It looks like fixing the payment flow issue isn’t that hard, albeit a lot of work. But that's not the end of it.

We’ve been thinking seriously this week of launching a new newsletter called “Medical tax compliance daily”.

The topic is so complex and moving so fast, we think it might fly. I wonder if the ATO, the various SROs and even Services Australia would come on board as founding advertisers?

We almost certainly wouldn’t be able to attract sponsorship from any of the practice software vendors after suggesting this week that, although it is not their responsibility to make sure a practice or doctor configures their software correctly for tax compliance, they need to get out in front of the problem more on behalf of their clients.

Their software gatekeeps all the data which ultimately ends up in the hands of an SRO or ATO to assess compliance.

It most definitely is not their problem if the data isn’t making an SRO happy, but they are in a position to help because they build and maintain the single point of transaction where this data is being generated. They might be able to do a bit of reconfiguration which makes a confusing process around emerging payment flow tax law easier to manage, or, if they haven’t got the money or inclination yet to build out easier product, they might be able to provide pointers to clients who are configuring their software and payment flows incorrectly.

For example, if a practice holds itself out to be in a tenant/landlord arrangement (most practices do), and they are processing all their tenant doctors through a central bank account, a software vendor might politely send them a nudge letter. Such a communication wouldn’t be an instruction of any sort, just a suggestion that given the current emerging law on payment flows, and perhaps even the recent position put by the RACGP on contractor doctors and their invoicing, they might want to check how they’ve configured the system.

Is this going too far and exposing the vendors to any sort of action one day from a client?

If it’s a polite nudge and suggestion to check only, it hardly seems like it could.

And besides, as we wrote this week, most of the software vendors have built their base workflows for their clients in a different tax compliance era – a time when no one was questioning centralised flows. It feels like at some point of time when they are able, the vendors will need to optimise their configurations to meet what is now becoming accepted law.

On that front, we are aware that one software vendor, one we mentioned last week as being a downstream integration to the major PMS systems that managed billing in real time for tenant doctors, has responded to at least one of its mid size clients and reconfigured the product. The software used to track and reconcile centralised payments in the past, now apparently tracks the payment directly by Medicare to all the tenant doctors instead, and invoices these doctors for a service fee after the fact. The software, according to this practice owner, does this all automatically so the practice can chase its service fee invoices in a timely manner (which is important for a lower cash flow in the new set up).

The owner of this particular practice said it took some forward planning and herding of the doctors who were tenants, but it wasn’t “that bad in the end”.

If this is right, this would be a living breathing example of a practice that has got its payment flows right without too much hassle, and just a little arm twisting of his software provider.

Notably this owner told TMR that the secret to the process starts with having your service agreements right first.

Every week, TMR learns more and more on the intricacies of such law, and we have to revise what we think.

Last week we thought setting yourself up for payment flows that are ideal in the eyes of an SRO for payroll tax exemption would not be easy. And that was the view on a few of the practice management socials as well, who accused us again of trying to scare everyone on the one hand, and on the other, said that setting up so your tenant doctors to invoice their patients on their own ABN and then take that money first into their own bank accounts would be so hard it probably would not be financially viable at this point of time.

Here’s a comment one person made about the issue on a practice management site:

“For most practices, this will be a nightmare to manage. Regardless of ‘multi-merchant’ functionality of Payment terminals (Tyro etc.), mistakes are always made, and eftpos payments will certainly end up in the wrong accounts over a long enough period… This lack of control is not in the practice’s interest, not the practitioner’s interest, and is very self-defeating from a financial management perspective”.

We suggested last week, incorrectly as it turns out, that possibly the software vendors could step in, do a bit of development and fix this problem for their clients so it is easier and not the nightmare this post suggests it might be. We were incorrect because it looks very much like, with a bit of admin sweat and tears on the part of a practice, it can be done without the software vendors stepping in and spending that much on development. Sorry, software vendors. Not withstanding, we still think the vendors could be helping more than they are.

In December last year, TMR wrote a payroll tax story that talked about the various forms practices and doctors needed to fill out in order to set themselves up for Medicare billing and that some seemed to be getting it wrong in the light of the Thomas and Naaz ruling of a few months earlier.

