NSW and ACT ad lib on payroll tax, why pathology rents could rise and more PRODA confusion.

There wasn’t a lot of love on social media last week from certain parties for my last column on there being only one way out for anyone running a services entity model.

Confusion seems to be the one constant, which is not surprising, because what is going on has a lot of moving parts. Payroll tax is a nonsensical tax anyway, doctors and owners naturally want to interpret the accounting and law in play and it’s way too complex to try that without good professional help. Services Australia seems to be adding to the confusion via some pretty weird changes to how you enrol for PRODA and HPOS, both precursors for MyMedicare eligibility.

What is apparent from listening to some of the webinars being run to sort out the confusion and reading comments on some of these stories in the media, is that there is a widespread lack of understanding of some of the basics. Even things as simple as what is a practice, a service entity, a contractor, or a tenant doctor.

In one webinar run by the South Australian arm of the RACGP some speakers were referring to a “general practice” as being liable for payroll tax.

“General practices” in the strictest sense are there to serve patients directly. Service entities, which is the dominant structure where GPs are working across the countries, effectively as tenants, exist to serve GPs, like Westfield is a service provider to all the shops in a shopping centre. In this respect, a sole proprietor GP who is a tenant doctor to a service entity can be a “general practice” – so you can see why people are getting lost.

Unfortunately, in the emerging game of payroll tax audits, getting terminology right is becoming important. There’s some irony in this observation because if you read further on, it looks like Services Australia are in a world of pain trying to understand the accounting terminology as well.

Some advisors are telling their clients running service entities to stop calling themselves a “medical practice” even, as it too is misleading and looks bad to a state revenue office (it can imply a service entity is serving patients not doctors).

They are suggesting renaming the entities with terms like “medical precinct, hub or complex” as it follows the “shopping centre” idiom. “Medical Centre/Practice” may not be OK, which is why the headings of each ruling cleverly refer to the “Medical Centre” ruling. They are taking a special aim at these poorly established arrangements according to some advisors.

If you as a business imply or advertise that you provide medical or healthcare services, you are straight away implying that you are employing or sub-contracting a regulated healthcare provider.

Advisors are also warning that a service entity website should get these terms right and that they should usually not be advertising anything to patients directly. If you Google your local GP you’ll find lots of these errors still being made.

The SA webinar also referred to GP contractors, which is probably also not right either. In a services entity setup, the contractor is more likely the services entity, not the doctor (the doctor is contracting the entity for services, like Coles might contract Westfield for services in a shopping centre complex).

Another key point of confusion which emerged on social media this week is whether a services entity giving in and starting to pay payroll tax might trigger income tax issues for the tenant doctors, as was suggested in my last column and previously.

On social media this week this post appeared with respect to that point:

“ [The] article is unnecessarily inflammatory and accusatory and makes some bold claims. Can you give us a published example, or ruling, or case law where a State Gov ruling that a tenant doctors contract was ‘relevant’ for payroll tax (and had to pay) that has led to the ATO then investigating and calling them an employee and therefore changing federal tax liabilities. State gov aren’t calling tenant doctors employees. They are just saying it is a relevant contract.”

It’s an important point to be raising: would moving to pay payroll tax make all the tenant doctors potentially liable for income tax liabilities with the ATO for the entire time they have been tenant doctors in the entity?

It won’t always, but there is a lot of devil in the detail here so a broad statement that it won’t ever is probably not going to help this situation.

As I always point out I’m not an expert or professional advisor, so get that advice on this stuff.

But I’m pretty sure the person making this comment isn’t either, as almost certainly the potential exists for this to happen via data matching based on several recent High Court cases clarifying how the ATO deems someone is an employee or not.

Many are not aware of a recent ATO ruling on how it classifies workers that actually helps to answer this question. Check it, as if you go to paying payroll tax and you aren’t set up correctly you can risk cancelling your contract doctors’ ABN’s and GST registration.

In general, if a services entity converting to paying payroll tax has not got its services contracts with its doctors nailed down extremely tightly you can incur these problems, despite what social media might be telling you.

As usual with payroll tax, nothing is black and white.

To answer the commenter, no, there isn’t a case so far where this has happened, but it’s obvious why: we haven’t had that GP case yet because we are very early on in the journey we are on as far as payroll tax goes.

