If you fill out an HW052 as directed, you might be setting your practice up for a payroll tax audit and ATO trouble around e-invoicing.

Significant confusion has started to emerge over the major forms used to set up providers and practices for online Medicare claiming.

Medical accounting and advisory firm Health and Life published an article late last month pointing out that one of the forms, HW052, seems to be directing practices to set up online claiming in a manner that could create issues with state revenue offices in terms of payroll tax interpretation, and which may create issues for GPs who are contractors with the Australian Taxation Office when e-invoicing rules are introduced next year.

The article states at one point that: “Many unknowingly may have committed a ‘serious offence’ under the Health Insurance Act and/or Income Tax Act and Payroll Tax rules.”

An HW052 form is described by Medicare as being required to “provide your bank account details to Services Australia for online claiming as a payee provider for one or more servicing providers”. A payee provider is a practice, although the use of the word provider is a little confusing in the form, as the bank account that Medicare is asking for is not actually the bank account of any provider but the account of the practice, by its location.

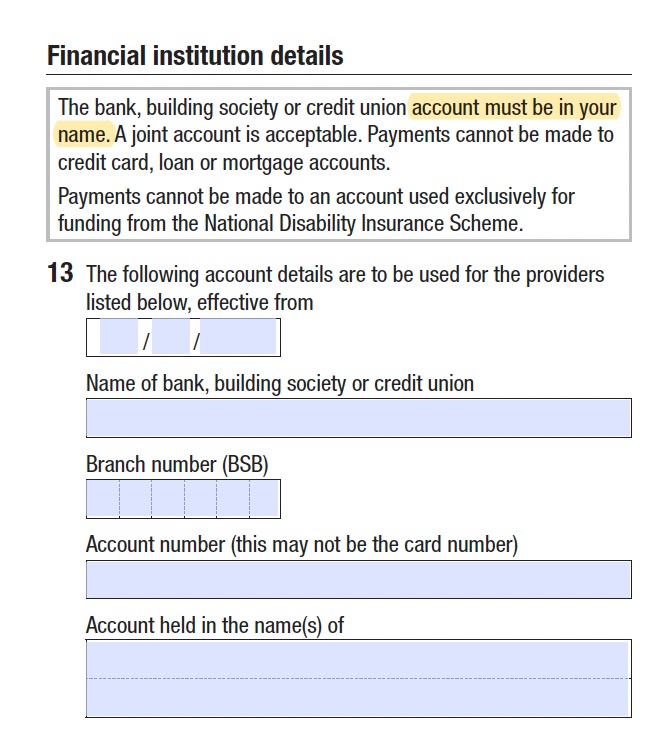

The form stipulates, just prior to asking for a bank account number, that “the bank, building society or credit union must be in your name” (we have placed the emphasis on your). It then asks the form filler to list up to six “providers”, their provider numbers and their names. A provider can have multiple provider numbers if they work in different locations.

The form does not explain clearly anywhere that the bank account required by Services Australia is the “master” account of a practice, and that the service providers you need to list are either your tenanted doctors, or employee doctors.

According to several sources, several practices are now questioning what bank account number to put on this form.

This is mainly as a result of the recent case of Thomas and Naaz vs The NSW Commissioner for State Revenue, in which a judge determined in favour of the NSW Office of State Revenue (now known as Revenue NSW)that the practices of Dr Jawahar Thomas were liable for up to $795,000 in back payroll tax.

One of two key arguments made by the judge in determining that the Thomas practice’s doctors were employees for the purpose of payroll tax, not tenanted doctors, was the flow of money for all Medicare billings directly into the practice bank account.

Following the case, a lot of practices and several corporates have been scrambling to find a way in which money flows between its tenanted doctors and the practice bank account, including the idea that the best flow may now be for the tenanted doctors’ Medicare billings to flow into a “blind trust account”, which would need to be set up by an accountant or lawyer for the practice, and then fees flow separately from the trust account to consulting doctors, and “rent fees” of a tenanted doctor to the practice.

In this way, the initial consult by the doctor provider does not flow first into a practice bank account, which is the way many practices remain set up.

The HW052 form does not mention that a practice can nominate a “trust” account, and its “must be in your name” wording doesn’t seem to contemplate the idea, despite this now emerging as the likely major structural means for practices to establish a money flow between themselves and their doctors that does not expose them to a potential state office tax audit and payroll tax liabilities.

