COVID-19 has put a rocket under local medical technology stocks. But how much of a bet might you be taking by buying into Australia’s best digital medical tech companies?

In As a sort of diversion from our normal Saturday fare of COVID-19, government, the regulators and medical college guts and gore, this week we thought you might be interested in why medical technology companies are suddenly so hot right now, and whether COVID-19 has much to do with that.

Oops, COVID-19 again, sorry. Can’t seem to shake the thing. This is not an investment column, just a novice’s dive into the whims of medicine, technology, digital stuff and how people see value and either make money or lose it.

Since we are ultimately talking about assessing value, and taking risk, a cautionary tale might be a good place to begin.

On the Australian Stock Exchange (ASX), there are 176 companies listed as healthcare stocks of which only seven could be classed really as digital health technology companies. Device companies, of which there are many listed, aren’t included.

Our tale is about number 168, currently with a valuation (share price x the number of shares) of $8m, which was not so long ago in the top 20 of ASX listed healthcare companies with a valuation of over $600m.

Oneview Healthcare debuted with much fanfare on the ASX three years ago with a share price of $3.76. The group was developing and rolling out a cloud-based communication and application integration platform for hospitals and other large healthcare institutions. So not only could a patient watch their Netflix through it, doctors could be monitoring their patients’ vital signs through it, via the integrated hospital EMR. One communication protocol for hosptials to rule them all. Neat.

The share price rose relatively quickly to a price of $6.72 by January 2017, and then commenced a steady but irresistible slide to the disastrous present-day price of 4.5c.

As far as cautionary tales go, this one throws off a few good lessons for punters, even perhaps sophisticated punters. The group had convinced some very well respected and large institutional investors to front up a lot of capital in the initial public offering (IPO) – about $68m. Once that happens, markets sometimes follow like sheep, assuming that a big smart group wouldn’t lay out all that capital without doing their homework pretty well. To this they added a good starting story, a couple of contracts with hospitals in big markets (the UK and US) ,a great business model (on paper), and a fair bit of well spun PR as things moved forward.

The point of failure in this particular venture seems to have been having a great story that ticks all the technology stock boxes – network-effect business model, huge unconquered digital market of healthcare, big markets, an esteemed board of directors, some great starting stats, a ground-floor platinum referece investor – but there was virtually no execution of the strategy to test it by the time of the IPO, or any demonstration that the grand plan was actually scalable.

Along the way were some omens: a first year where revenue reduced from $15m to $10.3m while losses increased from $30m to $40m, repeated misses of revenue forecasts, and even a CEO and chairman that were paying themselves significantly above market rate according to several industry newsletters. But the initial investors kept doubling down to meet a ballooning burn rate (how much cash you lose each year chasing the profit), and others followed. In these circumstances, companies and their officers aren’t necessarily doing anything dastardly. Sometimes the board, the founders and senior execs are all drinking from the same Kool-Aid fountain, willing the numbers to eventually turn, as a means of staving off the inevitable reality of facing up to something being fundamentally wrong. In this case it was a pretty heavy hitting board, air swinging all the way down.

Ouch.

OK, that’s the downside. Where tech stocks are concerned it’s been done before and will be done again. The overarching lesson is tech isn’t that easy to value, or pick. It has fundamentals and multipliers, like cloud-based delivery of software as a service, “network effects” and “digital market platforming” that are extraordinarily hard to model.

And while we’ve seen plenty of great examples of businesses winning on the same formula in other markets we think we can take some cues from – Xero in accounting is a bit of a poster child – healthcare adds an additional layer of complexity to modelling, and hardly any company in healthcare has been to a platform type of place like Xero has in accounting yet.

But a lot are trying. And some will succeed. And when they do, the value you are going to see in such businesses is going to reflect that they managed to spike a digital platform business in the healthcare market, with giant and stable government-based revenue streams into the never never.

It’s why Tim Cooke, Apple’s CEO, came out a year ago and said that in future people would remember Apple as a healthcare group, not a cool mobile phone, computer and content provider.

And that’s why people are going to persist with digital healthcare companies and stocks, and why it’s an interesting place to be in the next few years.

Back to Australia’s most valuable digital healthcare companies.

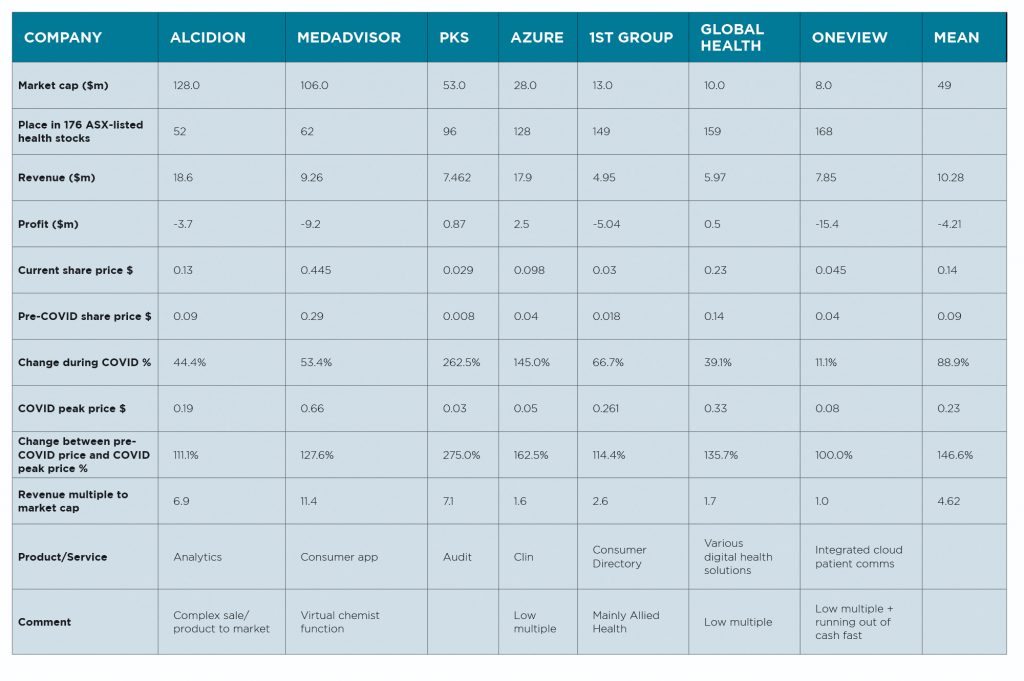

There are seven ASX-listed digital health technology stocks and we’ve presented their vital statistics in Table 1:

What immediately stands out is that COVID-19 (sorry) appears to have had a huge impact on the price of all these stocks. On average their share price has risen by nearly 90% from just before COVID-19 (sorry) started.

One particular stock, PKS, has increased by a whopping 265%! But that can be easier to do when your starting point is just below 1c, so it’s not that spectacular really. And if you add to this that during the period, the group acquired a reasonably good health tech company into its portfolio, which coincided with most of the increase, then the rise is even less spectacular.

Question: are these stocks going up because their products can directly contribute to ameliorating the crisis, or is there just a bit of a mania around digital health given it is playing a very large role overall in managing COVID-19 (sorry)?

A clue: of all seven ASX-listed stocks in Table 1, only one has any functionality that might directly help in the COVID pandemic, and that stock is the second-worst performing during COVID-19 (sorry). That stock is MedAdvisor.

Still, if you bought at just under 1c in late February, you’re probably pretty happy with yourself today.

If there is a bit of pandemic mania in these stocks, is their price and trend likely to be maintained?

The technical measure of actual value is the market capitalisation of the company, which is simply the number of shares held in the company times the share price. But a better measure of potential of a company is usually in the multiple of a company’s revenue to make up the company’s market capitalisation. The higher that multiple, the higher the potential. If we weren’t rounding up our figures, Oneview has a multiple of revenue under one. That’s obviously not good. It’s usually a sign of a group running out of cash with not enough runway to make a landing, which might be Oneview’s situation. They can raise money again of course, to extend their landing capability, but at a point investors might think they don’t want to chase their losses.

At the other end of the ASX listed companies in Table 1 we have MedAdvisor with a very respectable 11.4 revenue multiple, which should indicate lots of stars aligning in terms of business model, market effects, share and so on. The other two we have with higher multiples are Alcidion and PKS, which will discuss later, as we add to our list with some educated guesses around privately held companies and their value.

Table 1 gives you some starting point for trying to value privately traded digital health tech companies. If you start with how the markets are valuing public companies and you can get some data around key company metrics such as revenue, growth, market share, and business model, then you can make some estimate of value and potential.

At TMR we’ve done that and come up with our best guess of the top 11 most valuable digital health tech companies in Australia.

Table 2 below lists the 11 candidates, their ranking and their main features.

