A quick explainer on how your income will be affected.

As accountants, we know that tax can be just a little boring at times. But when it comes to tax cuts? Well, things just got a bit more interesting …

Do you know what the upcoming new stage 3 tax cuts will mean for you?

You’ve probably seen a lot of information floating around with different percentages, thresholds, and income levels.

We’re here to give you the clear and simple facts on what the tax changes will likely look like for everyone.

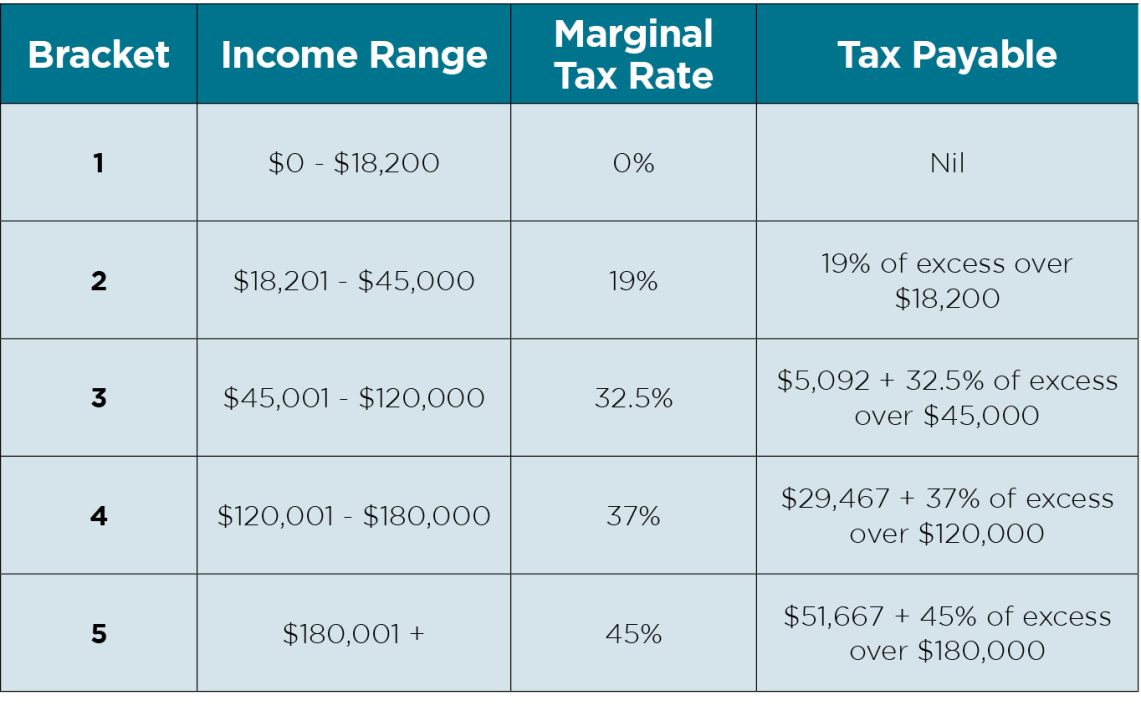

Here’s a quick refresher on what our current income tax system looks like.

The first $18,200 of your income is not taxable. This amount of money is not taken into account when calculating your tax rate.

There are then four tax brackets based on your income level.

- 19% of earnings between $18,201 and $45,000.

- 32.5% of earnings between $45,001 and $120,000.

- 37% of earnings between $120,001 and $180,000.

- 45% of earnings above $180,000.

Current tax brackets:

What are the stage 3 tax cuts?

These cuts are either changes in the amount of money you are required to pay on your taxable income, or they are changes to the threshold at which you would start paying on taxable income. You might often see them compared to the previous iteration of these plans. We’ll talk about what the differences between the two plans are in this article.

What does this mean for you?

Well, it depends on your income level. Your tax rate may change, or you may no longer be within a certain threshold so you will be paying a different rate.

What do I need to do?

Speaking to your accountant is always a great first step. The tax cuts are unlikely to make a huge difference to your financial strategy or goals, however they are definitely something you should be aware of to ensure your taxes are filed correctly and you’re paying the correct amount of tax.