The Medical Republic asked Services Australia to clarify what they mean by “your name only” on the HW052 form and they got back to us with this clarification:

- This form (HW052) is intended for payee providers for one or more servicing providers. For example, a medical practice that employs multiple doctors where claims are paid into a business bank account.

- To give us those bank account details, the ‘financial institution details’ section of the form needs to include the name of the nominated provider linked to that organisation’s bank account (known as the payee provider).

So essentially, Services Australia is asking for the practice bank account.

Such an arrangement appears to be largely out of step with the Thomas case, in that forcing a flow of money from a tenanted doctor for their Medicare consult directly into a practice account is forcing a set-up that makes practices far more exposed to state tax office audits by establishing a flow of money that is suggestive of an employee-employer relationship, not a tenant-landlord relationship.

According to author of the advisory article, David Dahm, the current set-up of forms for claiming online from Medicare claiming may also lead to serious issues with the ATO when the tax office enforces new e-invoicing procedures on practices and GPs after July 1 next year.

The problem, according to Dahm, is that with e-invoicing, the ATO will have full visibility over the transactions of every ABN – providers and practices – and will be able to easily match transactions between a practice and its provider doctors.

“E-invoicing is akin to real-time microchipping every transaction you make,” he said.

“When fully operational, e-invoicing should work like plugging in a missing bulb in a Xmas tree and instantly expose non-compliance.”

The issue with HW052 according to Dahm is that 100% of the revenue from that transaction under a HW052 arrangement is first going to the bank account of the practice, with a different ABN from the doctor’s. So the tax office may end up questioning who actually earned the income for the consult.

Although the practice then remits the provider doctor their commission, Dahm says that technically the initial Medicare revenue is generated 100% by the provider doctor, so for tax purposes the flow of money may appear wrong when e-invoicing starts.

“The ATO could easily deduce that the provider is not declaring their full revenue in these circumstances,” Dahm told TMR.

Dahm told TMR that it looks very much like a case of one hand not knowing what the other is doing at the moment between government departments, and that GPs and practices might easily get caught up in the middle of the issue.

“Services Australia don’t appear to be up to date with the state-based payroll tax cases, the Department of Health is not itself getting involved, and the ATO just does what it does,” he said.

“The problem with all of that is that while these departments aren’t co-ordinating, GPs and practices can get caught out through no fault of their own.

“It’s pretty messy because technically the GPs and practices won’t be following the law, but they will be following what they have been directed to do by Services Australia.”

“With forms like HW052, which look now like they are out of date and not contemplating what is happening in the real world to GPs and practices in differing jurisdictions such as state tax offices, it’s getting hard to advise exactly what a practice should be doing.

“If you follow what HW052 is asking you to do literally, you can be exposing yourself, moving forward.

“Worse than that, it looks like a lot of practices are set up this way anyway, as a result of this form. Some have been for decades.”

When TMR contacted Services Australia, we did get a sense that they were very wary about our enquiry.

Initially we were asked why we want to know that.

It took Services Australia two days to get back to us with their answer and notably they added to their reply that “we regularly conduct reviews of our forms and incorporate feedback to make improvements” and perhaps more interestingly, “we’re making changes to this form and related forms in 2022 to simplify the process”.

Services Australia also made the following suggestion, which came out of the blue for us as we hadn’t uncovered this form in our research prior to making our enquiry:

- We have an additional form (HW029) for individual contractors who may work for multiple practices with different payment arrangements.

- The payment arrangement between a servicing provider and their employer is solely a matter between them.

The latter of these two points is perhaps the most worrying in the context of what Dahm says about various jurisdictional groups not co-ordinating.

It seems to be counter to its own instructions in HW052 that make it fairly clear how a servicing provider and their “employer” (not the correct term to use, anyway, if your providers are tenanted doctors) payment arrangement needs to be set up.

If you are as confused now as us, Dahm and the various practices managers we have contacted, you can contact services Australia for clarification at www.servicesaustralia.gov.au/healthprofessionals, or call them at 1800 700 199.

Given the multi-jurisdictional issues at hand here and the answers they gave us on HW052, we aren’t sure they are going to be able to help immediately – although perhaps with enough incoming calls they may incorporate something into their planned revision of this form in 2022.

You can find more detail on this issue in Dahm’s original article here.