Shoot for the moon (no payroll tax) and you may land among the stars (national payroll tax consistency).

RACGP advocacy on payroll tax has made the shift away from asking for a one-size-fits-all exemption and toward a plea for national consistency with Queensland, something experts say is still entirely possible.

Despite a last-ditch push from the college that the tax must be National Cabinet’s “top priority” this week, it did not even rate a mention yesterday, meaning GPs will probably go into 2024 with no further clarity on the topic.

And clarity, as William Buck accountant Paul Copeland told The Medical Republic, is something that is so far available only in Queensland.

“You’ve got NSW, which are kicking the can down the road and Victoria just sort of saying, ‘well, nothing’s changed’,” he said.

“[But in] Queensland, for example, you’ve got the amnesty process in place and you actually do have a degree of certainty because you’ve got a ruling that says, ‘if you do it like this, then the payments for doctors are not considered taxable wages’.”

The detailed public ruling released by Queensland in September, which runs to almost 30 pages, was the first public piece of state revenue office advice to explicitly outline the business structures that are and are not considered to be relevant contracts for payroll tax purposes.

The RACGP hasn’t given up on asking for an exemption entirely – in a pre-national cabinet release, it still asked the government to consider exempting any patient or Medicare payments (i.e. the vast majority of money flowing into a practice) from payroll tax.

However, the main thrust of its advocacy appears to have been refocussed on getting the other states and territories on board with Queensland’s approach.

“The industry, I think, has given up on saying, ‘we don’t want this, we don’t want that’,” Mr Copeland said.

“They’ve come up with a workable solution, which is equitable to other businesses as well.

“It’s now just on the states to go ‘yep, okay, let’s do this’.”

While at least one state – NSW, here’s looking at you – has publicly said it won’t be following Queensland’s lead on releasing a detailed public ruling, Mr Copeland said it wasn’t a total impossibility.

“At the moment, we’re working with a number of larger groups looking for certainty around this area … [with] private rulings and feedback from the revenue officers,” he said.

“And in that situation, the feedback and the questions they’re giving us tend to lead towards a similar interpretation to the main payroll tax laws as Queensland.”

Given that payroll tax law is harmonised across the eastern states, Mr Copeland said, it follows that the interpretations will be either very similar or the same.

It’s a point that healthcare accountant and regular TMR contributor David Dahm has also made.

“Rulings are not law, but they are based on case precedents and law,” Mr Dahm told TMR.

Regardless of where GPs are practising, he said, the principles outlined in the Queensland ruling are likely to be informative. “It’s a good ruling, it’s a much clearer ruling and a safer defence than you’d have by doing nothing at all,” said Mr Dahm.

“As a bare minimum, no matter which state you’re in – including Western Australia – I would be following that ruling.”

As a Queensland GP and clinic owner herself, RACGP president Dr Nicole Higgins said the ruling had already been beneficial.

“What [my state’s approach] means to me … is that I have time to review contracts and work practices, and also the confidence to invest and grow,” she told TMR.

“What we need is a nationally consistent approach [along with] the reassurance that there’s no retrospective collection of payroll tax and that we have time or an amnesty period to adjust our work practices.”

Assurance that payments to doctors will be exempt from payroll tax or guidance on what is and is not a relevant contract would also be ideal, Dr Higgins said.

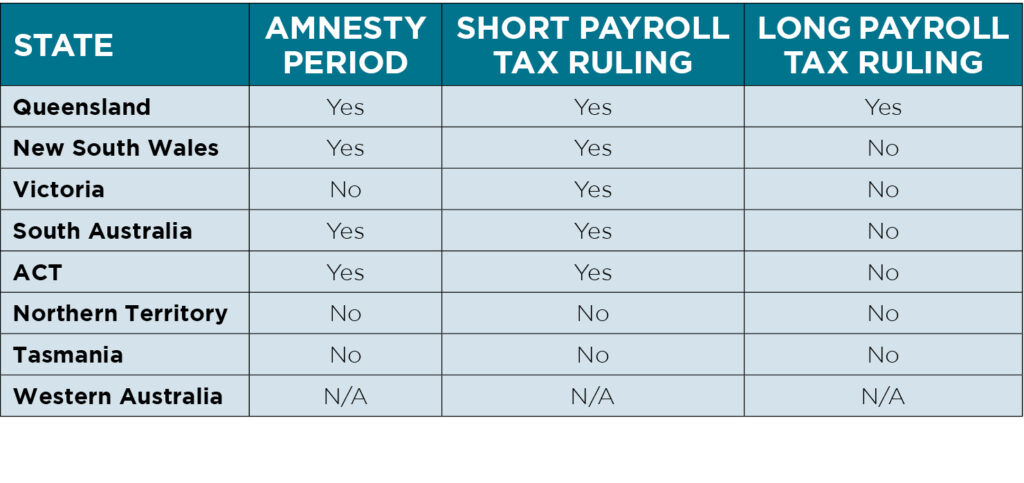

Here’s the current state of play around the country: