Everything you need to know about the income-protection policy changes and how they might affect you.

If you’re a GP who’s held an income-protection policy for some time, you would have no doubt seen your premiums rise in recent years.

We have seen insurers continue to record losses on income protection over the past few years, leading their regulator, the Australian Prudential Regulation Authority (APRA), to intervene to ensure the long-term sustainability of the industry.

Why do premiums keep rising?

Some of the issues that have contributed to the challenges include:

- A highly competitive marketplace

- Generous policy terms and conditions, and underwriting

- Increased insurer capital requirements

- Record-low interest rates

This has led to substantial increases in claims paid and all of these factors have resulted in significant losses and rate increases. In response, APRA has mandated some of the most significant changes ever seen in the Australian personal insurance industry.

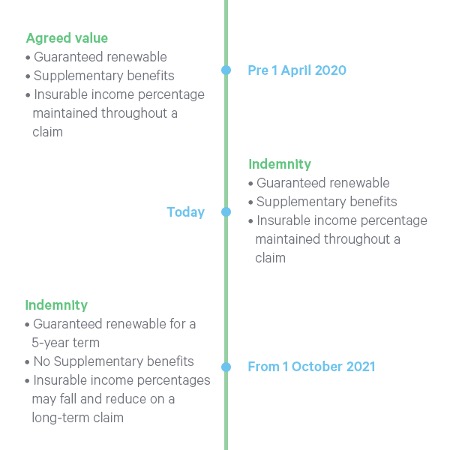

What changes have already been introduced?

The first step in the significant changes was APRA’s direction to insurers to remove agreed-value income-protection policies from sale to new customers as of 1 April 2020.

Policies from 1 April 2020 have been offered on an indemnity-only basis, meaning the policy owner has to provide evidence of income to support the insured monthly benefit at the time of a claim. While these polices are more restrictive than the previously available agreed-value contracts, proof of income for these policies is generally based on the best 12 consecutive months of income, up to 36 months prior to disability.

Are there more changes coming?

The most significant change that will start in October 2021 will see insurers able to offer only new indemnity income protection policies, where the evidence of income is required at the time of claim, and will generally be based on the 12 months immediately prior to disability. There are likely to be extensions available to this time frame for periods of unpaid leave (such as parental leave) of up to 12 months.

A look at the changing landscape

How will the changes affect me?

Most insurers are still designing their contracts and these are likely to be released later in the year. However, what we do know is that these contracts will be much more restrictive than policies currently available, as well as the agreed-value polices that were offered prior to 1 April 2020.

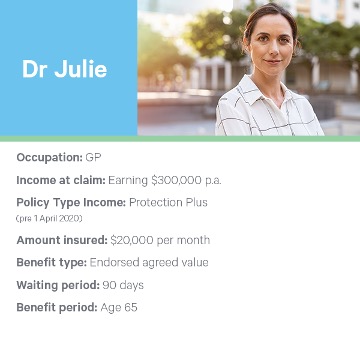

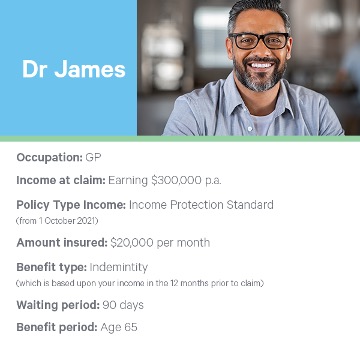

To put these changes into context and highlight the possible differences between the cover, we explore the three types of policies below with Doctors Julie, Kim and James.

Scenario 1 | agreed value and indemnity policy variations in the event of a claim

After suffering a significant back injury requiring surgery, the doctor is unable to work for six months before returning to work at full capacity post recovery. In the 12 months prior to their injury, patient appointments had been down significantly because of a temporary move to telehealth appointments only during the global pandemic, causing their income to drop to $200,000 p.a. (rather than the $300,000 they had been earning previously).

| Dr Julie | As Julie has an agreed-value policy and she provided evidence of income at application, she is not required to provide further evidence when she makes her claim. So even though Julie’s income had reduced recently, she would still receive the agreed-value benefit of $20,000 a month. |

| Dr Kim | Kim has an indemnity-style policy, which requires her to provide evidence of her income at claim, where she will be paid a maximum of 75% of her insurable income. Kim’s insurable income is based on her highest-earning 12 consecutive months of income in the past three years, which is $300,000. Therefore, she will be paid 75% of this, which equates to a benefit of $18,750 a month. |

| Dr James | James has a new indemnity style policy which requires him to provide financial evidence at the time of claim and will provide benefit payments of up to 70% of his insurable income over the last 12 months. Since James’ income has fallen, he will be paid 70%* of his insurable income of $200,000 which equates to a benefit of $11,666 per month. |

Key takeaway

An agreed-value benefit can provide more certainty of the amount you will be paid in the event of a claim. The indemnity policy is not guaranteed, so there is a risk that you may receive a lower amount than you are insured for and/or expect in the event of a claim. It is also important to note that a stricter definition of disability will apply to the policy post October 2021.

