Covid-tired GPs are abandoning the full-time ship in droves, putting more pressure on practices challenged by the look, walk and quack like an employer-employee-tax-structured-duck problem.

According to The Conversation, Australia’s covid-induced “great resignation” is a myth. Unlike in the US, the resignation rate in Australia has never been lower.

The problem, if it is really a problem at all, argue professors Mark Wooden and Peter Gahan of Melbourne University, is how employers are going to deal with “the ‘Great Resistance’ to the idea of returning to the office, and the daily commute”.

What about GPs, though?

Strong anecdotal evidence suggests that GPs, who have been on the frontlines of covid, in more ways than one, may have been more susceptible to the Great Resignation effect than the rest of Australia’s workers.

Although many practice managers and owners are reluctant to talk about it, a lot of GPs don’t want to return to the practice full time after some time in lockdown working on the phone from home, and some are asking if it would be OK if they just work off site doing the telehealth side of the businesses.

The essence of good general practice is face-to-face interaction with patients, and a longitudinal relationship built off that platform.

Telehealth is an important component of care being worked into such a relationship these days (maybe even more now with the government plan to tie rebated telehealth to patients staying with one doctor or practice) but if you’re a GP who wants now to “work from home” like all the rest of us want to do, you’re really asking for a completely different job: you’re sort of resigning from your old job, really.

Even if your practice does agree you can take the telehealth load for your practice and stay at home much more, you’re leaving.

If you think about the idea of a Great Resignation and GPs, you can hardly blame GPs for thinking they’d like a piece of the new-found freedom that many of us now “ex office workers” are likely to enjoy, moving forward. After all, how come we all get to keep working from home, going surfing at lunchtime, and GPs don’t?

Well, obviously because you can’t do your job as a GP without seeing patients face to face in the end.

But you can see the point of many of those GPs who, having gone through covid and experienced off site working, want a change now.

What sort of anecdotal evidence is out there that this might be happening?

- The Medical Republic has spoken to five mid-sized practices about the phenomena in the past few weeks and those practices are feeling the impact of their GPs either just walking away, asking if they can stay but work from home in some capacity, or going part time as far as their face-to-face duties are concerned, compared to what they did before.

- Creative Careers In Medicine (CCIM), which is a group of until now 13,000 doctors across Australia who either work outside of clinical practice part or full time or want to, has experienced a very large bump in membership, most of it from doctors who now want to explore the idea of doing something other than their full-time clinical work, but using their experience and qualifications.

- The GP recruiters are busier than ever but they can’t fill places.

- Some of the larger GP accounting and advisory firms are getting a lot of incoming on the problem from their clients.

It seems like the great GP resignation is real at some sort of scale – at least for now. TMR is going to use Healthed’s regular GP PULSE survey (next Tuesday at 7pm AEST) to try to get some sort of quantitative handle on the size of the phenomenon.

But perhaps this phenomenon is best not described as a “great GP resignation”, but as a “great GP rethink”, and likely, a big new spill to significantly more part-time GPs as a percentage of the entire workforce.

Most GPs aren’t just walking away (some are). They are re-examining their work balance in terms of what they can do other than be stuck in a windowless room for too many days a week seeing lots of patients.

Most GPs can make a reasonable living doing a few days a week in a practice and the work lends itself to being able to do this and have another, more creative job. It feels like it’s a workforce pattern in general practice that has been unfolding for years (it’s great for mums, this sort of flexibility, and that’s been borne out in the patterns of GP work) and which has had a rocket put under it by covid.

The net result of this problem for those practices reporting the phenomenon is significantly increased working pressure on the GPs who remain in a practice, and ultimately, more financial pressure as practices are not able to meet their normal patient demand.

Could such a problem come at any worse a time for practice owners and managers?

It’s hard to imagine if it could.

GP shortage on top of practice duck-hunting season?

A converging and increasingly serious issue for practice managers and owners is what one senior industry analyst described to me recently as the practice tax structure duck problem.

In terms of tax structure, the duck problem goes like this:

We are in a rapidly unfolding age of culturally far more aggressive state and federal tax departments (probably just gearing us up for the reality of post-covid budgets) ably assisted by neat new legislation and technology that allows them to micro data match at scale on things such as ABNs of individual doctors versus that of their practice.

Where once these state and federal departments couldn’t quite make out whether or not your practice was actually a duck in terms of all the detailed financial and contractual administrative set-ups needed to make sure you don’t have an employer-employee relationship with the doctors working at your practice, now these groups have new high-powered sights on their rifles where they can make out a lot more detail at very long distances.

In these circumstances, a lot of practices are starting to look more clearly like ducks when they get into the sights of these government groups.

The thing is, that they look like ducks is often coming as a surprise to both the practice owner/manager and often their accountants.

After all, they’ve survived duck-hunting season without a feather missing for years and years now.

What has changed?

A lot, if you add things up.

The duck hunters have some neat new weapons and post covid a very unfortunate amount of intent to hunt down a lot more ducks.

Are you a duck or are you a rabbit?

