Pfizergan, the merger of Pfizer and Allergan, falls victim to a US government ploy to chain Pfizer to America

Always the bridesmaid never the bride must be ringing in the head of Pfizer CEO Ian Reid this week the US government rushed legislation through congress that made the merger of Allergan and Pfizer uneconomic, and essentially chained Pfizer to US domicile.

It follows a similarly unsuccessful attempt last year to merge with AstraZeneca.

Allergan CEO Brent Saunders was so unimpressed he called the whole saga “un-American”.

“For the rules to be changed after the game has started to be played is a bit un-American, but that’s the situation we’re in,” he said in a live cross to US financial TV channel Squawk Box.

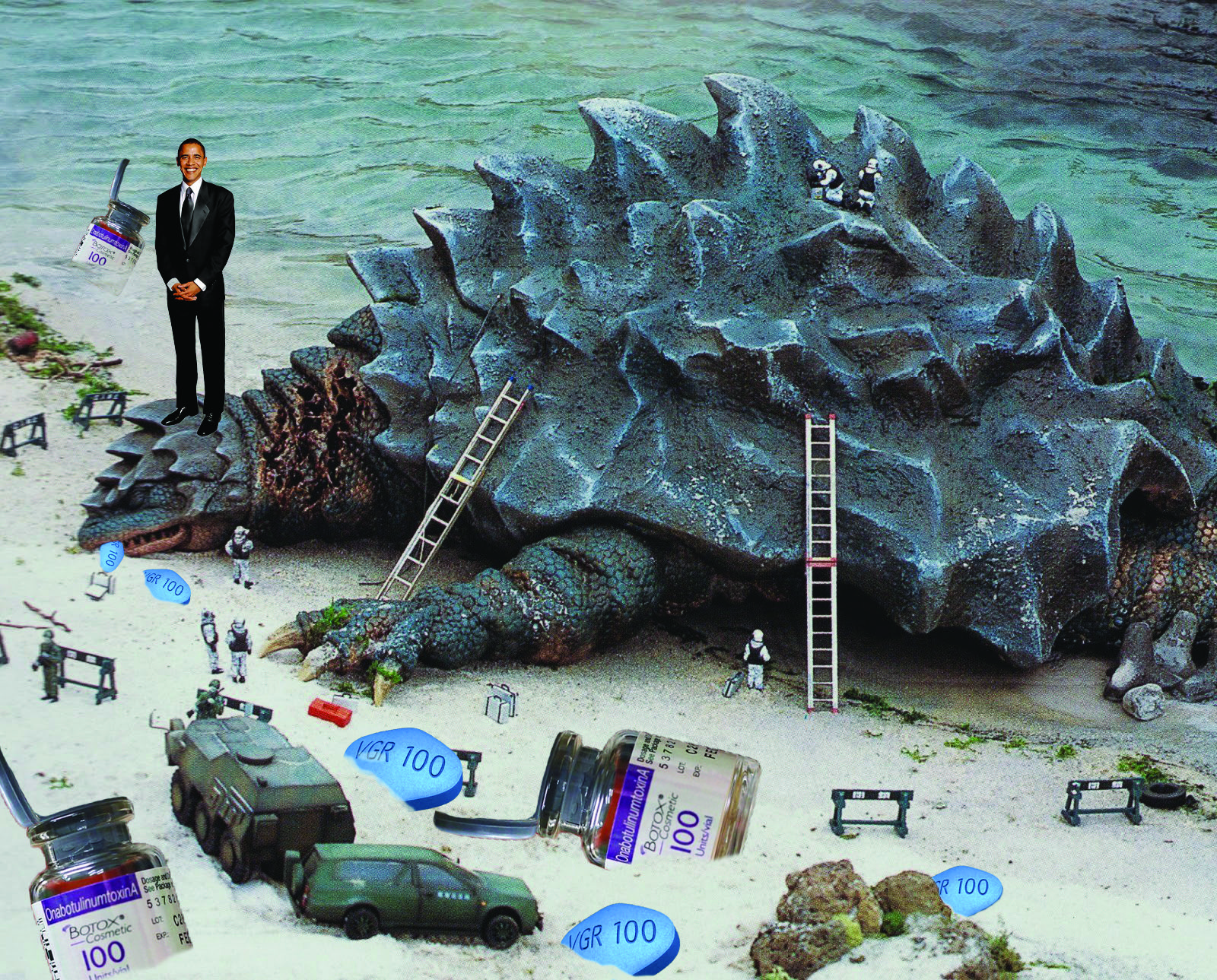

The $US160 billion tie-up, which was terminated on 6 April, would have formed the largest pharmaceutical company in the world. By combining with Dublin-based Allergan, Pfizer could have accessed lower tax rates in Ireland, using a loophole known as corporate inversion. The deal would have given Pfizer access to Allergan’s strong line of products, including Botox, Restasis and Linzess.

Pfizer’s board decided to kill the deal after the US government pushed through reforms to crackdown on corporate tax avoidance. These proposed new rules would make it harder for Pfizer to switch jurisdictions for tax purposes.

“The decision [to terminate the merger] was driven by the actions announced by the US Department of Treasury on 4 April,” Pfizer said.

The Pfizer-Allergan tie-up had been the subject of criticism by Democratic and Republican presidential candidates. While the White House denied the new rules were targeted at a particular deal, President Barack Obama has slammed corporate inversion, calling it one of the “most insidious tax loopholes out there”.

Allergan will receive $US150 million from Pfizer to cover the expenses involved in planning the acquisition. Both companies share prices rose after the announcement the deal was off.

Allergan is currently finalising the sale of its generic drugs business to Teva Pharmaceutical Industries, which will free the company of accumulated debt.