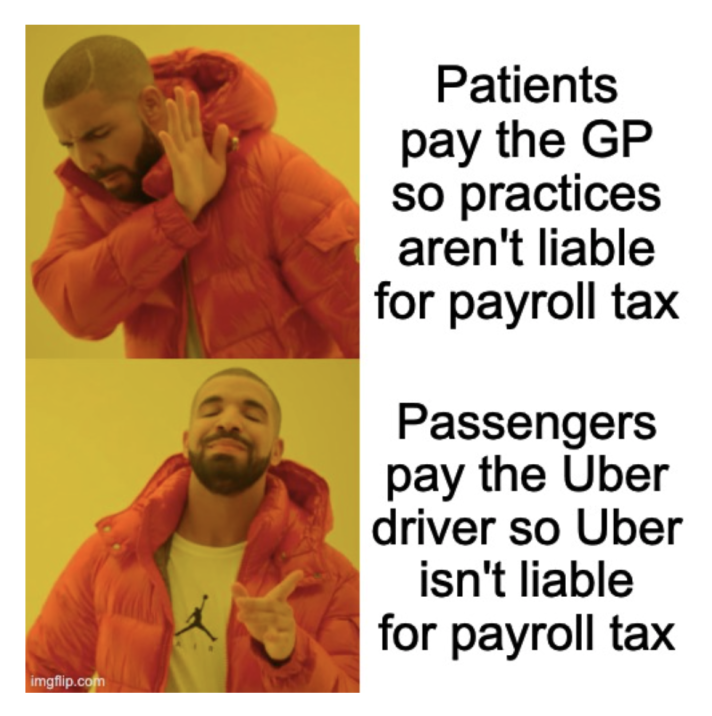

Weary practices are unlikely to give this decision five stars.

A judge has cancelled an Uber payroll back-tax bill worth $82 million, finding the rideshare giant does not pay its drivers wages.

Read it and, if you’re a non-WA Australian general practice owner, weep.

Passengers in fact pay drivers for their services, NSW Supreme Court Justice David Hammerschlag said on Friday, upholding Uber’s appeal against six tax assessments and interest claims from the state revenue service going back to 2015.

Considering the years of back and forth over how payroll tax should and should not apply to medical practices, it feels a bit like

According to AAP’s report, the learned judge found Uber acted as a “payment collection agent”, distributing money paid by riders to drivers. This could not be considered a wage even if – and this is not the judge’s words but us extrapolating – the money went into Uber’s pockets first and was then disbursed to the driver.

“It is not Uber who pays the driver,” Justice Hammerschlag ruled. “The rider does that. What Uber pays the driver is in relation to the payment Uber has received, not in relation to the work itself.”

The Chief Commissioner for State Revenue’s lawyers had argued that drivers provided a service not only to their passengers but to Uber itself – an argument that may sound familiar if you’ve followed our fairly dense coverage of the rolling payroll tax debacle, specifically on payment flows, service entities and relevant contracts.

Does a GP provide a service to their patient or to the practice under whose roof they work? Does the practice not, rather, provide services – premises, receptionists etc. – to GPs for which it charges them, as contractors, a service fee?

Uber countered this argument by saying it was only a “marketplace” through which drivers and riders could find and contract with one another. Again, sounds a lot like the sort of labelling practices have been recommended to use.

TMR broke the story three years ago about the payroll tax threat to practices, starting with a certain NSW tribunal finding, and it’s been breaking ever since.

Thomas and Naaz, the GP clinic group where effectively it all began, even found themselves back in the spotlight last week when Revenue NSW sent them a cheeky little $1.2m payroll tax bill, which was only revealed to have been an administrative error when Holly Payne thought to check with them.

We’ve all made “administrative errors” like that, I’m sure.

You can read more of our recent coverage on payroll tax generally and NSW specifically here and here and here and here and, our personal favourite, here, where our boss promised it would be his last payroll tax column ever. LOL.

Honestly, though, the Back Page doesn’t know whether to roll our eyes at this ruling or take it as a positive: it was a successful challenge against the state in court, but one by a multibillion-dollar company with armies of lawyers that small practices may never hope to replicate.

Thus we must end with the great columnist’s copout: Time will tell.

Send story tips on literally any other subject to penny@medicalrepublic.com.au.