Thomas and Naaz is once again at the eye of the payroll tax storm.

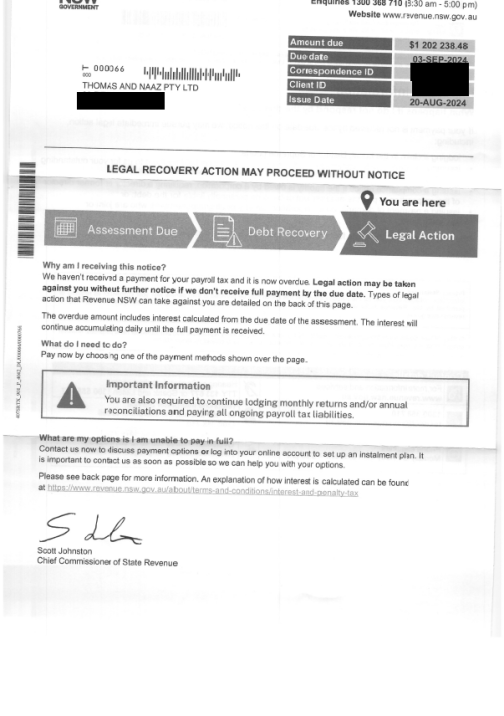

Last week, NSW GP clinic group Thomas and Naaz Pty Ltd – of Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue case law fame – received a bill for unpaid payroll tax amounting to $1.2 million.

The letter advised that legal action may be taken without further notice if payment was not received by 3 September 2024.

This was slightly odd, given that NSW Revenue has issued a full retrospective waiver for all historical unpaid payroll tax liabilities relating to GP contractor wages.

As part of the same reform package, clinics that register for payroll tax and meet a bulk-billing threshold can claim a full rebate back from the state.

In fact, the new NSW payroll tax measures for GPs came into effect on 4 September – just one day after the Thomas and Naaz bill due date.

Clinics cannot claim back any payroll tax paid on GP contractor wages if they pay before 4 September.

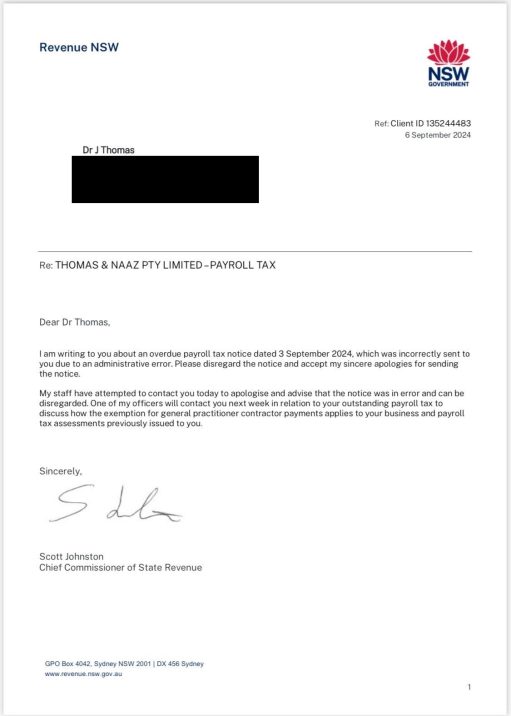

The Medical Republic has now confirmed that the bill was sent in error, and the portion that relates to unpaid payroll tax on contractor GPs will be waived.

“Any notice issued prior to 4 September 2024 that may include payroll tax liabilities concerning contractor GPs will be updated to reflect a waiver of that portion of the assessment,” NSW state revenue chief commissioner Scott Johnston told TMR.

“Revenue NSW apologises for issuing this notice, which was the result of an administrative error.”

The SRO has also issued an apology to the business directly.

It’s the latest development in the Thomas and Naaz saga, which began with an audit in 2018.

That audit kickstarted a chain of court cases which didn’t conclude until March 2022.

The final result was a decision from the NSW Court of Appeal upholding the 2022 decision of the NSW Civil and Administrative Tribunal that most of the doctors contracted to work at Thomas and Naaz’s three clinics had ‘relevant contracts’ in place.

Ergo, payments made to these doctors were wages and payroll tax applied.

As a direct result of the Thomas and Naaz decision, GPs across the eastern states (which have harmonised payroll tax arrangements) realised that they were potentially liable for payroll tax on contractors as well.

Related

Cue 18 months of lobbying from the RACGP and AMA.

One by one, the tax offices in different states released rulings on relevant contracts and payroll tax as applied to medical centres.

Deals were struck with state governments in Queensland, NSW, Victoria, South Australia and the ACT.

Tasmania and the NT never released rulings of their own and largely ignored the clarified laws.

WA goes it alone on payroll tax settings and has publicly said it does not intend to apply the tax to GP clinics.