Revenue estimates come from all sorts of intel, some from the market, some from deduction around market share and product pricing, some from statements from the companies themselves from time to time.

As in Table 1 you will see a revenue multiple, and what is important in forming the view of this is our score of “market dynamic” for each particular company.

The market dynamic score is perhaps the most important feature in the algorithms we’ve applied here and it’s the most mysterious and deliberately oblique. Secret sauce isn’t secret for no reason, but to let you in on the ingredients just a little, market dynamic is a score given to a company based on their positioning as a service or product within the market. It assesses for features which include but are not limited to:

- Revenue model

- Market share

- Market growth

- Ability of model to build into network effects – often related to companies that can form, or already are, digital platforms within a market (eg, Best Practice)

- Cloud readiness

- Technology

- Management experience and expertise

- And … it’s secret, right.

You will note that you can be high in the list but have a relatively small market dynamic score and/or revenue multiple of market value. This might be because you simply have more assets generating more revenue in play. But the revenue isn’t as valuable as the revenue generated by a company with much better market dynamics.

What follows is a little more logic explained per company in the Table 2 leader board. Please feel free to make corrections or suggest alterations to the methodology etc. We intend to make this league table available each year as a sort of running special update feature.

No. 1 Best Practice (privately held)

Market Cap Estimate: $290m

Business Dynamic Score: 8.5

- Largest patient management system with dominant market share of the GP market (the largest PMS market in Australia), but some share in other markets such as specialist and allied.

- Rapid growth from No. 2 a few years ago based on good customer service and brand – it is probably the most trusted PMS brand in the country.

- Doesn’t have a cloud version yet while some competitors (Clinic to Cloud, Medical Director, MediRecords) do; however, it might be better to be the trusted market leader and a fast follower given how complex the medical market has turned out to be for digital players.

- Good clinical-based leadership and understanding of customer and needs. Founder was founder of No 3 in this list, Medical Director, and left to compete with it. He’s done that pretty well.

- Backed by Sonic (which owns 30%) so it has capital if required when competition heats up.

- Revenue is probably not as big as Medical Director, based on Best Practice having lower (better) pricing. Medical Director also has other non-PMS-based assets generating revenue, but it will be close now given its market share of about 50% or more.

- Voted most likely by Wild Health (our sister digital health blog) to eventually be core doctor digital platform of the future, and the hub of most important digital health data transactions moving forward.

No. 2 Telstra Health (Business unit of Telstra, which is public)

Market Cap Estimate: $280m

Business Dynamic Score: 3.8

- The largest local digital health tech company by revenue by far, based largely on an aggregation of acquisitions made many years ago, followed by a smart reorganisation and marketing strategy

- Has a few assets, such as FRED IT (which has great assets like the country’s largest eScript exchange (ERx) and is a market leading pharmacy management system vendor). Some of these assets are of high value, possibly higher if demerged from Telstra Health, but while inside, they significantly add to the company’s revenue and value overall. They also make one wonder if Telstra might ever go back on the acquisition trail and complete the original vision of the ex-CEO of the whole organisation, David Thodey, and ex-CEO of Telstra Health, Shane Solomon, to be the hub of all digital health transactions in the country.

- Assets across a range of important product and service areas in the market including pharmacy systems, tertiary EMRs, chronic care management and data analytics.

- Access to capital via its parent Telstra, but that access was restricted a few years back with a change of CEO and a change of heart about the business unit. But with a turned around core group, and digital health tech market spinning up rapidly, maybe the boss will put some money back on the table for the senior leaders in the group to have another shot at the title.

- Despite some dilution of focus due to spread of assets, well managed and integrated these days.

- High capability and knowledge in systems interoperability and integration.

- Learning from mistakes, some of them big, but providing group with knowledge and experience no one else has (eg, Cancer Registry contract)

- Revenue is estimated based on comments by Telstra CEO Andy Penn about growth of the business in an investor briefing a year ago.

- Not a likely overall platform player without more acquisition but possible if senior Telstra management has a change of heart, or they sell the business to a bigger global health focused player.

No 3. Medical Director (privately held)

Market Cap Estimate: $220m

Business Dynamic Score: 7

- Largest patient management system by revenue but not share any more, with a long history, well developed product. Daylight to No. 3 in the market in terms of users. Has a specialist product, and good technical capability.

- Second in line to Best Practice as the most likely winner in the doctor platform race, but also a potential roll up one day with Best Practice.