There are three key forms a practice needs to consider depending on what set up they are going for: HW052, HW029 and HW027. (There is another way to claim that avoids the forms, which involves using a bank authority from Medicare called Easy Claims, which I’m not going to discuss here.)

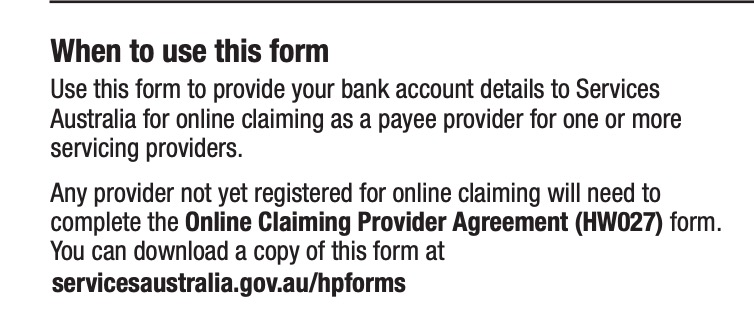

Our story back then, in the early days of Thomas and Naaz, pointed out that an HWO52 was described by Medicare as being required to “provide your bank account details to Services Australia for online claiming as a payee provider for one or more servicing providers”. That’s pretty confusing wording. A “payee” implies employer, but “servicing providers” implies contractor or tenanted doctor.

Prior to Thomas and Naaz, a lot of practices seemed to be using this form to set themselves up to pay their contractors, using a centralised bank account. Notably, an HWO52 points out that individual “service providers” need to separately fill out a HW027 (can you see why everyone’s getting confused here?).

HWO52

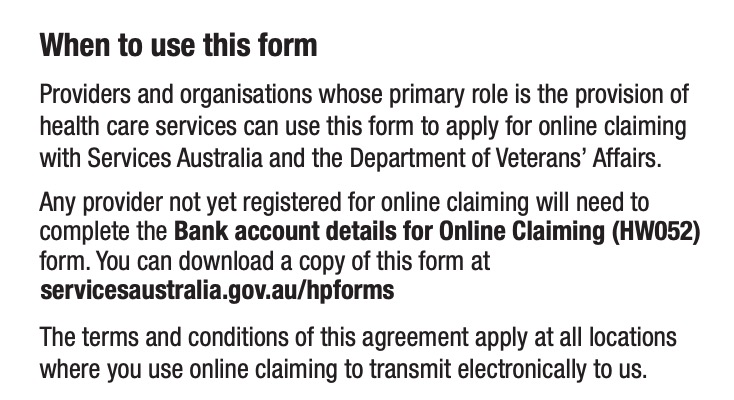

A HW027 is pretty confusing too as it says up front that “any provider not yet registered for online claiming will need to complete the bank account details for online claiming (HW052) form.”

HW027

Yet, clearly in the HW027, an individual provider (a tenant doctor) has a spot to put their own bank account details for claiming.

If you’ve stopped reading because you’re getting a headache I don’t blame you. Why is it this confusing? Especially now that if you are one of the great unwashed and confused and fill this stuff out incorrectly, you as a practice owner may be setting yourself up to fail a payroll tax audit, or if you are a tenant doctor, setting yourself up to fail a personal income tax audit.

Apparently two things have been going off the rails for some time now. Practices have been using HW052s to enrol their tenant doctors, tied to a central practice bank account (looks like an easy mistake to make), and, possibly worse, tenant doctors, when joining a practice are either being told to use the practice account on their HW027 by their practice manager, or their friendly new practice manager is doing the form for them and putting the practice account on the HW027.

Any of the iterations above are wrong as far as Thomas and Naaz goes and might be a trigger for a payroll tax audit of a practice, or an income tax audit of a tenant doctor.

What to do?

Apparently, it’s not as hard as we and a few others have been suggesting.

Start by checking all your tenant doctor HW027s. If their bank account isn’t on the form, start the process again. Apparently it isn’t that hard but each of your tenant doctors will need their own PRODA account to do this (as advised by the RACGP recently). With their own PRODA account they can go in and use electronic forms to do it. You may have other actions to redo here as changing this information affects a lot of downstream associated data. A practice doesn’t have to do this. A tenant doctor can do it as really it is their form and application.

