The ACCC wants more feedback on Chemist Warehouse’s planned $8.8bn merger with Sigma Healthcare.

As it pushes ahead with its planned merger with Chemist Warehouse, drug wholesaler Sigma Healthcare has offered to release its franchised pharmacies from their agreements without penalty if the deal goes ahead.

This could give hundreds of pharmacies the option to freely quit the group and is part of a move by Sigma to address competition concerns raised by the proposed $8.8 billion merger.

The agreement also includes a pledge to protect the franchisees’ data from Sigma staff working with Chemist Warehouse should the merger proceed.

This story first appeared on Health Services Daily. Read the original here, or sign up for your discounted GP subscription here.

Sigma is one of the largest wholesalers of prescription medicines, over the counter and front of store products. Sigma is also a franchisor of pharmacies under banners including Amcal + and Discount Drug Store.

Chemist Warehouse is a franchisor, wholesaler and distributor to pharmacies and retail stores under its brands Chemist Warehouse, MyChemist, Ultra Beauty, My Beauty Spot and Optometrist Warehouse.

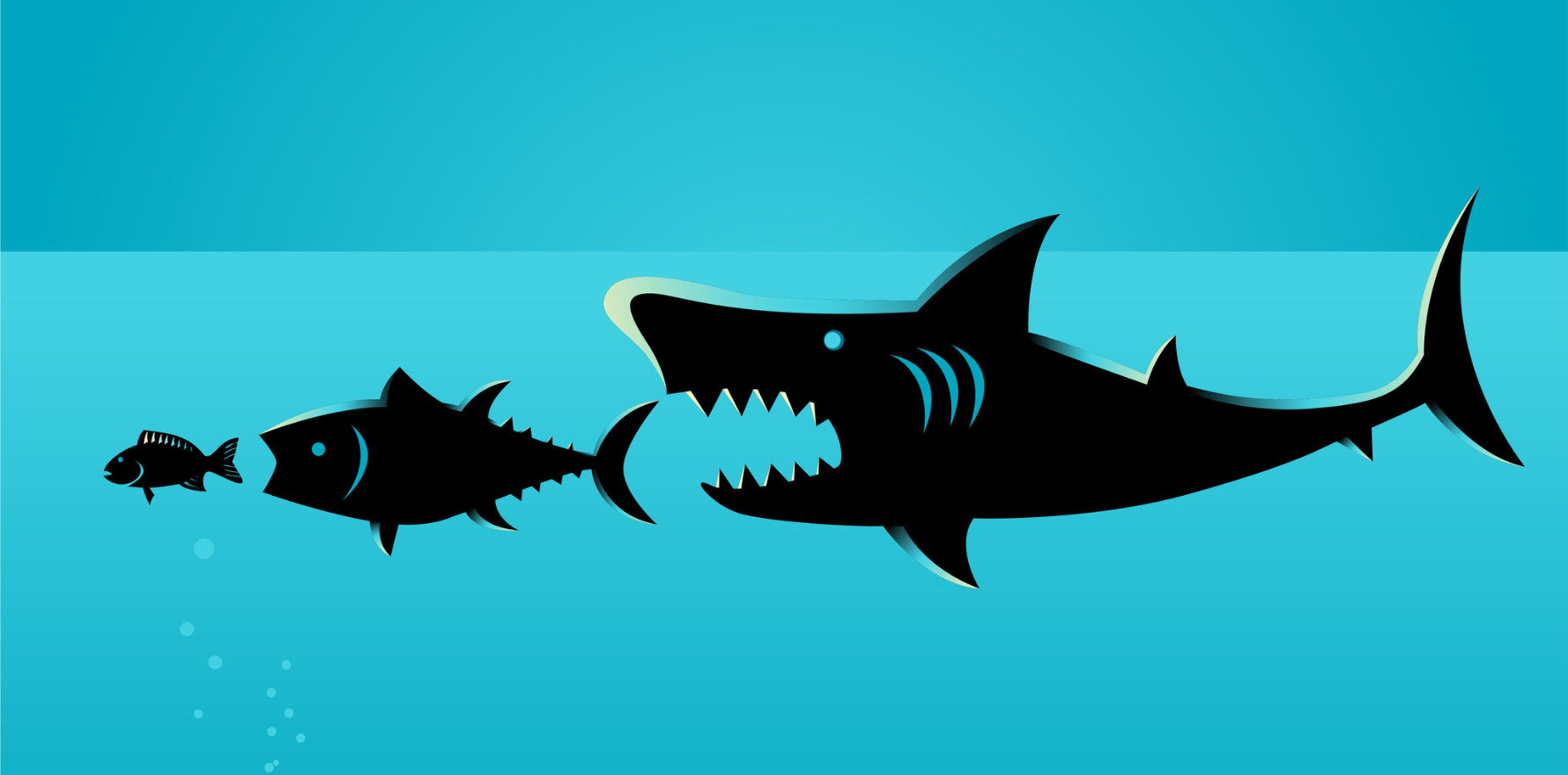

The Australian Competition and Consumer Commission released a statement of issues in June that identified a range of preliminary competition concerns with the proposed acquisition, including at the retail level and the impact of the proposed integration that would result across the wholesale and retail level.

