Questions remain over Example 9 and flow of funds. Both the RACGP and AMA NSW are pushing Revenue NSW for answers. Here’s what we know so far.

New South Wales’ $189 million payroll tax relief initiative takes effect today. Here’s what we know, and what we don’t.

The initiative, announced in the 2024-25 budget, introduced a bulk-billing support that would rebate payroll tax for contractor GP wages at clinics with bulk-billing rates above 80% in metropolitan Sydney and above 70% in the rest of the state.

The plan will also offer full retrospective waivers for historical unpaid payroll tax liabilities – estimated to amount to $104 million – so all clinics are starting with a clean slate.

The new payroll tax rules take effect from today, despite calls from the RACGP to extend the amnesty.

Speaking to The Medical Republic, RACGP NSW & ACT chair Dr Rebekah Hoffman said the release of the Commissioner’s Practice Note and a list of the areas classified as metropolitan Sydney were clarifying.

“There’s still a few questions that remain unanswered and we’ve got ongoing meetings with the revenue office this week and next week to clarify those,” she said.

“We’re still trying to lay out all of those really specific findings, but there’s a lot more information than was available last week.”

Here’s what clarity we do have.

First off: the retrospective exemption

As promised by NSW Treasurer Daniel Mookhey when the exemption was announced, in a state-first, it has been legislated.

“No GP clinic will have to pay any back taxes they might owe on a contracted GP’s wage,” he said in June.

“Extinguished through legislation – that is our plan – NSW is the only state that will [legislate this] because we prefer GPs to spend more time with their patients than with their accountants.”

According to the Commissioner’s note, where payroll tax has not been paid on GP wages up until today, the exemption applies “and the employer is not required to declare those payments as wages for payroll tax purposes”.

Dr Hoffman said this retrospective exemption was a “ticked box” that the RACGP were very grateful for.

AMA NSW CEO Fiona Davies concurred that “GPs are not required to take any action to benefit from the exemption”.

But to anyone that has already paid payroll tax on GP wages prior to today – sorry to say there will be no takesies-backsies (i.e. refunds).

Which general practices are liable for payroll tax going forward?

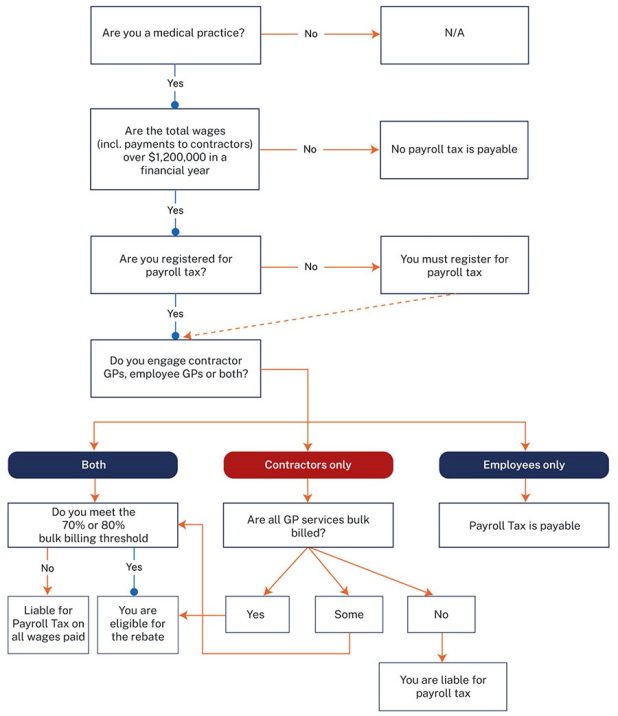

According to this flowchart, courtesy of Revenue NSW, if you’re a medical practice, with total wages (including payments to contractors) over $1.2 million in a financial year, all roads lead to registration for payroll tax, even if you are then eligible for the rebate.

Dr Hoffman said practices meeting the wage threshold should register for payroll tax.

“If they meet the $1.2 million threshold they need to register for payroll tax, and then it’s a matter of if they meet any of the exclusion criteria, which is outlined by the revenue office, with the bulk billing incentive being one of those exclusion offers.”

According to the Commissioner’s note, payroll tax is payable on “relevant GP wages”, the definition of which can be found in the note.

It remains unclear if there may be some payment structures that avoid classification as “relevant GP wages”.

Dr Hoffman told TMR that confusion remained over the flow of funds.

The RACGP is engaging with Revenue NSW for clarification on this.

“We’ve gone back to the state revenue office and asked them to be more specific in regard to flow of funds and in regard to service entity and room rental, because my understanding is that is still not completely clear and there is still some discussion among GPs about whether or not that means they’re liable for payroll tax,” said Dr Hoffman.