- Has already developed a cloud version, which BP hasn’t but significant questions over the integrity of the product in the market are being asked, with very little traction in the few years it has been available among GPs. Likely it needs to be re-developed now as it was originally designed to be used by Primary Healthcare when it was a bulk-bill-only play.

- Has completed process to be able to compete in UK market, which is much bigger but also highly competitive, so a lot of product development to do.

- Suffered under both its last owner, Primary Healthcare, and its current private equity owners, both of which have not read the market well, and both of which have failed to invest in development at the right time and in the right areas of the business effectively.

- Still an important and close No 2 to BP not withstanding.

- For sale now, but private equity owners apparently can’t get more than the $140m they paid for it five years ago, which makes our $220 estimate maybe a little high in the real world. Affinity’s major problem was that they probably overpaid for it five years ago. Given its market dynamics and position, $140m would be a good price today, as it has so much market share and is essentially a run down product with similar potential to Best Practice if managed better. That isn’t a comment on the current management, rather a comment on the owners, who have cut costs in the business rather than invest in important things like cloud development properly.

- Under a new owner, with investment in the right places, it could regain momentum as a company in the future. Always valuable as the No. 2 in market but needs a new home quick.

No. 4: Genie Solutions (privately held)

Market Cap Estimate: $130m

Business Dynamic Score: 6

- Market leading specialist patient management platform with declared intention to eventually become a digital platform for all doctors in the country, and the backing of the private equity group under giant health based super fund HESTA.

- Leadership experience from the Xero-MYOB cloud accounting wars, rapidly learning how much more complex the healthcare environment is, but bringing a lot of knowledge from cloud-based market dynamics to healthcare.

- Growth has been stalled somewhat by the rise of cloud-based competitor Clinic to Cloud which is a ground-up purpose-built cloud application designed specifically to compete in certain major sectors of the specialist market.

- Still hasn’t got a fully functional cloud version and like all the vendors who have been in the market a long time is finding out how hard it is to completely rebuild a version for cloud functionality, which has enough integrations and functionality that it remains attractive to its existing base of desktop users.

- Will need to acquire probably to get into the larger GP market but so far has not emerged as a buyer of Medical Director.

- Notwithstanding, other than BP, which is backed by Sonic, probably has the best capital backing of any player seeking to become the major doctor platform into the future and lots of declared intent.

No 5: Alcidion (public)

Market Cap Estimate: $128m

Business Dynamic Score: 4

- Unusual in the list as it is primarily a tertiary based company providing intelligent clinical workflow and analytics mostly to hospitals and thus competing in a large global market against players such Cerner, Allscript and EPIC.

- The hospital EMR and analytics market in Australia is dominated by the major global players and products like the ones Alcidion produces often integrate with these systems, although at times their modules compete with modules offered by the big global players.

- Major products include smart overlay analytics platform for tertiary healthcare, communications platforms and patient monitoring.

- Its most important product, MIYA, has a lot of black box AI functionality, which is at once attractive for its potential, but also complex and hard for some clients to get their heads around. It also may not ultimately deliver what it promises in the presentations.

- Is the highest capitalised health tech company on the ASX at $128m on revenues of $18.6m, a loss in 2020 of over $3m, and a multiple of revenue to capitalisation of nearly 7 times. This is a high valuation, probably largely based on the potential of the company to crack overseas markets.

- In our top 10 we have given Alcidion its ASX valuation as this is the market speaking. But if we at TMR were brokers (which we aren’t in any way, shape or form) we’d be putting a “SELL” sticker on the group for now. Why?

- While it is competing in a much bigger market, it is competing against much longer term established players, in a very complex market – EMRs and analytics of hospitals – which is changing rapidly and hard to forecast trends.

- In the scheme of the above, the company is a very small player with very little capital to compete. Its secret will be the integrity of its new product and an ability to sell it in and get traction in a few important sites. That will take a long time as the product is complex, and it is an evolving technology.

- Our valuation is 50% under that of the ASX simply because we are rating the degree of difficulty higher than the current crop of investors.

No 6: Clinic to Cloud (privately held)

Market Cap Estimate: $107m

Business Dynamic Score: 7

- Cloud only competitor to Genie Solutions in the specialist patient management system market, which claims to have taken a lot of share off the market leader in its first few years.

- Is another player in the race to build a broad spectrum digital platform for doctors and as a working cloud based platform has some advantages over Genie to date.