These concerns included the potential harm to pharmacies currently supplied by Sigma and the potential for Chemist Warehouse to access these pharmacies’ data in ways that damage competition.

In response to this, Sigma has offered a court-enforceable undertaking that would require the company to:

- Not prevent or hinder franchisees who entered into their franchising arrangements prior to 1 January 2024 from terminating their franchise agreements with Sigma, for a period of three years. Sigma will waive its right to recover contributions Sigma has made under its franchise agreements and future fees payable to Sigma if these franchisees choose to terminate their agreements.

- Place restrictions on the collection, use and disclosure of confidential data and information from Sigma wholesale customers and franchisees for a period of three years.

- Remain a participating pharmaceutical wholesaler under the Commonwealth Government’s Community Service Obligation (CSO) arrangements for at least five years. The CSO arrangements contain service standards and compliance requirements for wholesaling of prescription medicines to all pharmacies.

The ACCC has now called for community and industry comment on this proposed undertaking, said the commission’s chair Gina Cass-Gottlieb.

“We are now seeking feedback from stakeholders on whether the draft undertaking offered by Sigma may be capable of addressing the competition concerns arising from its proposed acquisition of Chemist Warehouse,” she said.

She said the ACCC was continuing to investigate the impact of the proposed acquisition.

Related

“While the ACCC is publicly consulting on this undertaking, this should not be interpreted to mean that this or any other form of undertaking will ultimately be accepted by the ACCC,” Ms Cass-Gottlieb said.

The ACCC invites submissions on the proposed undertaking by 14 October. The draft undertaking incorporating the proposed remedy can be found here.

The ACCC has also pushed out its decision on the deal to 7 November, almost three months later than it had originally been expected.

Under the application being considered by the ACCC, Sigma is proposing to acquire Chemist Warehouse in a transaction that is in effect a “reverse acquisition” of Sigma by Chemist Warehouse, resulting in an ASX listing of Chemist Warehouse.

Sigma is set to acquire all the shares in Chemist Warehouse in exchange for Sigma shares and a $700 million cash consideration. Upon completion of the proposed merger, Chemist Warehouse shareholders will hold 85.75% of the ASX-listed merged entity while Sigma shareholders will hold 14.25 per cent.

Sigma is an ASX-listed wholesaler and distributor of prescription medicines (including Pharmaceutical Benefits Scheme prescriptions), over the counter and front of store products to more than 4000 community pharmacies nationally.

Sigma also owns and operates MPS Connect Pty Ltd which offers medication packing services and management solutions to pharmacies and aged care providers. Sigma holds 51% of the shares in NostraData Pty Ltd which supplies technology and data analytics solutions to pharmacies, wholesalers and manufacturers.

Chemist Warehouse is an unlisted Australian public company. It is a franchisor to approximately 600 pharmacies and retail stores. Chemist Warehouse executives also have direct ownership interests in a large number of Chemist Warehouse pharmacy stores. Chemist Warehouse provides brand and support services to its franchisee pharmacies and owns private label product brands which it sells online and supplies to its franchisees. These include Wagner, Bambi Mini, Barely, Bondi Protein Co, Inc, and Goat.

Our sister publication Health Services Daily first reported on the proposed mega-merger in December last year, with Chemist Warehouse co-founder and chief executive Mario Verrocchi telling the Australian Financial Review that the retailer could become the next Walgreens or Boots and expand rapidly overseas from the merger.

He described the listing, which is part of a 100-year growth strategy, as a “life dream”. Chemist Warehouse has more than 600 stores in its network. Together with his billionaire co-founders, Jack Gance and Sam Gance, Mr Verrocchi will own almost 50% of the combined company. Mr Verrocchi will remain chief executive of the Chemist Warehouse business as part of the merger plan.

“Everybody thinks that the 100-year plan is some sort of marketing gimmick,” he said.

“I actually believe it. I actually subscribe to it. And I live it every day. For the first 30 years, you do what you have to do in your own patch.

“The second 30 years, what I need to do now is set up the next chapter of our story in new markets overseas or whatever, and then the last 30 years it’s up to the younger generation. It’s got little to do with money. Without getting emotional and sooky about it, it’s just a life dream. I saw Boots, and I said that’s who I want to be.

“It’s only taken 50 years, but we’ve got there in the end. Almost.”

The Gance brothers bought their first pharmacy in Melbourne in 1972 and Mr Verrocchi joined them eight years later. The trio opened their first MyChemist branded store in 1997, followed by their first Chemist Warehouse in 2000.