If we start getting lots of service entities giving in and paying payroll tax we will find out pretty quickly whether the ATO, which has a lot of discretion in how it interprets contracts as being employee contracts or not, thinks that converting entities have got their tenant doctors contracts right or not.

And if they decide if they don’t?

Well, that’s going to be one terrible case of “we shoulda thought more carefully about that”, which feels like how mostly everyone ignored the enormous implications of the Optical Superstore case, which established most of the principles of what was going to wrong here as far back as 2018, but was ignored initially.

Perhaps one of the biggest ongoing confusions is payroll tax amnesties, and from NSW, the amnesty you have when you’re not having an amnesty, a “pause”.

And the ACT? Well, that looks like incompetent politicians trying on a bit of standover. Just how idiotic and ill thought out the ACT initiative is gives us all an idea of how bad things can get when politicians who have no clue about accounting, the law and the history of general practice business management decide to pile on in an already confusing situation.

The bottom line for the ACT is that barely any practice can afford to increase to the required 65% of bulk billing, and in the end the ACT government has no clue if any practices there are liable or not anyway. For all they know, most practices would pass an audit.

But the ACT government is carrying on like it’s a done deal that every practice is liable, which is simply naive and unhelpful.

What’s worse, the ACT is asking every general practice services entity owner to start enforcing bulk-billing rates on its GPs – exactly the kind of employer-like behaviour that makes you more likely to be liable for payroll tax in the first place.

It certainly isn’t coming across as a government that understands anything about the plight of GPs and GP medical centres, or cares. It looks stupid and greedy.

Leaving aside the ACT, are amnesties and pauses a good thing or not? And given we now have Queensland, NSW and SA on one or the other, is this at all likely to lead to a change in the law for doctors on payroll tax as the RACGP and the AMA say they are pursuing?

My (again inexpert) assessment here is that “amnesties” are bad but a “pause” is pretty good, especially as it seems NSW is not going to put any conditions around its pause as Queensland and SA have put around their amnesties.

The amnesties have terms and conditions associated with them and if you opt for one you have to lift your dress and show the SRO everything that is going on now. Without any time to assess how robust your services entity setup might be, this is handing over information which I doubt any professional advisor would advise you hand over at this point of time.

If you aren’t set up right, the SRO has you stone dead, and you’ll probably need to convert to paying payroll tax, with all the possible downstream issues that can cause you, and of course the significant ongoing extra cost.

Also, in the Queensland and SA amnesties, the terms are set out in a manner that if you do own up, you can still miss out on the actual amnesty and get assessed backwards. Everyone needs to read the fine print.

A “pause” on the other hand, if it stays as just a casual “pause,” might be good.

Essentially it gives all the entities in NSW a year’s grace to look at their setup and fix it if they need to without having to dob yourself in for anything.

I doubt the NSW SRO is very happy with its political masters. It’s naïve as well. It looks and feels like a cave-in from an inexperienced new government – not that it isn’t nice to have something go GPs’ way for once and see the RACGP and AMA have a political win.

There is zero evidence that payroll tax audits are causing a drop in bulk billing rates – that is coming from years of other government forms of neglect – but the RACGP and AMA threat that it is happening or will happen seems to have been enough to get the NSW government to hit that pause button.

It’s a good win for the college and AMA and their various politickers.

NSW RACGP chair Professor Charlotte Hespe did a pretty good job of bluffing here on Network Ten’s The Project. It was nothing if not brave. She must have put a pretty big target on her back as far as the NSW SRO goes saying she is upping her fees to pay for payroll tax.

There is possibly only one problem with NSW’s pause.

It may lull some service entity owners into thinking that the AMA and RACGP can get the law changed one day so some owners either don’t do anything and keep waiting (unlikely any would be that naïve now, though) or they remain slow to react given they’ve all now got a year’s grace.

Payroll tax is a big problem outside of general practice for other professional groups set up in a similar way.

Try to find just one accountant defending all these other entities in other markets who will say to you they think state governments will end up changing the law just for doctors (strictly, the small businesses with which doctors work).

You won’t.

Which means that the amnesties and pause are at best buying time on this problem.