- Hard to ascertain exact share of specialist market but maybe as much as 30%, which for a cloud based PMS vendor, makes it the most successful cloud play healthcare today.

- Is only in the larger specialities – the specialist sector is unlike GP, in that by sector functionality requirements can vary a lot – and the ROI of developing more individual functionality moving outwards to more but smaller specialist groups is potentially not there now. But the group has designs on moving into the GP market.

- The issue with this plan, as with Genie’s intention to move across the GP market, is that the GP PMS requirements are a lot more broad and complex, with a lot more integrations and interoperability requirements. In addition, there is already a well established GP market, with very well positioned incumbents (BP and Medical Director), and the cloud GP vendors MediRecords, although only achieving small market share to date, is likely the most functional GP cloud vendor by a significant factor. Moving into the GP market is going to be tough but it is the biggest market.

- Is still privately funded and has access to a lot less capital in the short term than BP, Genie and Medical Director. It recently raised just over $12m to help fund its next stage of development.

No 7: MedAdvisor (public)

Market Cap Estimate: $106m

Business Dynamic Score: 6.2

- Is the market leading consumer facing health app in Australia, after HealthEngine.

- The main product is medication help for patients, which hasn’t been particularly huge as a market driver (might be now with eScripts) but MedAdvisor has done a great job of partnerships with pharma in medication adherence, in ease of use, and in developing distribution to pharmacy and doctors.

- Well placed now as it has good patient numbers and doctor/pharmacist use, it is in the middle of patient side chronic are management, and eScripts combined with telehealth are likely to create a large step change in momentum for the business model.

- A likely potential acquisition for other groups attempting to dominate patient side distribution such as HealthEngine.

- Likely to develop other functions critical to patient side management with bigger numbers.

- Business model is COVID-19 winner – it facilitates less face-to-face interaction when needed in the system.

- Like Alcidion we suspect that MedAdvisor might be a little overvalued per its ASX market capitalisation. Unlike Alcidion, it is a platform play, consumer side, with very high potential to move rapidly up the value scale, hence of all the top 10 companies it has the highest multiple of revenue to market capitalisation, which suggests it is the highest potential company for growth in the bunch.

- The problem with a consumer side platform play is high risk high return. It might make B2B transactional hub plays such as Best Practice or Medical Director, a little less potential on the high side, but a lot less risky.

No 8: HealthEngine (privately held)

Market Cap Estimate: $92m

Business Dynamic Score: 5.5

- Is the highest trafficked (3.6m page views/month) and most online visible patient based healthcare directory in Australia, monetising mostly via integrating with 25 patient management vendors to deliver leads to practices for new patients, and by provided appointment based software to various practices.

- HealthEngine exists in that strange world between Google and a consumer (the patient). Google puts up with online specialist directories like HealthEngine and Hotdoc, but it doesn’t like anyone between them and where they ultimately get their money – the consumer. But I guess given Google isn’t evil, that should be OK. The other distribution problem that both HealthEngine and Hotdoc have, which drops their business dynamic score a notch or two, is that if Google can cut them off consumer side, then Best Practice and Medical Director, combined, could cut them off in trying to reach doctors (B2B side).

- Has more downloaded patients on its consumer app than any other app in Australia, including MedAdvisor.

- Major functionality is appointments – claims 13m bookings a year – which is becoming commoditised over time, and might eventually suffer from the major PMS systems deciding to do their own. But it likely will always have a place as having the most access consumer side in the online ecosystem.

- Integrates to 25 patient management systems.

- Looking now at more important app functionality such as eScripts, which is looming as a new driver of patient engagement on top appointments now that telehealth has become Medicare-funded.

- Doctor led and positioned as patient facing but also has the largest client base of allied health professionals in the country.

- Has suffered recently from a data privacy scandal, but is largely through that and still has retained most clients, based on good core servicing and functionality doctor side, and lack of patient awareness of the scandal consumer side.

- The most backed health tech play in Australia in terms of capital raising, with over $35m raised and including investors such as Telstra Health, Channel 7 and global VC behemoth Sequoia Capital.

- Doctor founder and leader, who remains committed and at the heart of the business.

No 9: Hotdoc (privately held)

Market Cap Estimate: $55m

Business Dynamic Score: 5.5

- Is a B2B doctor directory monetising primarily through appointments software as a service.

- Competes in some respects on business model with HealthEngine (appointments) but is mainly subscription-based revenue versus HealthEngine which makes most of its money on a transactional basis of delivering new doctor leads via its appointments system.