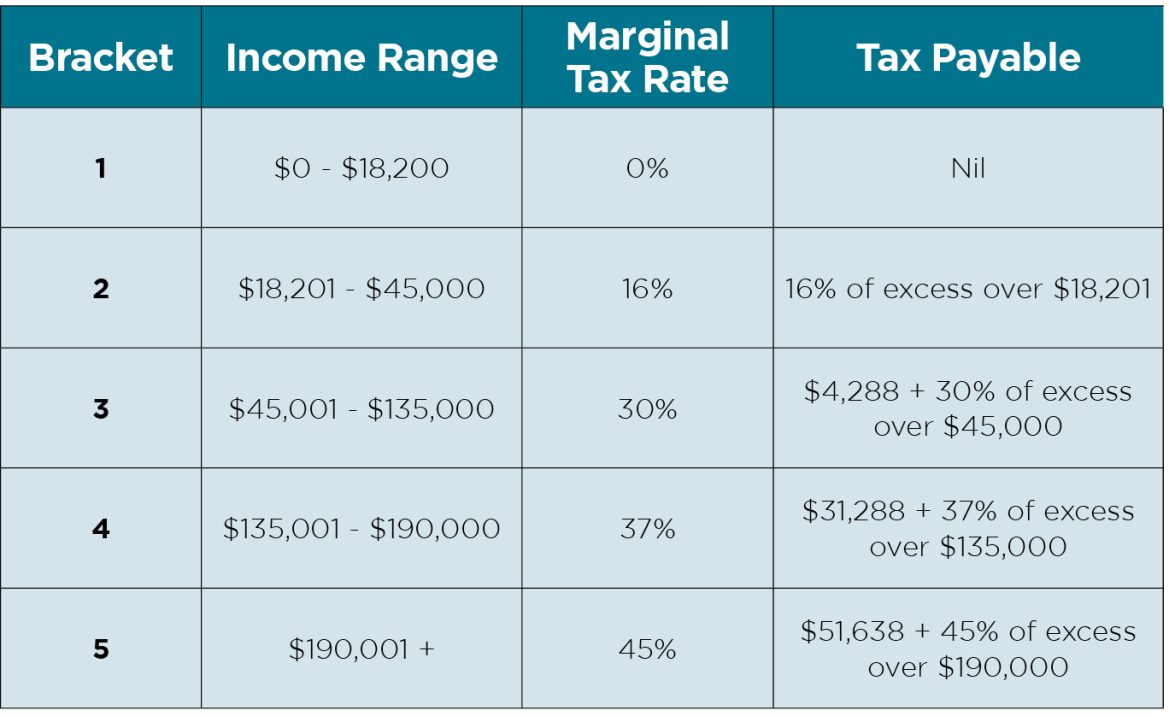

What are the key changes in the stage 3 tax cuts?

Something to remember is that these plans are not yet implemented.

You will not pay tax on the first $18,200 that you earn; this will remain unchanged.

The 19% tax rate on incomes of $18,201-$45,000 is being cut to 16%. This will save $804 for those on a taxable income of $45,000.

The 32.5% rate on incomes $45,001-$135,000 is being cut to 30%.

The 37% rate is staying the same, but the threshold for it to apply is being increased to $135,000 and capping at $190,000.

The 45% tax rate is also staying the same, but the threshold is now increased to $190,000 and above ($10,000 less than in the original plans, but $10,000 more than the current tax rate)

Brackets from 1 July with revised stage 3 tax cuts:

What’s the aim?

The tax savings have been distributed more widely, with a stronger focus on low and middle income taxpayers. The total cost of the tax cut package remains the same as the original plans.

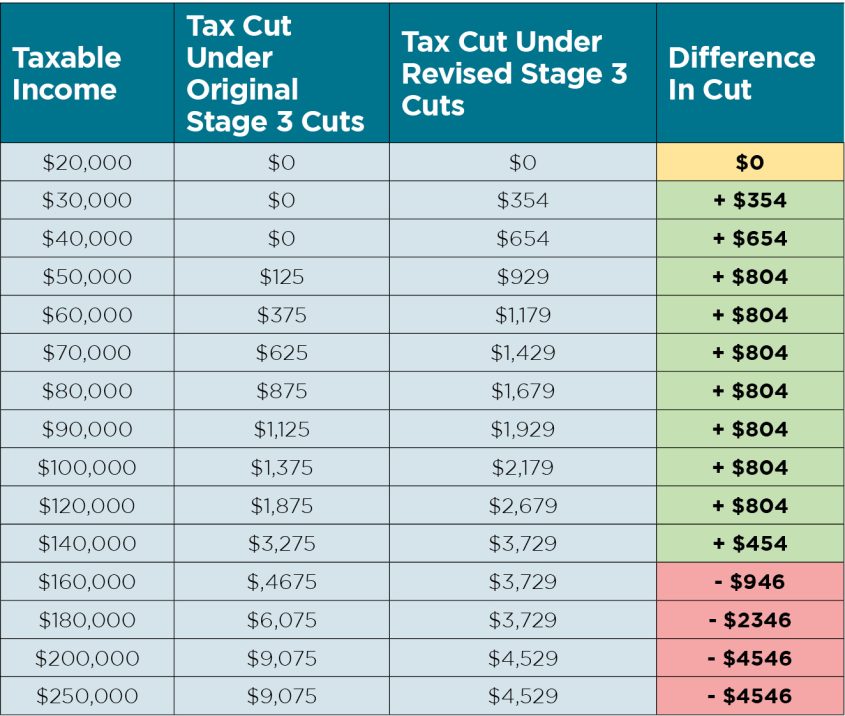

What’s the difference between the original cuts and the new ones?

If you earn between $20,000 and $140,000 you’ll be getting a better tax cut than the original stage 3 plans. However, if you’re earning $160,000 or more, you’ll be getting a smaller cut than originally planned, but a tax cut nonetheless.

Please remember when reading the chart below, the “difference” column is representing the change in the tax cut amount when comparing the original tax cuts and the new tax cuts. It is not saying how much money you’ll gain or lose from the new cuts.

The good news is, nobody will end up paying more tax with these new stage 3 tax cuts when compared to the tax you currently pay.

If you would like to discuss your financial situation further, we encourage you to book a free, no-obligation consultation with one of our dpm tax accountants here.

Anthony Dickinson is a tax consultant and chartered accountant at DPM.