There is still only way out: assess your situation and fix it with the time you have.

Herein might lay one of the biggest issues and confusions in the payroll tax debate: the RACGP and the AMA, and now a lot of governments continue to view the state SRO rulings as law, and for some reason keep saying to their constituents that no one is going to be able to escape this tax.

This is very dangerous misinformation from groups that should know a lot better.

A lot of practices have been audited and passed, and others have been audited and assessed for a lot of back tax, then fought the SROs and won.

It’s hard to understand why the RACGP and the AMA do not give their members much better information on how the services entity structure can be completely non-liable under all the new payroll tax rulings.

It feels wholly political to stand only on a position of “it’s a bad new tax so we need to get rid of it”. If it’s not and they really still don’t understand the accounting and the law properly then it’s one of their biggest misses in decades.

More PRODA confusion

We wrote a few weeks back about how the precursor enrolment protocols to get yourself into MyMedicare could easily set up an audit trail that a payroll tax office might use one day in an assessment.

We understand that various stakeholders, including some elements from within the RACGP, have been talking to DoHAC and Services Australia about the issue in an attempt to lessen the confusion

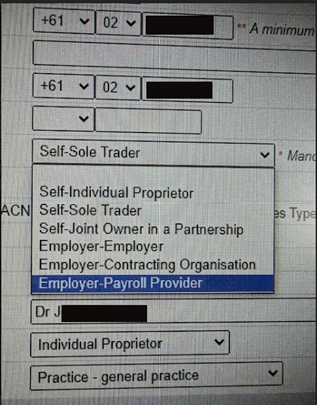

And last week, one practice trying to redo their PRODA profile suddenly ran into the following screen:

Where once there were only two choices here, and no explanation as to what to pick depending on your signup circumstances (are you a tenant doctor, an employee doctor, a services entity etc), now apparently you have all these choices.

The only problem is, what do any of these terms mean?

We asked some accountants and while there are some terms that are obvious – sole trader for instance – the associated “self” and “employer” tags render most of the terms nonsensical in terms of tax accounting.

As an example, “Employer – Contracting Organisation”, doesn’t make a tonne of sense and feels like it has a lot of potential to create a lot of confusion. Surely if you are a contracting organisation, you shouldn’t be an employer as well in terms of setting up an audit trail on payroll tax?

“Employer – Employer” is reasonably clear, notwithstanding.

If the accountants don’t understand what is going on here, how could a doctor or practice owner?

More explanation is probably needed here from Services Australia.

At least they are thinking harder about the problem of business entity identification in PRODA and HPOS enrolment. This is a further concern if they are incorrectly linked to their ABN. This may slow down the government’s enrolment process.

As well as a better definition of what these terms actually mean to SA, it would be interesting to know the origin of the terms.

We will ask this week and get back to you.

On the upside, pathology rents might be undercooked

If you’re a service entity owner who rents some space to a pathology lab, then it might be worth your while to download the decision this week in Chief Executive Medicare on behalf of Commonwealth of Australia v Healius Pathology Pty Ltd and read through the fine print.

At first glance this case didn’t seem like it would be good for service entity owners because Medicare was going after a pathology lab for paying over the odds for their space. If Medicare won, then surely this might be bad across the board for owners in general.

But it was a strange case and restricted to a few wild examples of alleged overpayment (the judgement ended up saying they were five times higher than a normal commercial value).

As a part of the case the Commonwealth got a few expert opinions on what is a commercial rent for pathology space and in these assessments there might be quite a bit of upside for owners.

While these assessments turned out to be significantly under what Healius had been paying for the centres in the case, according to one GP advisory principal, David Dahm of Health and Life, they are probably quite a bit higher per square metre than what many entity owners are getting for their rent now.

“If you actually read the judgement and the fine print, a lot of people are going to start to realise that their own pathology rents are probably undervalued,” he told us.

Dahm thinks that the given the valuations that the judge found to be correct were done on behalf of Medicare by several experts, and they exist as precedent in a court case, owners now have a form of benchmark they can use in any future negotiations they might have with their leases.

If Dahm is right, the case may have backfired on all the big pathology labs, not just Healius, and end up offering a rare upside in income for service entity owners.