- As opposed to HealthEngine, declares itself as doctor first not patient first, so it is more concerned technically with delivering efficiencies to the doctor. The reality is that both HealthEngine and Hotdoc have to deliver to both the doctor and the patient to succeed.

- Hotdoc is a much younger company than HealthEngine and has built its platform ground up on the cloud, which makes it more agile and easy to iterate on development and it has shown this ability recently.

- Has built very good market share in its short life compared to HealthEngine (supposedly they have similar share of doctors using their systems for appointments) and is aggressive in its objectives and vision.

- Is primarily reliant on distribution and integration via the major Patient Management Systems of BP, Medical Director and Genie. Has a long-term deal now with Genie, but BP has declared a desire to have its own booking functionality on its patient side application which would put it into competition with its distributor eventually and expose the group’s reliance on just booking functionality.

- Is doctor-led, and has a more modern operational feel to it than most other companies in the list, perhaps an effect on the company of their founder.

- Will need to seek other important functionality quickly to maintain its good momentum so far.

No 10: PKS Holdings (Public)

Market Cap Estimate: $53m

Business Dynamic Score: 3.8

- AI based learning systems that audit clinician data entry on the fly and support decision making at the coal face.

- A niche set of products trying to find a home in a very complex milieu of hospital based software, but attempting to deal with a very important and widespread problem.

- Good revenue and reasonable growth, and has now aquired a synergistic company, Pavillion Health, to give it access to more clients with more products

- Just appointed Tim Kelsey as CEO, who is the immediate past head of analytics at global information digital health standards , education and governance group, HIMSS, the immediate past CEO of the Australian Digital Health Agency, and the founder of successful hospital performance data analytics group in the UK, Dr Foster (which was sold to Telstra and is now a part of Telstra health). Kelsey has lots of high end connections, understands digital health intimately, is a past successful entrepreneur and is smart. It’s a bit of a step down from his previous roles, or perhaps, he knows something we all don’t, and he’s going to make the gorup fly.

No 11: Healthshare (privately held)

Market Cap Estimate: $55m

Business Dynamic Score: 5.5

- Firstly, why Top 11 and not 10? Simple, we did 10 but left one out and when we put it back we wanted to leave Healthshare in the story because they are an interesting group.

- Is another patient facing online health directory, but monetising differently from HealthEngine and Hotdoc, using a range of models which include partnerships with pharmaceutical companies for distributing patient information, and with private health insurance, providing the only comprehensive directory to patients of specialists and their fees, including no gap providers.

- Has never raised capital outside its core investors, and is tightly held and overseen by a successful entrepreneur, who previously built and sold a sophisticated procurement and supply chain services business and has a good tech development track record.

- Has pivoted its business model(s) successfully a few times now and is careful where it invests and how.

- Most recently it has launched a doctor clinical decision support system, which polls patients prior to their consult via all the booking systems and an sms note, in order to streamline the consultation process for both the patient and doctor. The data being generated, non patient identified of course, is fascinating and likely one day to valuable in developing AI care models.

- Has a spread of business models based on its distribution via its directory, making its revenue stream less risky (not singular functionality like appointments) but also it is spreading its focus.

- Like all the directories has distribution exposure to Google on the consumer side, and the major PMSs on the B2B side.

- Hasn’t hit a major product functionality that will drive major growth yet, but it’s a sort of watch-this-space creative group, that has defied a difficult market for many years now, has a lot of experience and is throwing a few interesting things against the wall.

Disclaimer: Very obviously I’m not an investment analyst. I’m mostly just an interested and passionate observer of an interesting and fast developing sector of the healthcare market. I did once run a largish company ($90m at its peak, 350 FTEs) for many years just so you know it’s not all amateur hour. This group did a lot of digital development, and had significant digital revenue streams in its life ($50m at its peak).

Notwithstanding, I don’t have a good grounding in finance, or financial analysis. The best CFO I ever worked with, who went onto bigger and better things because he was good, would roll his eyes at me regularly and laugh heartily at any attempt I ever made to make sense of anything mildly financially complex. Another one quite correctly asserted once that my monthly management meetings, which involved quite a bit of financial scrutiny of business units, reminded him of the Cantina bar scene in Star Wars. I’m bad with simple things like balance sheets, and worse with more ethereal financial concepts like discounted future earnings, terminal value and so on. Which means, if you’re planning to use any of this as any sort of investment advice, or for research on anything, you’ll probably want to think again.