Pulse IT is owned by a global medical software company that competes with some key advertisers and subscribers.

Virtually no media group is truly independent.

Often media ends up captive to its largest advertisers (Harvey Norman and Nine Entertainment) or, even more commonly, to the political views of an owner (Rupert Murdoch and Fox/Sky News).

Rarely, however, do you see media owned by a major advertiser (vendor) of the market it serves.

The only synergy in buying media in the market you serve is marketing, and that will always be fraught with conflict issues around how you treat stories about your own company versus those of your competitors.

Would the obvious trade-off of independence in such a set-up be worth it?

In January or March of 2019, Irish-based medical software group Clanwilliam “made an investment in” the major media vehicle of digital health in Australia and New Zealand, Pulse IT. It did not at the time, and so far has not, publicly declared the nature of that investment (such as whether it was a controlling investment or not).

Recent ASIC document searches confirm that it is now 100% owned by the group.

On spec, it doesn’t look like Clanwilliam wants anyone to know that they own 100% of the major digital health media group in Australia, while also owning a suite of software companies in Australia and New Zealand, some of which compete directly with many of the advertisers and subscribers to the media group.

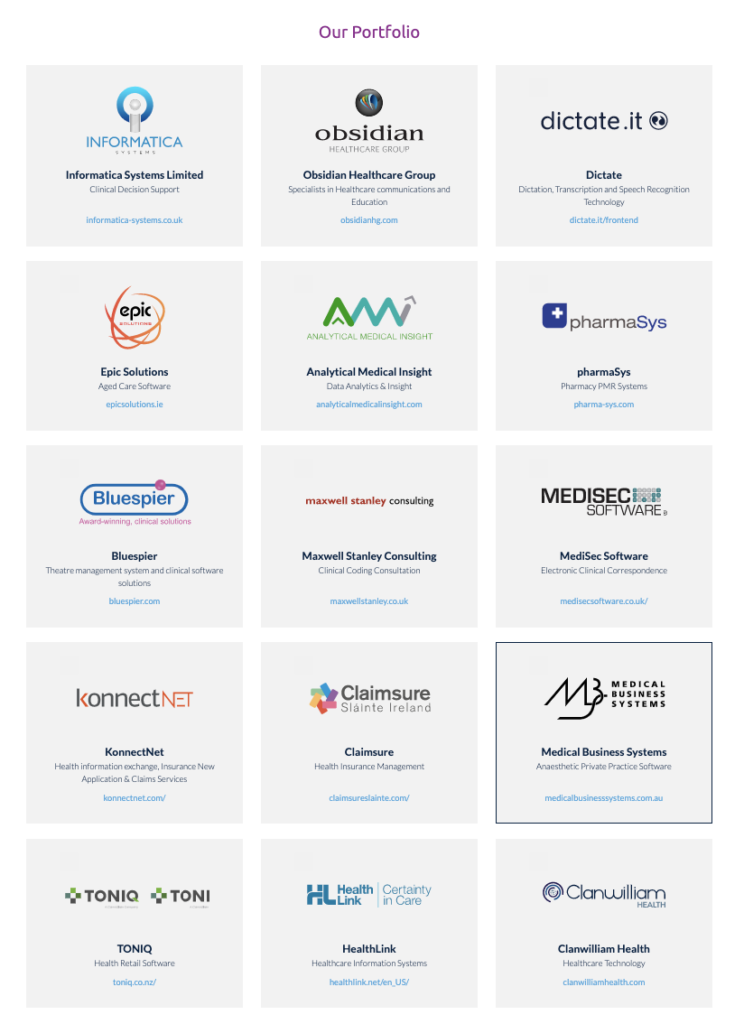

Although 100% owned by the group, Pulse IT does not feature as an owned portfolio company on its global website, like all its other 100% owned companies do.

If you search the Pulse IT website for any mention of Clanwilliam, you only get one story, and it’s not that the group has taken a controlling shareholding of the company (it’s about a Clanwilliam Healthcare software release in New Zealand).

The story about Clanwilliam’s initial investment in Pulse IT was published on Pulse IT in 2019, but it’s not there any more.

That announcement is still accessible as a snippet on the global Clanwilliam site if you do a site search. Notably, the announcement describes Pulse IT as “independent”.

The announcement is dated March 2019, which is when Pulse IT ran its story.

Subsequent to that 2019 announcement, Pulse IT did occasionally feature the following disclaimer when writing about Healthlink, a major secure messaging vendor in Australia and New Zealand owned by Clanwilliam group:

Notably, the disclaimer suggests that Clanwilliam did acquire a controlling shareholding of Pulse IT group in March 2019, when it declared it had made “an investment in” the group.

But this disclaimer stopped appearing on articles potentially in conflict late in 2019.

After the 2019 investment we can only find articles featuring one direct competitor of Healthlink, New Zealand-based BPAC: here is one in June 2020 about the BPAC product, SeNT eReferral software and another last week.

Healthlink also competes in Australia with Argus (Telstra Health), Medical Objects and a raft of upcoming cloud-based start-up alternatives to secure messaging services like Consult Med. We can’t find any articles on those companies after March 2019. (Note: the Pulse IT site has just been replatformed and its search and Google indexing do not appear to be working properly, so these searches may be biased by that problem).

