A poorly explained process could expose you accidentally to ATO issues or your entire practice to payroll tax liability.

MyMedicare enrolment does not properly consider the most common business structure of modern Australian GP practices in its enrolment process and is already creating confusion among GPs and practice managers who are attempting or contemplating enrolment.

The key issue identified by some advisors and practices is that at no point does the new enrolment process stop to ask an enrolling doctor or practice manager which business structure they work within.

In the past, DoHAC has been careful to steer clear of offering any advice or education around business structure and potential tax liabilities of GP practices, but given the emerging national crisis around payroll tax liability, some advisors are now suggesting they need to be more pro-active in helping GPs with this issue.

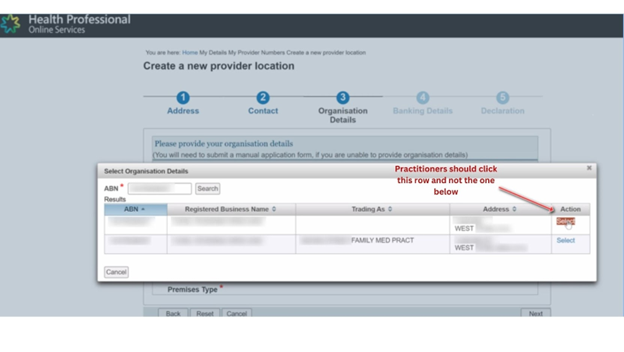

At a key point of the existing online MyMedicare enrolment process a doctor or practice manager is asked to click one of two enrolment options, but the implications of clicking either option are not outlined.

The first option appears to link a practitioner to their own ABN, which is correct if you have a tenant doctor arrangement. The second option appears to link to a path which is appropriate if a practice is running doctors as employees or subcontractors. Again there is no explanation of this.

It is apparent now that some doctors or practice managers are defaulting to the wrong option for the business structure they are operating in. Most often tenant doctors are choosing the option that Services Australia is pre-filling with the name of the practice in which a doctor is operating and which is appropriate for a practice running employee doctors.

Tenant doctor scenario example

If a doctor is operating as a “tenant doctor” – where the practitioner is the “practice” that is buying support service such nursing, administration staff, premises, plant and equipment from the “service entity” – opts for the pre-filled second option with their practice name or medical centre name in it, they will likely be exposing their entire practice to future payroll tax audits.

This is because they would effectively be declaring that they work as either an employee or subcontractor of practice which is running an employee doctor model.

For a services entity it will require all its tenant doctors to fill out the first option correctly, but the confusion will likely see some choose the wrong option.

If this happens there will be some problems in terms of Services Australia payments to these doctors and blended payments to a practice, but nothing like the problem the services entity may face down the track if it is audited: it will only take one tenant doctor to make the mistake and implicate the whole practice for non-compliance on payroll tax.

Tenant doctors opting for both structures in the same entity will likely also confuse distribution of activity-based payments.

MyMedicare also requires practice accreditation, but RACGP accreditation guidelines as they currently stand also tend to implicate a practice as being liable for payroll tax.

According to Health and Life practice advisory principal David Dahm, several of his clients have already been tripped up by the lack of clarity.

“Many practice owners and practitioners continue to not understand how their legal and tax structures operate and due to ignorance or costs are reluctant to seek professional legal and accounting advice,” Dahm said.

“Unwittingly some are completing forms not full understanding the implications of making a false or misleading statement to the government.”

Dahm told TMR that if a practice is running a services entity model – it is believed that over 90% of practices in Australia are running such a model – then every tenant doctor would need to be enrolling individually in MyMedicare using the first option.

In that option, which still uses the term medical practice (another confusion according to Dahm), individual tenant doctors need to register themselves using their own ABN, but still associate themselves with the supporting centralised service entity structure in PRODA and HPOS.

“If you’ve got lots of tenant doctors in your services entity it significantly multiplies the potential for confusion because every doctor needs to understand exactly how they should be enrolling individually, and strictly, the services entity can’t be seen to be directing the process too closely.

“This can be difficult if the tenant doctor does not clearly understand their legal and working relationship.

“The other issue here is probably that services entities will need to be reconfirming their individual tenant doctor contracts to contemplate any support services that the entity will need to provide to the doctor’s practice in terms of MyMedicare.