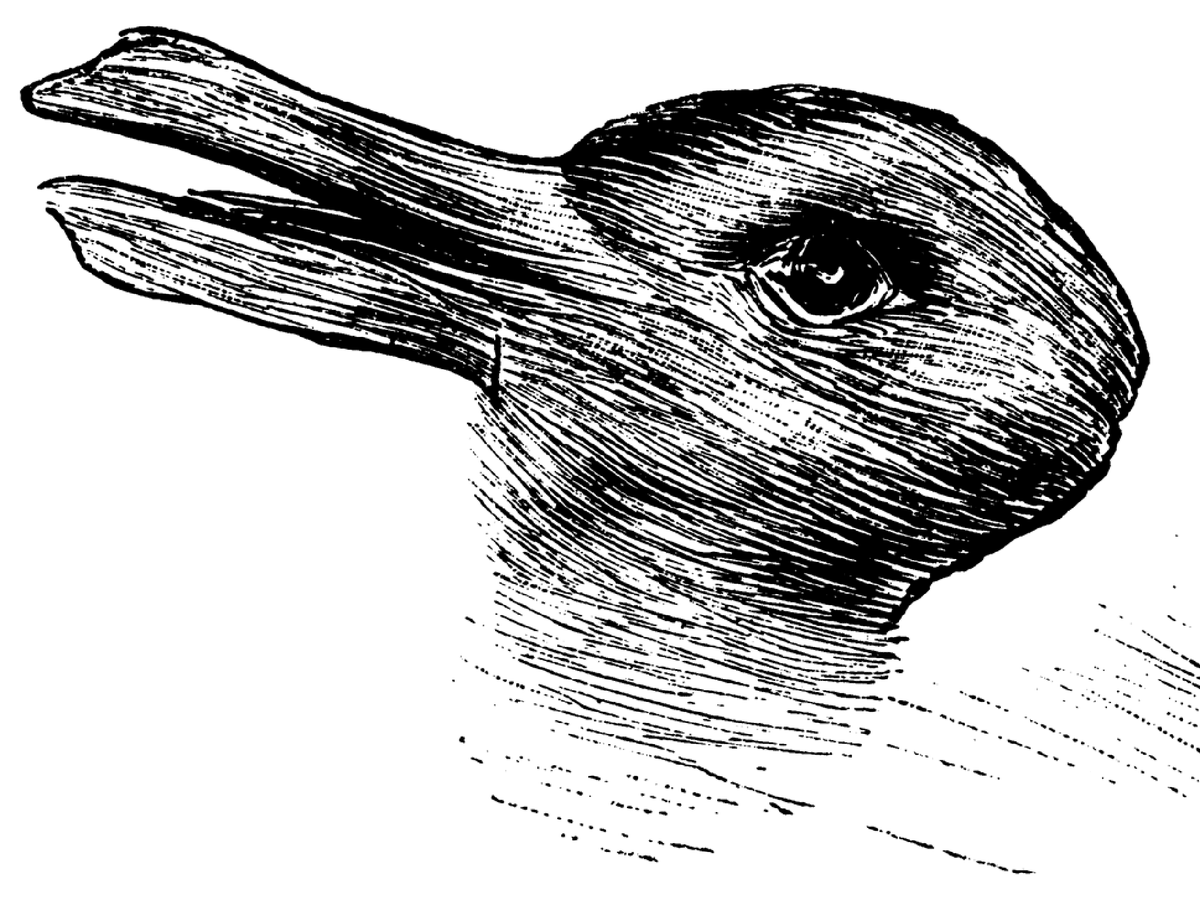

Remember the old Looney Tunes episode where Bugs Bunny keeps swapping the rabbit hunting season poster in the forest with a duck hunting poster so that Elmer Fudd shoots Daffy Duck and not him.

In this analogy, the duck (Daffy) is a practice that is set up, for all intents and purposes, as employee/employer, Elmer is the tax man and Bug’s practice is set up as tenant/landlord.

Bottom line: you need to make sure you are much more clearly identifiable as the rabbit that you actually are, even if it’s deep down.

OK, way too far on the duck and rabbit analogies.

The point is, after the past few months of payroll tax rulings, its entirely clear that state government departments are triangulating on GP practices that may not have their ducks in a row (lol, I just can’t help it) in terms of making things blindingly clear to tax authorities that the doctors that work within their practice are not employees, but essentially tenants taking advantage of a specialised “WeWork” type of office space service for doctors.

There are lots of component parts to why practices are finding themselves in this situation and, given the history of things, it’s understandable that many do.

One part already described is that there’s a (wrong) assumption that if no one saw you as a duck for the past 20-or-so duck-hunting seasons, why are they seeing you as a duck now?

Some doctors are even questioning whether it is even “fair” for tax authorities to now be seeing practices as ducks as if they are in a manner reclassifying the species and moving the goal posts. And also, they are doctors busy fighting covid for the government.

All good questions.

But of course, the tax department is one thing. The health department is another.