Why, if Pulse IT is truly independent, are there no stories on Medical Objects or Argus which are Healthlink’s biggest competitors, yet there are scores of Healthlink articles?

At least one of those articles on a Healthlink contract in SA implies that Healthlink is providing a service to SA Health that would connect all the secure messaging vendors on behalf of its hospitals, but Healthlink is not doing this. At least one of the other major secure messaging providers has not even been contacted by Healthlink regarding this contract and what this article says it is doing, and has confirmed there is no interoperability at all between the two vendors. In other words the article is misleading in favour of the Clanwilliam owned company, and not favourable to its competitor.

Once you get to 2020, the disclaimer on any Healthlink articles have disappeared altogether, despite the obvious conflict in ownership remaining.

It doesn’t appear on these two articles published by the group on Healthlink, one in 2021 and the other in 2022: HealthLink’s FHIR-powered secure messaging system rolling out in South Australia and Paper route dropped in favour of eReferrals.

Notably, the initial announcement by Clanwilliam in 2019 did not stipulate that it acquired “a controlling shareholding” in Pulse IT. It simply says it “made an investment in” it.

We asked Clanwilliam why the ownership was not declared in the same manner as their other properties on their global site (each feature a logo with a link and summary of their services), why there appears to be no attempt to make the conflict clear on their global site or the Pulse IT site, why it doesn’t feature any stories on its major competitors, and why stories featuring their own companies, or those of their competitors, do not feature a disclaimer as to the potential conflict.

Their response is below:

“Clanwilliam Group, headquartered in Ireland, is, and has been since the acquisition was announced in 2019, the ultimate owner of PulseIT along with over 20 companies globally acquired through investment over the past 25 years. Whilst Clanwilliam Group is the ultimate owner and sponsor of the business since 2019, PulseIT’s management and editorial team have complete editorial independence and autonomy and serve the ANZ healthcare and technology market with utmost integrity.

“All related investment details and ownership matters are fully available on the various company registration websites, available in the public domain, as is required by law in all the jurisdictions in which our portfolio companies operate.”

When the first announcement of an investment was made, many people at the time speculated that Clanwilliam had taken a minor shareholding, probably based on the wording “an investment in”, and the group was still controlled by its founder and previous owner, Simon James.

According to ASIC documents, James started the group 15 years ago and he was the only shareholder at that time. Prior to this, James was an employee of Healthlink, which subsequently was acquired by Clanwilliam, but well before they acquired Pulse IT.

In January 2017, a local holding company for Clanwilliam was established (Clanwilliam Australia Investments – CAI), presumably to make local acquisitions in Australia.

On January 1, 2019, a new company called Pulse IT Communications was registered, which is 100% owned by Clanwilliam Australia Investments (CAI).

In Australia CAI also owns a specialist patient management system, Medical Business Systems. In New Zealand, Clanwilliam owns Healthlink (secure messaging), Toniq (pharmacy software) and Konnect.net (health insurance software). Pulse IT services both the New Zealand and Australian digital health markets.

The directors of CAI and Pulse IT Communications include both the CEO and CFO of Clanwilliam global, based out of Ireland.

It was not initially clear if Pulse IT Communications owned all of Pulse IT after January 2019 and thus controlled it, as James’s original holding company for the group, Pulse IT Magazine, also existed at the time (and continues to exist). James also continued to work at the company as its CEO and as a director of Pulse IT Communications until earlier this year.

Clanwilliam never declared that they had fully “acquired” Pulse IT in any announcement, only that it had “made an investment in” it.

Confused?

It’s a bit confusing, but essentially, it looks like Clanwilliam bought all of Pulse IT way back in January or March of 2019 and retained James to run the group on some sort of earn-out or retainer, likely with a payout if he managed the group to certain KPIs.

ASIC documents and James himself – on his Linked-In profile – confirm that he ceased to have anything to do with the company in June this year. James stepped down as a director of the company on April 14, according to ASIC documents (an event which initially sparked an interest in this story). His LinkedIn profile says he stopped working as a consultant to the company as late as June this year.

The only remaining information connecting the two companies outside of searching the ASIC registers is the old PR snippet on the global Clanwilliam site, which can be accessed in a site-wide search. But the snippet does not reveal the nature of the ownership, just that the group made an investment in Pulse IT in 2019.

All of this would suggest that the major media group for digital health in Australia has been owned by the company that owns one of the major infrastructure software vendors in the country, and a few minor ones as well, since 2019.

The lack of any public footprint of declaration of full ownership by Clanwilliam, including leaving it out of its portfolio on its own website, hints that the company might prefer that its competitors aren’t alert to the fact that they own the media in the market they compete in.

Our ownership and interests:

Wild Health, where this story first appeared, is a brand of healthcare media group The Moose Republic Pty Ltd, which also owns The Medical Republic. Its brands provide media services to GPs, specialists, hospital clinicians and digital health professionals. It is 80% owned by its founders, who still work in the business, 10% owned by Tonic Health Media, a consumer health information group, and 10% owned by HealthEd, a GP medical education group. The author is a non-executive director (unpaid) of cloud healthcare group Medirecords and holds a minor shareholding in that group (less than 1%).

