The two pharmacy giants are now free to create an $8.8bn super entity, with an exit path for pharmacies who want to get their supplies elsewhere.

The Australian Competition and Consumer Commission has stepped out of the way of the merger between Sigma Healthcare and Chemist Warehouse after five months of deliberation.

The deal – contingent on a court-enforceable undertaking from Sigma to not enforce contractual restrictions on exit and ensure payments under contracts do not make it costly for a pharmacy to switch wholesaler – will create an $8.8 billion super entity.

Sigma is a wholesaler and pharmacy franchiser. CW is the country’s largest pharmacy retailer. The combined group will consist of 860 stores and over $495 million in earnings.

On 11 December 2023, Sigma and Chemist Warehouse entered into a merger implementation agreement under which Sigma would acquire all the shares in Chemist Warehouse in exchange for Sigma shares and a $700 million cash consideration.

Upon completion of the proposed merger, Chemist Warehouse shareholders will hold 85.75% of the ASX listed merged entity while Sigma shareholders will hold 14.25%. The transaction is in effect a reverse acquisition of Sigma by Chemist Warehouse.

The ACCC said it no longer felt the proposed merger would substantially lessen competition.

“There is and will continue to be effective competition at all levels of the pharmacy supply chain, capable of constraining a combined Sigma Chemist Warehouse,” said ACCC chair Gina Cass-Gottlieb in an announcement this morning.

“The ACCC’s analysis found that the proposed merger is unlikely to substantially lessen competition nationally or locally because other pharmacies and non-pharmacy retailers will continue to compete to the same extent they compete now.

“Consumers value different aspects of Sigma’s and Chemist Warehouse’s banner pharmacies’ offerings.

“Importantly, consumers will continue to have choice between smaller format stores offering personalised services to consumers and the Chemist Warehouse offering, focused on larger format discount stores and front-of-store offerings,” she said.

Chemist Warehouse was predictably delighted by the decision.

“We welcome the ACCC’s decision,” said Mario Verrochi CEO of the Chemist Warehouse Group.

“Chemist Warehouse has a history of driving innovation and competition, based on a high volume, low prices model.

“Our entry into the pharmacy industry in 2000 added a new dimension to competition in that industry, leading to a more competitive and dynamic industry as a result.

“We believe that the combined group will continue to drive competition within the industry. By bringing together Sigma’s advanced distribution and logistics capabilities with Chemist Warehouse’s strengths in retail and marketing, we are creating an opportunity that will benefit both companies’ shareholders and customers.

“The proposed merger sets the stage for a new chapter of growth for both Chemist Warehouse and Sigma, aimed at delivering greater value to our customers, employees, franchisees, and shareholders.”

Sigma managing director Vikesh Ramsunder told the Australian Financial Review the ACCC decision was “a critical milestone”.

The ACCC also found that a combined Sigma Chemist Warehouse was unlikely able to influence Sigma banner pharmacies to the same extent Chemist Warehouse influences its current franchisees. Sigma franchisees are expected to continue to make their own individual commercial decisions.

“Critical to our conclusion that a substantial lessening of competition is unlikely is the competitive constraint provided by competing wholesalers including API, EBOS, and CH2,” Ms Cass-Gottlieb said.

EBOS and API are large national wholesalers supplying full product lines, and CH2 is a smaller wholesaler that supplies both community pharmacies and the hospital sector. Each of these wholesalers has agreements with the Commonwealth government to distribute PBS medicines as well as spare capacity to supply new retail pharmacy customers.

The ACCC said it had found that these wholesalers have actively competed for new pharmacy customers and retail pharmacies have switched between wholesalers.

“The undertaking given by Sigma will ensure that pharmacies currently engaged in longer term contracts with Sigma will also be able to readily switch wholesalers should they choose to do so, strengthening the competitive constraint of these alternative wholesale supply options,” said the announcement.

The ACCC therefore formed the view that a combined Sigma Chemist Warehouse would be “unable to foreclose downstream pharmacies that compete with Chemist Warehouse franchisees”.

Ms Cass-Gottlieb said the ACCC had received many submissions from parties concerned about the merger.

“We reviewed the transaction very closely to test these concerns and conducted detailed analysis of Chemist Warehouse and Sigma’s internal documents,” she said.

“The evidence gathered, augmented by the undertaking given by Sigma, led us to conclude that a substantial lessening of competition is unlikely.”

The enforceable undertaking also requires Sigma to safeguard and delete the data of those pharmacies that choose to switch and to require the merged Sigma Chemist Warehouse to continue as a pharmaceutical wholesaler under the Commonwealth government’s Community Service Obligation (CSO) arrangements for five years.

“The ability of pharmacies to readily exit their existing agreements with Sigma will maintain and enhance the ability of alternative wholesalers to constrain the merged entity,” said Ms Cass-Gottlieb.

