive practice.

Key factors that affect the value of your practice

There is a large difference in the price of a general practice.

If you are still reading this, we are about to enter into some hopefully easy to understand high level key internal and external factors that drive the value of your practice up or down.

Before jumping into those magical valuation formulas, it is important to understand the context and basic principles that drive the value of your practice up or down. Practice value is quantified by these formulas.

The higher the risk and higher the return and less your practice is worth

Often doctors feel ripped off when they are made to pay for goodwill (which is hardly fair) and are more prepared to pay for the tangible assets. The reality is any practice that enjoys a reputation where both their patients and their providers keep returning to their location, then the practice is most likely worth more than the secondhand equipment being bought in the sale. If you can guarantee patients will be in the waiting room on a Monday morning, this is a real intangible value that is bankable.

A fundamental principle in investing and determining the value of your practice or any investment is risk. If the buyer perceives a higher risk the buyer expects a higher return and will offer a lower price for your practice to compensate for any unforeseen financial loss. The hardest bit is to know what risks do and do not exist. The more open and transparent the seller is the lower is the risk.

Practices that are able to simply explain their future value to a potential buyer can expect a higher value for their practice. Like buying a house off the plan, there is little or no money on offer if you have no plan.

People are prepared to pay a higher price for certainty

Hoping somebody will buy you is not a strategy. Wishful thinking will most likely leave you bitterly disappointed. It is not really a choice unless you want to leave a liability and not a legacy behind. Practice owners will have to walk and chew gum on this issue.

It is your choice to decide on what strategy to use in order to drive up fair value for your practice. From “do nothing expect nothing” approach to “do everything the right way” approach. There is potentially no limit to what your practice could be worth. The recent eye watering Healius and Medibank prices paid for general practices are a case in point.

Practices with financially scaleable intellectual property are hard to find. They are worth a lot more than a traditional practice that does not have a clear vision or strategy, less systemised and engaged with all their stakeholders. Your job is to explain this point of difference clearly to a potential buyer.

The greatest risk to buyers is the retention of doctors and the impact of a change of ownership. The aim is to reduce this uncertainty and secure a higher value for your practice.

Know your potential buyer

Is it a corporate, a doctor, a practice manager or non-medical investor?

The capacity and appetite to pay more for your practice will depend on the purchaser’s background. Know what they want first. Surprisingly, doctors are more likely to pay a higher price for other reasons such as control/influence.

For example, corporates generally like larger group practices greater than 8 doctors with room to grow. In my experience and according to corporate financial reports, the optimum size is 12 FTE GP’s per site. Value is increased for multi-disciplinary practices with on-site pharmacy and allied health.

For smaller practices sometimes it is easier and better to look under your nose and simply mentor and sell to your enthusiastic registrar who will rope in their friends. You only need one to set off a chain reaction. Make sure they are a strategic fit and can add value, avoid offering ownership just because they are a high biller. A low billing trusted doctor who teaches and has regular contact with registrars is strategically worth more than a higher biller.

This is why I love teaching practices. You can offer a future and not just a percentage. It is cheaper and the easiest way to recruit and retain quality doctors. Recruitment companies can be useful but come at a cost. Focus solely on recruiting the right culture of owners that share your vision.

Be clear and upfront from day one, put it in writing and you can attract a higher premium on a partial or full sell down of your practice.

Future profitability matters!

Your practice value is based on the future expected profit (earnings) adjusted for unexpected costs. Start with your accountant’s annual profit and loss statement. Where it says net profit, it should be positive and ideally it should increase in accordance with your one pager strategic plan. Certain costs like excessive wages rents paid to related parties like the wife or property trust needs to be adjusted to market value. This may improve your practice value. A low profitability is not always a bad thing. If it can be seen this may lead to higher profitability such as an IT upgrade such as implementing the Doctors Pay Calculator as a new way to recruit and retain doctors.

Future risk matters!

Other hidden costs include but are not limited to pending long service leave, liabilities (e.g. debts and reinvestment required) and litigation risks. My personal favourites are the underpayment of staff wages, payroll and tax office “employee v contractor” risk and pathology rent compliance due to out of date or non-existent documentation. No matter how big or small you are they are poorly understood and implemented correctly in Australia. This is a buying opportunity and not a problem.

Buyers will factor in a $10,000 or up to $1m or more upfront discount depending on how serious your problems are, until it is not worth it. So expect any offer to decrease based on any problems you were aware of or did not attend to prior to a sale.

Ultimately, the basic formula usually stays the same but the number can dramatically change depending on certain material factors as suggested above.

Your valuation numbers are adjusted down or up for a given level of future risk. This is based on an overall risk rating or multiple of earnings for items that cannot be particularised. I call it the gut feeling multiple. I will illustrate this point later.

The bottom line?

In order to secure an accurate value it is important to look at these material factors first as different buyers will use a different multiple to vet any discount offer to mitigate any downside risk.

These are the critical intangibles considering that will enable a practice to secure a premium on sale. Whether it is a sell down or sell out it is a critical provider recruitment and retention strategy

When is the best time to buy or sell?

If you are a buyer

You know what you are doing and have a good business model you can implement rapidly. The best buys are in debt and divorce. As a minimum make sure you are a good strategic fit beyond money. Can you grow the pie?

If you are a seller

You are ready to sell and let go of total control. Either the new owners are a great strategic fit or you are about going into full retirement mode.

A big tip for registrars is to buy from a doctor who trash talks owning any practice. You will get a bargain if you can make them a good offer. Remember they need you in order to sell to the next generation, you are their link.

Conclusion

Due to increasing complexity, there are increasing natural barriers to entry. The demand for quality established practices is high. Due to regulatory and technology reasons, practices are becoming more complicated. Assessing tangible factors such as the building, plant and equipment with intangible factors such as systems and goodwill is increasingly becoming more difficult.

Intangible factors play a greater role than they used to in an increasingly digitised GP world. This is why we see such a large disparity in practice values.

Smart buyers need a good set of financial statements, well documented systems that clearly substantiates your business model. Increasingly this is critical when convincing a potential owner, corporate or a bank manager to pay a fair premium for all your hard work.

If you choose to do it properly, you can become a price maker. You can set your own price. If you choose not to, you become a price taker. Expect buyers to low ball a price by picking out holes in your practice.

When it comes to valuing your practice, understand your business model and structure. Simply explain it. Then you will be in a better position to sell your practice for what it is really worth.

Best of luck to all of you.

Note: This information is for general information and discussion only. I am not a lawyer. Please seek professional experienced and qualified accounting and legal advice and do not act on this information alone.

About me

After a serious work related car accident in 1989, and nine operations later I continue to be a patient and provider advocate. I enter my third decade as a national Chartered Accountant for Medical and Healthcare practices in Australia. I am a former 10-year Australian General Practice Accreditation surveyor. I come from a medico family. I have served on the AAPM national Board and was the inaugural national Chair of the Certified Practice Manager CPM post nominal. I continue to provide accounting tax and practice management advice to many practices all over Australia.

I thank you for this real honour and privilege to serve you and your community through you.