Yes, of course it’s fair for the government to do this (well, it’s legal at least), and no, no one has moved any goal posts to put practices in this situation. They just have much better duck-identifying and -hunting technology. The rules haven’t changed, so they’re entitled to use their new technology as much as that may not seem fair either.

This said, what does a duck do?

Don’t panic is the first bit of advice, I’m told, as panicking often leads to your changing a whole lot of stuff in how you run and structure your practice immediately, and often such changes can easily be identified by the tax authorities at an audit and get you into a lot more trouble for deliberately trying to game the system.

The reason I’m told you don’t need to panic is that it’s still very early in this new era of high-tech and aggressive tax hunting, and that there is a lot of legislation that still protects most practices from being targeted in any systematic way.

There is time to review things and “adjust”, as it were.

Such a process has to be undertaken with care and patience. And it does not mean you are simply making artificial changes to hide yourself.

Most practices have been set up with the full intent of creating a relationship that is only that of a “tenant-landlord” but for various reasons – changes to technology, cutting corners on administration, bad advice, not paying attention to detail that turns out to be important now – the set-up is, in today’s world, a bit sloppy and needs to be tidied up to what it was really meant to be.

What practice owners and managers might want to think about doing is their own thorough internal audit of all the things that could get you shot should for some reason you come under the purview of your friendly local state tax office.

As it turns out, and this is possibly part of the problem, there are quite a lot of things now you have to be aware of.

This problem has been enhanced unfortunately a lot by most state governments who these days, for some reason, are not making it very clear what the standards and rules are to be a duck or a rabbit.

In a manner, they are marching out legal test cases and pushing the interpretation of existing rules outwards as they go.

They are entitled to do this. They are of course searching for more revenue, which is the nature of the tax office beast, so probably don’t get hung up on a “it’s just not fair, they’re a bunch of monsters” thing.

Before the most recent payroll tax case of Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue NSW, much of the problem lay in the contracts that practices had with their “tenants”. After this case a few things have been added to the list of “do not do’s” including a pretty complex new issue: how the money actually flows between your tenant and you the landlord.

Thomas came a cropper mostly on this issue, not on the contracts issue (he is appealing his case though).

As an example of what is probably the wrong set-up, practices, for very practical and understandable reasons, often will bill a patient with their ABN on the invoice, not the ABN of the doctor (tenant) doing the consult. That probably won’t fly if you ever get into an audit with the state tax office. The duck hunters are probably going to say that’s a big sign your tenant is actually an employee.

The movement of money between a tenant (doctor) and a landlord (practice) is a pretty new game in town and one a lot of practices are trying to figure out now.

Essentially, the Thomas ruling threw a lot of confusion into an already reasonably confused picture. Money has to be seen to be flowing to the tenant first and later taken back by the landlord, as rent. This is going to be a costly adjustment in processes for some practices.

And there appear to be some issues with the automatic reconciling software that sits at the back of some practice management systems. These vendors are needing to work with their practices to redo how things work.

The thing is, it’s a bit of a moving feast at the moment, so you as an owner or practice manager have to keep up and keep adjusting as you go. While you plug all the spaces being vacated by all those GPs fed up with covid and wanting to either go part time or just leave.

What a life.

Contracts between a doctor and a practice need to very clearly outline a relationship that is tenant only.

In the past this was problematic for some practices where the ‘space renting bosses’ wanted their tenants to abide by certain practices and rules that they loved themselves in order to optimise the entire practice office space venture.

Things such as non-compete clauses in contracts seemed sensible once, but a non-compete clause tends to suggest an employer-employee relationship.

In the same way, practices can have contracts that make it clear it’s a tenant-landlord relationship and still contemplate important things such as optimising ePIP returns to a practice, or doing a reasonable amount of care plans, without stipulating in a contract that a doctor has to do this or that.

A simple way is to have clauses that charge doctors more for their tenancy if these services aren’t done by them, with a reason being it increases the operating costs overall of the space if they aren’t doing that. A landlord has a right to do that.

There are a quite a few other hygiene things as well, such as , if you have a practice website, don’t have stuff on it like “our doctors this” and “our doctors that”. They’re obviously NOT your doctors.

I just remembered: I’m not accountant or an advisor of any sort.

I can’t even understand a balance sheet after 12 years of being a CEO of a biggish company and many more years of running smaller companies, so in no way take any of what I have talked about here as practical advice of any sort.

See someone who really understands this stuff if you think you are a bit confused in any way.

I’m just trying to make a point here that in this new and evolving world, the meaning and intent of what you’ve always tried to establish in your practice structure has to be constantly looked at and adapted these days so that things are in the order required by the tax authorities.

And from time to time, the manner of what is required does change, maybe through a test case run by a state tax department, and you need to be alert to what that means for the framework around which your practice is set up.

In duck-hunting terms, you aren’t buying in better camouflage technology (which would be avoidance).

You are simply brushing off the mud that is hiding your rabbit fur, and pinning a few easy identifiers to your tail that say: “I’m not a duck, guys – move on.”