“Some of it will be similar to how contracts handle other blended practice payments like ePIP.

“But there is no explanation of any of this in the enrolment process or the implications on any future funding.”

Although it’s not strictly DoHAC’s role to be providing any advice on business structure or tax liability, given the current and significant ongoing issues with payroll tax for practices across the country, Dahm said it would make sense for DoHAC to provide a lot more clarity around the relationship between the program and what business structure they are operating under.

Dahm said that “technically DoHAC has the right buttons in there, but without any explanation about which ones you should be opting for based on what business structure you are operating under, anything could happen”.

When asked why the enrolment procedures and educational material do not specifically address the potential issue of payroll tax for certain practices according to business structure, a Department of Health and Aged Care spokesperson told TMR the following:

“General practices are private businesses with diverse operating structures and employment models, and it is the responsibility and choice of the owner, or the individual in the case of a contractual arrangement as to how they operate and to seek the appropriate expert advice reflective of their unique business arrangements. Tax obligations and compliance with taxation regulations related to individual business and/or payment structures remain the responsibility of the individual provider and practice or services entity.”

The department followed up that answer by saying they are “not aware of a link between eligibility for MyMedicare and tax policy” and invited TMR to provide any legal and/or accounting advice we have that indicates the requirements for MyMedicare might lead to a tax liability.

To be clear, eligibility for MyMedicare would not create a payroll tax issue if a doctor or practice manager completes the enrolment process properly.

The issue identified by Dahm and some practice managers attempting to enrol so far is how easy it is for enrolling doctors or practice managers to identify themselves with an incorrect business structure which might then create an ongoing liability.

GP practices around the country have been able to enrol for MyMedicare since 1 July, in preparation for the first patient enrolments on 1 October.

The government’s monetary pitch for practices to participate in MyMedicare has a very low return to practices or individual doctors in the near term and a largely unknown return moving into the future, based on information provided so far by DoHAC on the scheme.

The pitch so far from DoHAC includes:

- Registered patients will have access to longer MBS funded level C and telephone consults (from November)

- Registered patients will create access to a triple bulk-billing incentive for longer MBS telehealth consultations (Levels C, D and E) for children under 16, pensioners, and concession card holders (from November)

- Blended practice payments if their doctors can keep identified frequent hospitalgoers out of hospital (from 2024-25)

- Additional payments to GPs and primary care clinics for regular appointments, health assessments and care planning with aged care residents (from August 2024)

- Chronic disease management items will be linked to a patient’s registration in MyMedicare from November 2024.

Unknown monetary variables moving forward for practices and GPs include how many patients a practice or a GP might have who end up being identified as frequent hospitalgoers, and what the government will end up paying practices or individual GPs for linking MyMedicare to aged care homes.

Several practices contacted to check the frequent hospitalgoer patient item told TMR they either did not have patients who went to hospital as frequently as required (10 times in one year) or that if they did, the complexity of such patients usually would mean that there would be very little a practice could do to lower the frequency of hospital visits.

“I’m not sure they’ve really done their sums on that one,” said one owner.

While chronic disease management items can be linked to a MyMedicare registration as well, patients who are not registered in MyMedicare will still be able to receive these items from their usual GP so there doesn’t appear to be a significant advantage here in linking registration.

TMR called several practice managers to see if they were planning on registering in the next three months, as DoHAC is urging.

The practices contacted said variations on the following:

- Overall the offer didn’t seem very compelling so far

- They’re worried about the cost of the effort to get patients enrolled

- They had a few far more urgent issues at hand to be thinking about (some mentioned payroll tax specifically)

- That they would wait to see how things panned out.

One respondent said that the outcome of the Health Care Homes trials weighed on his mind when he thought about enrolling in this new program.

The most urgent matter most of these practices are likely facing today is the increasingly aggressive stance of state revenue offices towards payroll tax audits.

Wouldn’t this suggest that adding clarity around this issue in the MyMedicare enrolment process might ease minds a lot?

Several PHNs around the country are conducting extensive educational programs for practices around the enrolment procedure at additional expense to the federal government, but like the Services Australia online enrolment process, none provide any help on how to enrol to avoid accidental exposure to tax problems.