Payroll tax was voted the top area of concern by attendees of the annual RACGP-run practice owners conference.

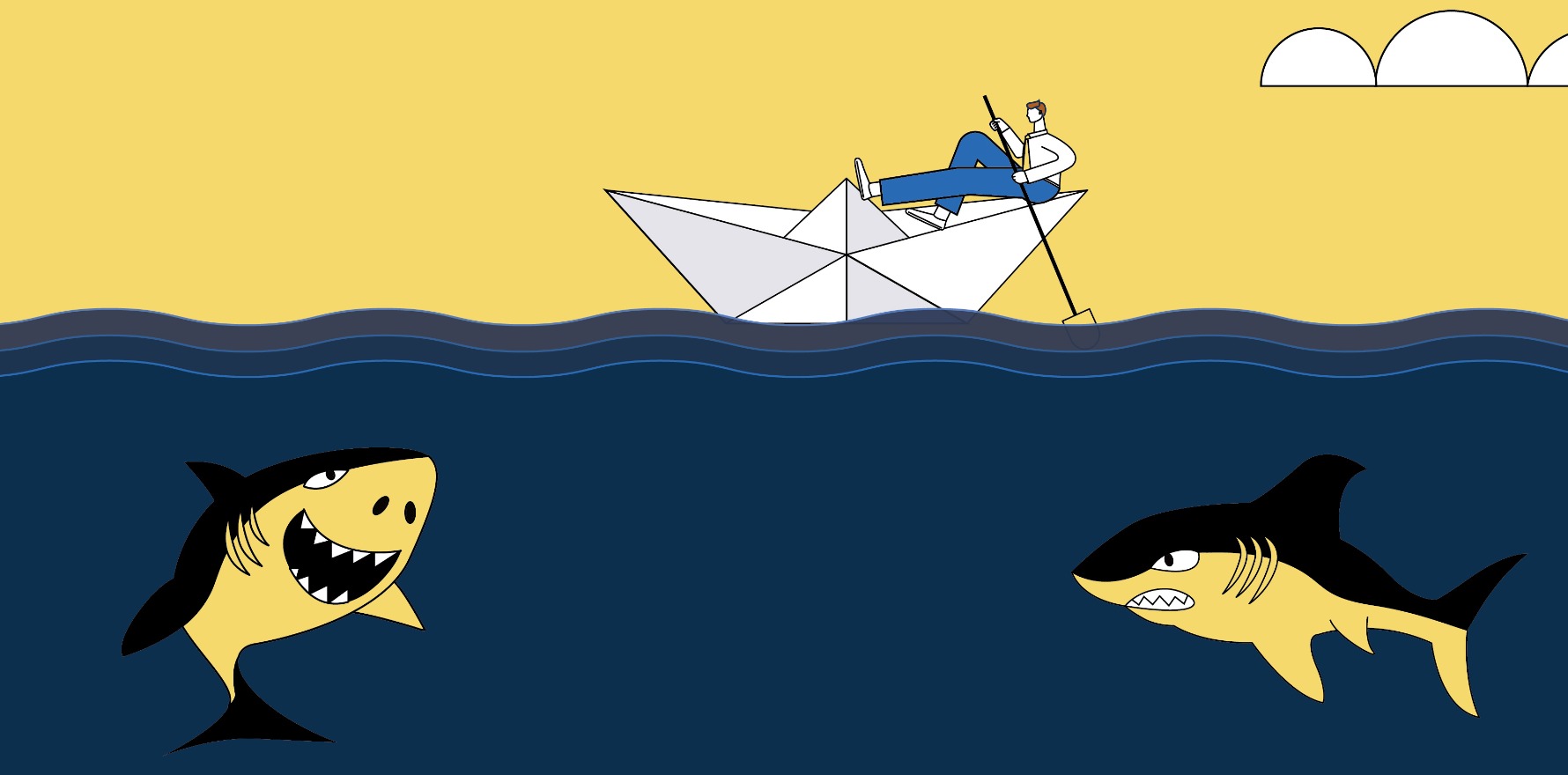

The RACGP is urging calm and vigilance in the face of payroll tax panic, as practices begin to report contact from state tax offices.

South Australia hosted this year’s edition of the RACGP Practice Owners National Conference – or PONC – which took place over 20 and 21 May at the Adelaide Convention Centre.

It kicked off with a “hot topics” panel. The subject matter was voted on by delegates before the conference.

RACGP vice president Dr Bruce Willett said one topic beat the rest by “a country mile”: payroll tax.

Specifically, the developments in case law that have clarified the meaning of a relevant contract in a medical centre setting, raising the possibility of some GP practices receiving a backdated tax bill in the order of hundreds of thousands of dollars.

Because of harmonised tax laws, it applies across all states and territories bar Western Australia.

Late last year, a doctor on Brisbane’s southside received a retrospective payroll tax bill that he estimated wiped out three years’ worth of profits from his three practices.

Since then, Queensland has introduced a two-and-a-half-year grace period for medical centres that were unaware they were breaching tax laws, but no other jurisdictions have followed suit.

In April, RACGP president Dr Nicole Higgins said the ACT Revenue Office had begun contacting practices in Canberra regarding payroll tax.

It appears the trend is continuing steadily southward, now hitting NSW and Victoria – the states where the pivotal Thomas and Naaz and Optical Superstore cases were heard.

Dr Willett told TMR he had met practice owners who told him they were being audited by state revenue offices.

“I was approached by a few practices [at PONC] who indicated quietly … that particularly in NSW and Victoria there seems to be quite a bit of activity around payroll tax,” Dr Willett told The Medical Republic.

Dr Willett acknowledged that practice owners were extremely concerned about audits and advised that the situation was not likely to resolve quickly.

“It’s going to require case law to build up over time to work out exactly where and when relevant contracts and payroll tax applies,” he said.

“That’s going to take years, rather than months, for those cases to work through the system.”

In the meantime, Dr Willett advised practice owners to keep calm, especially given that Thomas and Naaz is not necessarily representative of all GP contracts.

“I don’t think we need to panic,” he said.

“I think there’s a way through this, but at the same time it’s important that practices don’t ignore this and do look to their contracts and their workflows to get it right.”

Other popular sessions at the conference looked at technology and new service models, particularly how those can work together to keep general practice at the centre of care.

“We want one home for the patient’s care, but different models of providing it,” Dr Willett said.