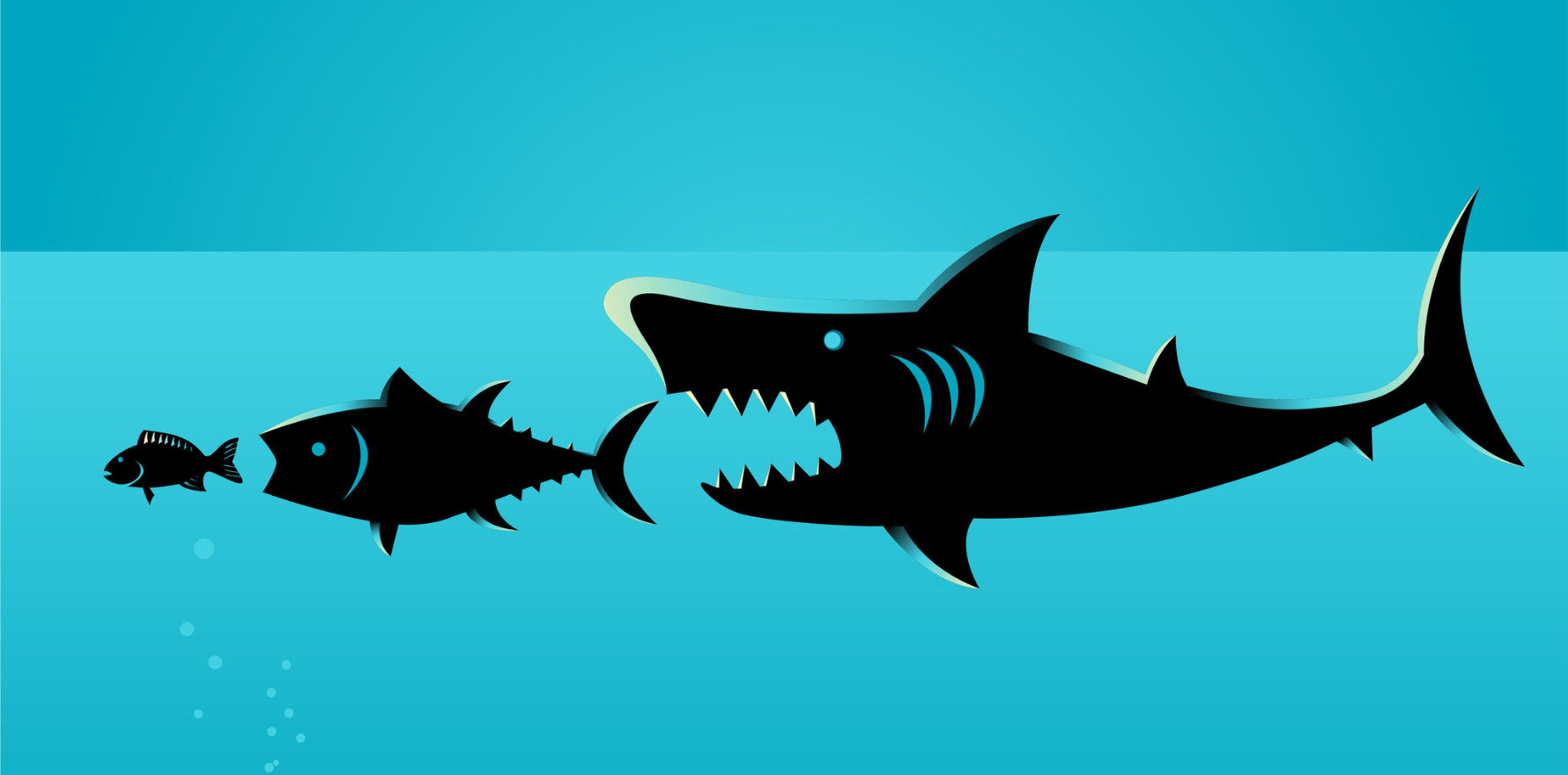

The Pharmacy Guild had opposed the merger, arguing the new group would control more than half of the revenue in the retail chemist sector and that there was an “inherent conflict of interest” in which the new group would be “incentivised to provide preferential treatment to CW-branded pharmacies”.

TMR reached out to the Guild for comment today but it had not responded by publication deadline.

Related

In other ACCC news, the Commission has raised concerns about the proposed acquisition of I’rom Group – owned by CMAX Clinical Research, one of the largest suppliers of phase 1 clinical trial services in the country – by Blackstone, which indirectly owns Nucleus Network, the other big supplier.

“We are concerned that the proposed acquisition would be likely to have the effect of substantially lessening competition in the supply of phase 1 clinical trials in Australia,” ACCC commissioner Dr Philip Williams said.

“The proposed acquisition would bring the two largest providers in Australia under common ownership, with 59% of phase 1 trial beds in Australia, likely significantly lessening the competition faced by these providers.”

In addition to indirectly owning Nucleus, Blackstone also has a majority interest in Precision Medicine Group, which operates the Precision for Medicine contract research organisation. Precision provides services to drug sponsors and assists with selecting phase 1 clinical trial service providers.

“We are also concerned that Blackstone may have the ability and incentive to restrict access to phase 1 clinical trial services by competing contract research organisations,” Dr Williams said.

The ACCC invites submissions in response to the Statement of Issues by 21 November 2024.