Under new legislation, services billed to veterans with Gold, White or Orange DVA cards will contribute towards meeting the 70% and 80% thresholds for a payroll tax rebate.

The NSW government has passed legislation to expand its payroll tax rebate initiative to include services billed to veterans.

In June, the state government introduced its bulk-billing support initiative, that would provide a payroll tax rebate on contractor GPs wages at clinics with bulk-billing rates above 80% in metropolitan Sydney and 70% elsewhere in the state.

The government also legislated a retrospective waiver for all unpaid payroll tax liabilities up to 4 September.

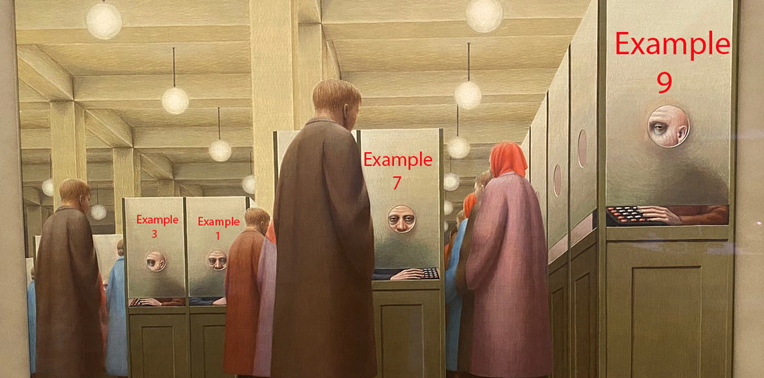

As reported by The Medical Republic in August, example 9 in the Commissioner’s Practice Notes – which aimed to provide clarity over liability – implied that services provided to veterans, or workers compensation patients, may not contribute to bulk-billed services and therefore reduce likelihood of eligibility for the payroll tax rebate.

Speaking to TMR, RACGP NSW and ACT chair Dr Rebekah Hoffman said that this lack of clarity was her “most significant” concern over payroll tax and that the college had raised concerns with Revenue NSW.

Dr Hoffman said, at the time, that she was “very hopeful” that if GPs charged DVA rates it would be included towards the bulk billing threshold, “because that’s the sensible answer”.

Related

Under the new legislation, passed today, services billed to veterans with Gold, While or Orange DVA cards will contribute towards meeting the thresholds for a payroll tax rebate.

This will apply retrospectively from 4 September this year.

Dr Hoffman said this was “definitely a step in the right direction” and provided clarity for a very vulnerable population.

“We’d really love to see what Queensland’s been able to achieve [in NSW], which is a complete [payroll tax] exclusion for all GPs,” she said.

Dr Hoffman was hopeful that NSW could follow in Queensland’s footsteps.

“I’m probably more hopeful in election years [but] I’m always optimistic,” she said.

“I do think that if one government’s able to prioritise this and say, ‘this is of something of value to us’ – and it should be of something to value to the entire country – it shouldn’t be something that’s relies on post code.

“It’s something we all should strive to achieve, and that’s really, essentially, affordable health care.”

Dr Hoffman said the only other remaining gap in this space was around workers compensation patients.

“Now we’ve clarified that DVA is contributing towards that bulk billing threshold,” she said.

“We don’t have that same clarity around WorkCover, so we’d love to see specific clarity around that.

“But again, would even more love to see a complete exclusion, like our incredible Queensland colleagues have achieved.”