If most of your tenant doctors were once getting banked centrally and you go to all this trouble so they bank all the money first to their own account on their own invoice, what happens then?

Firstly, your cash flow is going to plummet in the short term as you will now only bank service fees centrally, not the whole consult , so you’ll need to plan for that.

Eventually it will even itself out but you probably will never be able to go to the bank for a loan with the same juicy balance sheet you once had as all that money that was always mostly your tenant doctors’ money is not showing up in your practice account any more.

The next thing you need to do is work out with your practice software, or the software that is integrating to it, how you accurately invoice your tenant doctor for their service fee, quickly, so you get the money as fast as you can, now you don’t get it all up front.

Possibly, you will put a term in your landlord service agreement that gets consent from your tenant doctor to reach into their account on a regular basis and make direct debits, based on the data you get from your PMS on what consult that doctor did, and then was likely paid into their own account.

It might even be possible for your practice PMS to do the invoicing on behalf of your tenant doctor, so long as that doctor’s ABN is on the invoice, and the money goes into their bank account.

One thing here, is that you still can’t reconcile the money to a bank account, which isn’t ideal. You would need to gain permission of your tenant doctor to reach into their accounting software, which talks to their bank, to do that, and none of the software vendors have developed that functionality yet (they may never, it’s complex).

Notwithstanding, at least Medicare does provide a practice with a form of reporting on who they have paid in a practice, to what bank account, and for how much. While this isn’t proof positive that the money hit a tenant bank account, it’s as good as you’ll get, and if you ever get into trouble from anyone because the money didn’t hit your tenant account, then at least you have someone to blame for the error: Medicare.

It’s hard to get a gauge of how many practices are still paying centrally but anecdotally it’s a lot.

Why?

This isn’t entirely clear to TMR or any experts it is talking to on the subject, but there could be a few reasons:

- A practice still isn’t willing to let the power of direct banking to their tenant doctor happen because they worry they will lose too much financial (and other) control

- A practice is worrying about how it will transition its cashflow and not run out of cash (and go bankrupt) during the transition process (this is a pretty real and good worry to have)

- A practice still doesn’t believe all the press on the payroll tax cases (there are plenty of denialists running around some of the practice management social media groups)

- A practice still isn’t aware of all that press

- A practice doesn’t have the bandwidth in admin at this point of time (remember that thing called covid wave three) to do all this work yet.

- Variations of any of the above

There are some good reasons to be delaying. But get to it sooner rather than later if you are going to keep running a tenant/landlord arrangement. It’s fairly clear now that the best payment flow is your tenant doctors taking all the money first, using their own ABN and bank account, and you invoicing them for the service fee after the fact.

Your PMS or some of the downstream integrations probably can take all the consult data being generated by your tenant doctor, issue the service fee invoices, reconcile to the Medicare reporting, and send it all downstream to your practice accounting system, without too much hassle.

Mind you, this workflow is only taking into account Medicare payments. A practice also needs to record and reconcile any transaction that is outside a PMS (e.g. a booking engine or Healthdirect telehealth session) and get it all into those accounts. But that’s another article.

Phew … that wasn’t so bad after all.

But wait, there’s more

Unfortunately, both Thomas and Naaz and Optical Superstore suggest that payment flows are just one test of a few that they can apply. In the case of Thomas and Naaz the NSW SRO used the failure of payment flows to go on and look at things like “second supply” – that is, was there anything indicating the tenant doctors are providing services to the practice, and not just the patient, such as a restraint of trade clause in that tenant doctor’s contract?

So payment flow is just step 1. (Giant sigh.)

Steps 2 and on are a little bit more fluffy in some ways, and can get weird even, if you look at what some cases are suggesting you need to do about things like your practice website, but there are some check lists emerging from some of the professional accounting firms you can use to tick off all you can.

In order to give you a breather, we are going to break this article into two parts, and discuss these other elements in more detail in Part 2, on our Wednesday morning Money & Medicine newsletter.

If you missed our webinar on payroll tax, you can catch up here – and we’ll be holding another one soon.