“[Revenue NSW] needs to be able to provide a clear answer.

“That might be talk to your accountant [or] talk to your lawyer, which is where it’s at [at the moment].

“But when I talk to accountants and lawyers from the RACGP perspective, they’re still confused, they still don’t have absolute clarity.”

Dr Hoffman said she was “absolutely” hopeful that clarity would be provided.

And now, to the rebate

The payroll tax rebate is only payable for contractor GPs meeting the bulk-billing threshold of 80% in metropolitan Sydney or 70% in the rest of the country.

A full list of which suburbs are included in metropolitan Sydney has now been published on the Revenue NSW site.

“For the purpose of determining whether a medical centre meets the relevant proportion, the employer must consider the total number of GP services that are bulk billed as a proportion of the total number of GP services that are provided at the medical centre (whether bulk billed or not) including those GP services provided by GPs who are engaged as employees,” reads the notes.

GP services include all services provided by a GP – employee or contractor – at a practice and is per location.

Dr Hoffman said that some areas where the triple bulk billing incentive means that bulk billing rebates are closer to $80 – like southwest Sydney and some regional and rural areas – may already be hitting the bulk billing thresholds, but very few MM1 practices, where the incentives are lower, would be meeting the threshold.

Dr Hoffman said her “most significant” concern over the payroll tax was around veteran affairs.

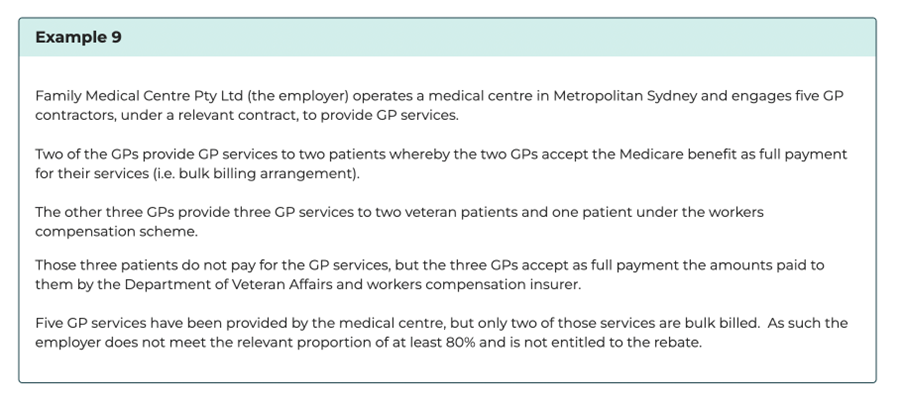

As reported by TMR, example 9 in the Commissioner’s note implies that services provided to veterans, or workers compensation patients, may not contribute to bulk billed services and therefore reduce likelihood of eligibility for the payroll tax rebate.

Dr Hoffman said it remained unclear whether charging patients DVA rates would be included toward the bulk billing percentage.

“We’ve gone back to the state revenue office and asked them to really look at that and reconsider,” she said.

“They’ve said they’ll go away and have a look at it, that’s exactly what we would have hoped for.

“We’re yet to get that information back, but that is something that really concerns us, because we don’t want to make it harder for veterans to be able to access care.”

Dr Hoffman said she was “very hopeful” that if GPs charged DVA rates it would be included towards the bulk billing threshold, “because that’s the sensible answer”.

Related

AMA NSW’s Ms Davies reiterated that not all practices would be liable to pay payroll tax on contractor payments.

“AMA NSW has always stated that payroll tax was not directly relevant to bulk billing and that a doctor’s decision to bulk bill or not is related to other factors such as the costs of practice and the level of rebates provided by the Commonwealth Government,” she told TMR.

“Payroll tax is payable, and practices can assess each quarter whether payroll tax is payable and whether they meet the bulk-billing threshold should they wish to claim a rebate.

“There are some ongoing discussions regarding some of the finer details, however, these are not currently time sensitive issues.”

She encouraged doctors to seek advise on their “business arrangements, including where they have a potential payroll tax liability and whether they may be eligible to claim the bulk billing rebate”.

Dr Hoffman said that the bulk billing thresholds wouldn’t increase bulk-billing rates, and any argument to the contrary from health ministers was unfounded.

“We know from the ACT that setting these thresholds doesn’t increase bulk billing,” she said.

“What they might do at best is maintain bulk billing, but with the health and finance ministers coming out today saying it will improve bulk billing rates, that’s definitely not the case and we’ve told them that.”

The way to increase bulk billing would be more federal funding, she added.