*The above and following illustrations are based on a recently released product called AIA Core Income Protection. This product allows for 70% of your income to be insured; however, APRA guidelines have indicated that insurers may be able to provide up to 90% of insurable income in the first six months of a claim with a required decrease to at least 70% thereafter.

Scenario 2 | long-term claim benefit variations

After a horrific car accident, the doctor suffers serious head and eye injuries that result in significant vision impairment that prevents them from working again as a GP.

| Dr Julie | Julie will receive her benefit of $20,000 per month (indexed) until she turns age 65. |

| Dr Kim | Kim will continue to receive her benefit of $18,750 per month (indexed) until she turns age 65 as her pre-disability income was based on her highest-earning 12 consecutive months of income in the three years prior to claim. |

| Dr James | James’ policy will provide him with 70% of his earnings in the 12 months immediately prior to claim, which equates to $11,666 per month. It is also likely that under the new APRA rules, the definition of disability will become more restrictive for longer-term claims (perhaps even as soon as after two years on claim). |

Key takeaway

In the event of a long-term claim, an assessment under a comprehensive agreed value or a current indemnity policy provides protection against a short-term fall in income. The policies available from October 2021 will have a stricter definition of indemnity and a requirement to change the definition of disability and/or have your payments reduced at some point, in the event of a longer-term claim.

Scenario 3 | claiming supplementary benefits

The doctor has a skiing accident while on holidays and breaks their lower leg. They are off work for only a few days before returning at full capacity.

| Dr Julie | Julie has a Comprehensive or “Plus” policy, which includes a specified injury benefit that entitles her to two months of her monthly benefit payment (even though she is back at work and did not meet her waiting period). She will therefore receive a $40,000 benefit payment. |

| Dr Kim | Kim also has a specified injury benefit as part of her policy, and therefore she will be entitled to a benefit of $40,000 even though she is working and has not met her waiting period. |

| Dr James | James’s policy is not able to include a specified injury benefit; therefore, he is required to be off work for longer than his waiting period to receive a benefit. As he was not off work for longer than 90 days, he would receive no benefit under his policy. |

Key takeaway

Policies that are issued prior to October 2021 allow you to have a comprehensive policy that includes supplementary benefits (such as the specified injury benefit), which can be paid even when you have not met your waiting period and if you continue to work. From October 2021, these benefits will not be available because of the changes mandated by APRA.

Scenario 4 | future rate increase predictions on different policies

During their annual insurance review, the doctor enquires about the expected long-term forecast on premiums for their policy.

| Dr Julie | Julie’s agreed-value comprehensive policy has proved to be unsustainable; therefore, APRA mandated that it be removed from sale. There is an expectation that the premiums will continue to rise due to the unprofitable nature of these policies. |

| Dr Kim | With Kim’s current indemnity policy, there is an expectation that these policies will be more sustainable than agreed value policies over time. However, as her policy is also a comprehensive policy with more generous definitions of disability and pre-disability earnings, it is still possible that they will be subject to profitability pressures and premiums may continue to increase. |

| Dr James | James’ policy is more restrictive and is less likely to be subject to profitability issues. Therefore, it is more likely that his premiums will be more stable and predictable, moving forward. |

Key take away

Predicting future premium increases is very difficult because of the range of factors that affect the profitability of income-protection policies.

Scenario 5 | requirement for limited underwriting every five years

Six years after obtaining their policy, the doctor’s personal circumstances have changed, and they are unsure if they are required to disclose this to their insurer or how their cover will be affected.

| Dr Julie | Julie’s policy is a guaranteed reviewable policy, which means the terms and conditions cannot be altered to her detriment, provided she continues to pay the premium and does not let the policy lapse. This means Julie could change her occupation, take up smoking or a hazardous pursuit such as skydiving and her policy will not be affected. |

| Dr Kim | Kim’s policy has the same guaranteed renewable nature as Julie’s policy and therefore there is no requirement for her to disclose any changes after she is initially underwritten for the policy. The policy terms and conditions cannot be altered to her detriment. |

| Dr James | James’ policy has a five-year guaranteed renewable term, at which time James can elect to continue the policy for another five-year term based on the policies available at that time. The policy will not be medically underwritten; however, James will need to provide information relating to his occupation, income and pastimes. His sum insured may be reduced, his occupation rating (affecting premiums) may change and exclusions may apply to pastimes. |

Key takeaway

A five-year guaranteed renewable policy term and the requirement to be partially underwritten every five years is a significant change in the retail insurance industry. If you are taking out a policy after October this year, it important to be aware of this requirement and how this may affect your policy terms and conditions in the future.

Income-protection policies are changing – understand your options before it’s too late

The APRA changes have increased the complexity of comparing the features and benefits of income-protection policies.

If you currently have, or are thinking about obtaining, income protection, now is the time to speak to a specialist insurance adviser to discuss your options. Investigating your options now will allow you to weigh up the benefits of the current more comprehensive policies, compared with the more restrictive policies that will be available from October 2021.

To learn more about the changes and get a better understanding of how you may be affected, call 1800 093 485 or click here to listen to insurance consultant Tom Rogers discuss the upcoming changes in a 10-minute podcast.