Canberra needs to cut red tape to get medtech to consumers and keep innovation at home, the MTAA chief says.

Australia is losing groundbreaking medical technologies to overseas markets due to “gaps and flaws” in the process to launch them at home, says a leading expert.

Health Minister Mark Butler launched a Value of MedTech report last month as industry players converged on Canberra, but old parliamentary recommendations were still left hanging.

And while Medical Technology Association of Australia chief executive Ian Burgess said the new report quantified the contribution of medical technology (medtech) to Australia’s bottom line, the government needed to prioritise recommendations made in another report released in 2021.

He told The Medical Republic that it was an effort to streamline bureaucratic processes that stymie getting medtech, such as incubators, heart valves and wearable diagnostics, to consumers.

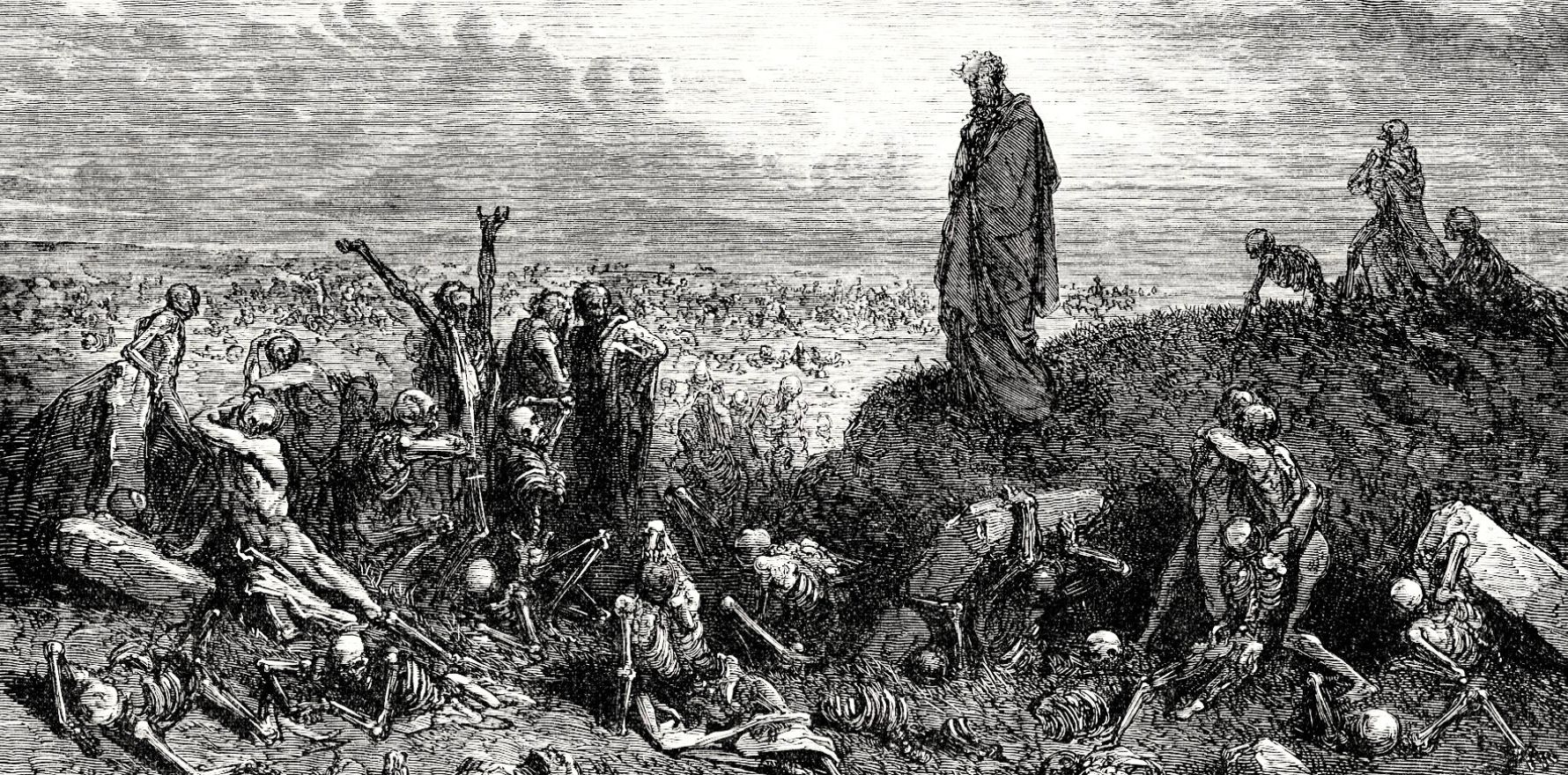

“We’ve got a vibrant, thriving, local R&D and innovation sector but there can be a Valley of Death along the way where we lose those technologies. They just fall by the wayside, or we lose them overseas,” Mr Burgess said.

He called on the government to implement the recommendations of The New Frontier report, released in November 2021, created by the parliamentary inquiry into approval processes for new drugs and medtech in Australia.

“Out of 31 recommendations only one has been actioned. Whilst that may have been latched on to as ‘action’, we want to see the recommendations that actually improve patient access to be implemented,” Mr Burgess said.

Mr Burgess said Australian consumers and industry were missing out because getting medtech to market was an arduous process with “lot of gaps and flaws in the process”.

Even getting existing medical technologies to market was “arduous”, he said.

“The first market access point – getting Therapeutic Goods Administration approval – is often a longer process than other countries,” Mr Burgess said.

“Once you’ve TGA approval, getting it funded, for example through private health insurance, it can be a delay of years just to go through that funding process.”

By the time assessment and reimbursement were attained by some medtech, their technologies has gone out of date.

The assessment processes around reimbursement for emerging technologies in the private and public health system needs to be better defined.

“They are not fit for purpose,” Mr Burgess said.

Consequently, many emerging medtech companies that have been supported through government funded incubators, relocated overseas to markets that have clear frameworks for how technologies and medical devices were assessed and paid for.

The Value of MedTech report, undertaken by Nous Group, was commissioned by the Medical Technology Association of Australia (MTAA). Mr Burgess said the report revealed new metrics on the extent of local development.

“Although the majority of medical technologies are imported, 71% of all med tech companies and had some level of local development,” he said.

“There’s 394 clinical trials for medtech underway or starting in the next 12 months, in Australia,” he said.

The report showed the ways medical technology supports Australia’s health, innovation and economy bringing $5.4 billion to the GDP in 2020/21. The report also revealed that half the 68,000 jobs in medtech were filled by women.

The report was launched by Health Minister Mark Butler MP at the MTAA roadshow in Canberra last month, where medtech industry rubbed shoulders with politicians and senior bureacrats.

Speaking at the event, Mr Butler said he would look at The New Frontier report’s recommendations closely.

Mr Burgess is “cautiously optimistic” but that the longer it took, the more patients were missing out.

“It’s ultimately all about improving patient outcomes [but] it’s not going to happen overnight. So, we’re going to keep hitting our head against the wall for while yet to get that change,” he said.