Early Bird tickets for Wild Health’s next event, No better time to align our digital health strategy with our health reform agenda, must end on 1 September. Book now to ensure you don’t miss out on discounted tickets.

Corrections and Clarifications:

Following a comment from the ex owner of PULSE IT, which only sought to cast aspersions on this article and how it was written (no claims as to what was wrong), Wild Health has received a long list of complaints from PULSE IT itself about the article.

We are publish corrections and clarifications pointed out in this response where appropriate below, but not the full list, as, much of it is attempting to throw smoke over an important issue with either false claims or irrelevant points. Some of the response is defamatory in our view which we won’t publish either.

Before we get to the clarifications it is probably important to restate the key facts of this article, that the major media vehicle for digital health media in this country and New Zealand is:

- Owned by a major global software vendor, whose companies service both countries extensively

- On the websites of this vendor and PULSE IT, it is not immediately obvious, as it should be, that this serious conflict is in play

- The vendor never declared publicly its full ownership of PULSE IT, despite this occurring as far back as 2019 and despite it owning the major media vehicle in the industry once it did acquire it. It did make a statement that it had “made and investment in” PULSE IT.

- PULSE IT publishes stories about the companies of this vendor and fails to put a disclaimer on all those articles. It does put a disclaimer on some of the articles. It has claimed in its comments to us it does it on all articles. It doesn’t. But it should.

- PULSE IT publishes many stories where competitors are mentioned, and whether they are mentioned in a good light or not, PULSE IT fails again to publish disclaimers as to the conflict that exists in its ownership

Overall, whether this global vendor is being transparent in its ownership of the major media vehicle in digital health or not, it is in conflict owning it regardless. How can any reader, or competing vendor trust what is being said about a company owned by this vendor, or what is being said about companies that compete with that vendor’s companies? The ownership means quite simply you can’t.

While PULSE IT is owned by a market supplier it should at the least audit every article it has published since the full acquisition in early 2019 and post a proper disclaimer on every article that features a company owned by its owner, and on every article in which a potential competitor is featured. They should do this moving forward also. They and their owner should also make it very clear on each website – easy to see on the home page, and access via search – the nature of the relationship between the two companies.

Here are the clarifications and corrections from PULSE IT:

- PULSE IT appears a second time on the ClanWilliam site which we did not point out. We asked why it didn’t appear like the other companies on the front page as a major box with links. PULSE IT has pointed out that if you go to the “about” page, and scoll to the bottom of this page (quite a long way), and then read the acquisition time line chart, PULSE IT is there as an icon on that chart as being acquired in 2019. That is here if you want to judge how clear it is for yourself versus all the other portfolio companies owned by the group: https://www.clanwilliamgroup.com/about/

- Ownership of Clanwilliam does in fact appear on the PULSE IT website. The article said it did orginally but it had disappeared. The information was not accessible in a search at the time of writing the article, but if you go to the About Page of PULSE IT, and scroll to the bottom, the second last line of the page states: “In 2019 Pulse+IT joined the Clanwilliam Group, a global leader in healthcare technology and services”. We are not able to say how long that statement has been there. Our question btw was “why is the ownership not made clear to readers?”. One line buried at the bottom of the about page is possibly not the necessary level of “clear” given the conflict in play.

- There are some articles of articles featuring competitors written post 2019 in PULSE IT, which we could not find (we did point out that the search may not be working on the new site in the article). They sent us these as examples:

https://www.pulseit.news/australian-digital-health/two-way-secure-messaging-volumes-growing-12pc-a-month-in-victoria/

https://www.pulseit.news/aged-community-disabled-care/global-health-expands-vic-community-health-footprint-with-latrobe-contract/

https://www.pulseit.news/australian-digital-health/hunter-new-england-region-rolls-out-sent-ereferrals/

https://www.pulseit.news/australian-digital-health/app-for-air-secure-messaging-and-api-gateway-on-the-adha-agenda-for-2021/

We note that there is still virtually nothing on Medical Objects, and the ratio of articles on Healthlink versus Medical Objects, Argus, and lots of start ups in the referral space, is not close to being representative of the market share of each of these companies. If Medical Objects for example, has a big share of the Australian market, which it has, why does it virtually never feature in stories?

4.The PULSE IT website was not working when we did the originally article. We pointed out this possibility in the article at the time.

PULSE informed us they get over 30 results on the working search. They provided us with a link which works and does point to Clanwilliam articles HERE: https://www.pulseit.news/?s=Clanwilliam.

Notably, in most (not all) of these articles, there is a disclaimer. We are also not able to determine now what did and didn’t have disclaimers prior to us writing this article. Regardless, not everything has a disclaimer still. PULSE IT sent us one link with a disclaimer on an article which did not have the disclaimer on it a few weeks back.

5.PULSE IT pointed out that the article had erroneously said Simon James had been an “employee” of Healthlink. According to PULSE IT, he was a “consultant” working for Healthlink.