Seldom has an interim analysis prompted such an overflowing of animal spirits.

Amid the disclaimers, treat with cautions and further research neededs that usually accompany a scientific “breakthrough”, you can always rely on stockmarkets for a stark interpretation of the news.

Pfizer and BioNTECH’s announcement – via press release rather than, you know, published science – that their BNT162b2 vaccine appeared to have 90% efficacy went to investors’ heads like champagne.

Following as it did hot on the heels of a far-too-long-lasting election, it was an extra (sorry) shot in the arm for sharemarkets as they once more dared to dream of business as pre-pandemic usual.

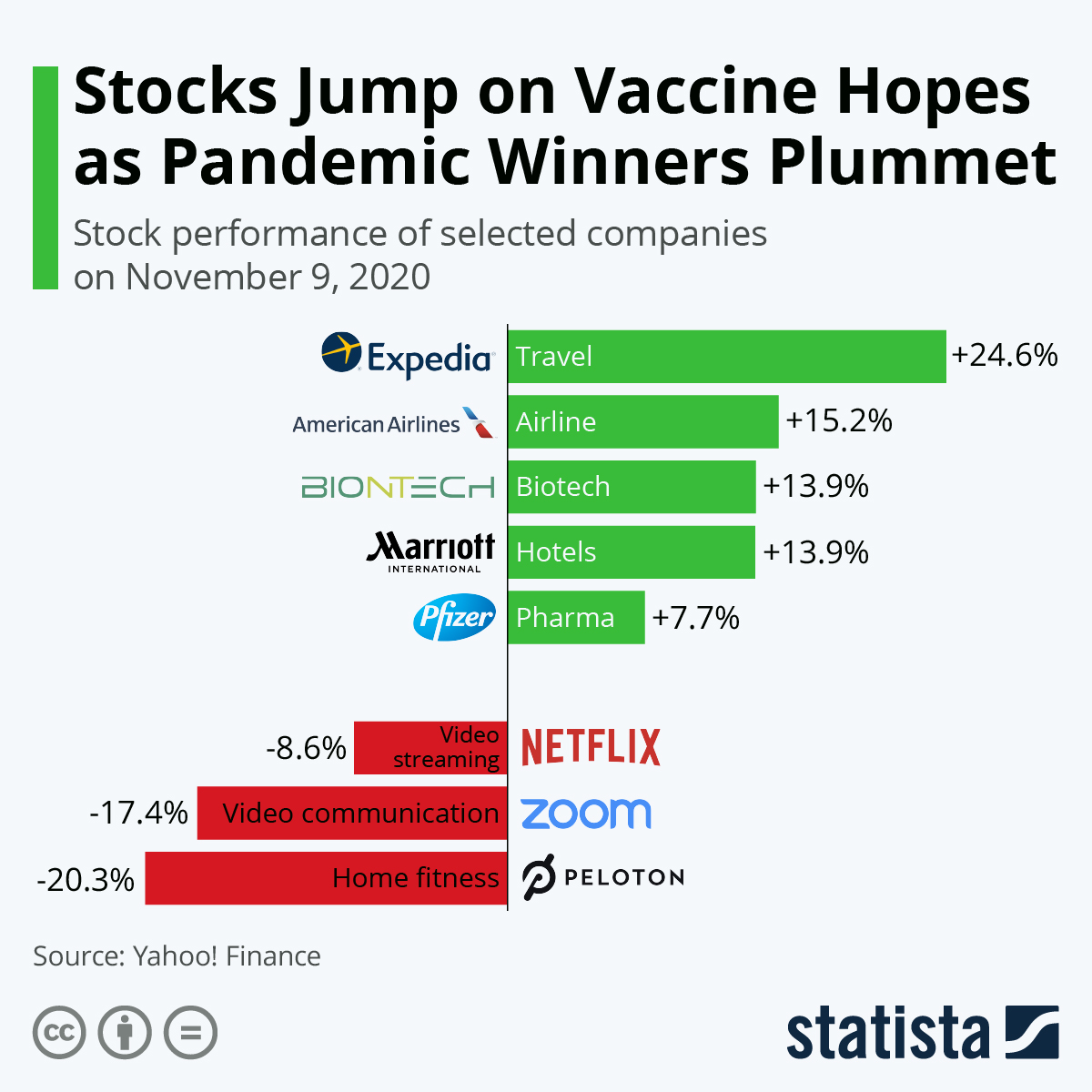

But as the folks at Statista have pointed out, stocks were divided into COVID winners and losers and both experienced quite a reversal of fortune.

Travel giant Expedia, for example, was up nearly 25% on the news as were large airlines and hotel chains.

The losers included Netflix (down about 9%), home exercise company Peloton (took a 20% whack) and most pleasingly Zoom, which took a 17.4% dip.

To which we can only say:

Here in Australia, the Pfizer-BioNTech news built on the post-election vibes to push the ASX back up to where it was trading on March 5, according to the AFR.

There was a similar “COVID IS CURED” feel to the winners, including a 44% uptick for shopping mall owner Unibail-Rodamco-Westfield and travel companies including Webjet, which was up by 13.6%.

This comes on top of news that Australians, especially Victorians, are spending up to 15% more via credit card than they were last year, indicating what we can only fear is a very premature confidence in both the vaccine and the economy.

If you see something stupid, say something stupid … send hot trading tips to felicity@medicalrepublic.com.au.