The latest payroll tax amnesty that the RACGP is hailing as a victory is really just a way to scare practices into doing the revenue office’s work for it.

This week the South Australian revenue office Revenue SA announced it would follow the path of Queensland and give practices a one-year amnesty on payroll tax audits.

This was followed by a similar series of self-congratulatory positioning statements from the RACGP that we saw when Queensland announced its amnesty.

Another great win for GPs in the great state payroll tax ripoff, apparently.

It’s pretty hard to see how GP owners in that state are winners, though, or in any state that goes the same way.

If you take South Australia, in one year’s time it is the clear intention of that state’s revenue office to have flipped a large proportion of GP practices into paying payroll tax.

That’s a good get for a state government agency that until this week was doing virtually nothing in the space, probably has very little capacity to do large-scale auditing anyway, and which so far at least is collecting virtually no payroll tax from practices which are operating a services entity model, where their GPs are being paid as if they are tenants, not employees.

Just put out a note to every GP in the state, scare the living crap out of them, get them to send you all their employment contracts and practice flow information now, when likely many of them haven’t had the chance yet to fix things, so such information may well be incriminating, and start adding up the money that you probably had no capacity to chase properly before.

Today virtually no practices in SA are paying payroll tax – not even one practice has been audited for it – but if all goes according to the SA revenue office plan, in one year a large proportion of them will be.

How exactly is that a win for GP owners (which is what the RACGP seems to be spinning), especially given how the college argues that adding payroll tax to most practices’ margins would send them hurtling towards insolvency?

Feels like an all-round loss, not a win.

It gets worse, of course.

The only possibly significant carrot in the whole state revenue office offer is that if you dob yourself in now, then you might not get stung for the last five years of not paying payroll tax.

RevenueSA hasn’t actually come out and said it is going to do this, but according to the SA RACGP chair, who has been talking to the office directly, it is going to do that. It’s what the QRO did as well.

That is a pretty big carrot and likely the major motivator for many practice owners to just give up.

Paying payroll tax going forward is one thing, but doing it and paying a giant back tax penalty is almost certainty fatal for a practice.

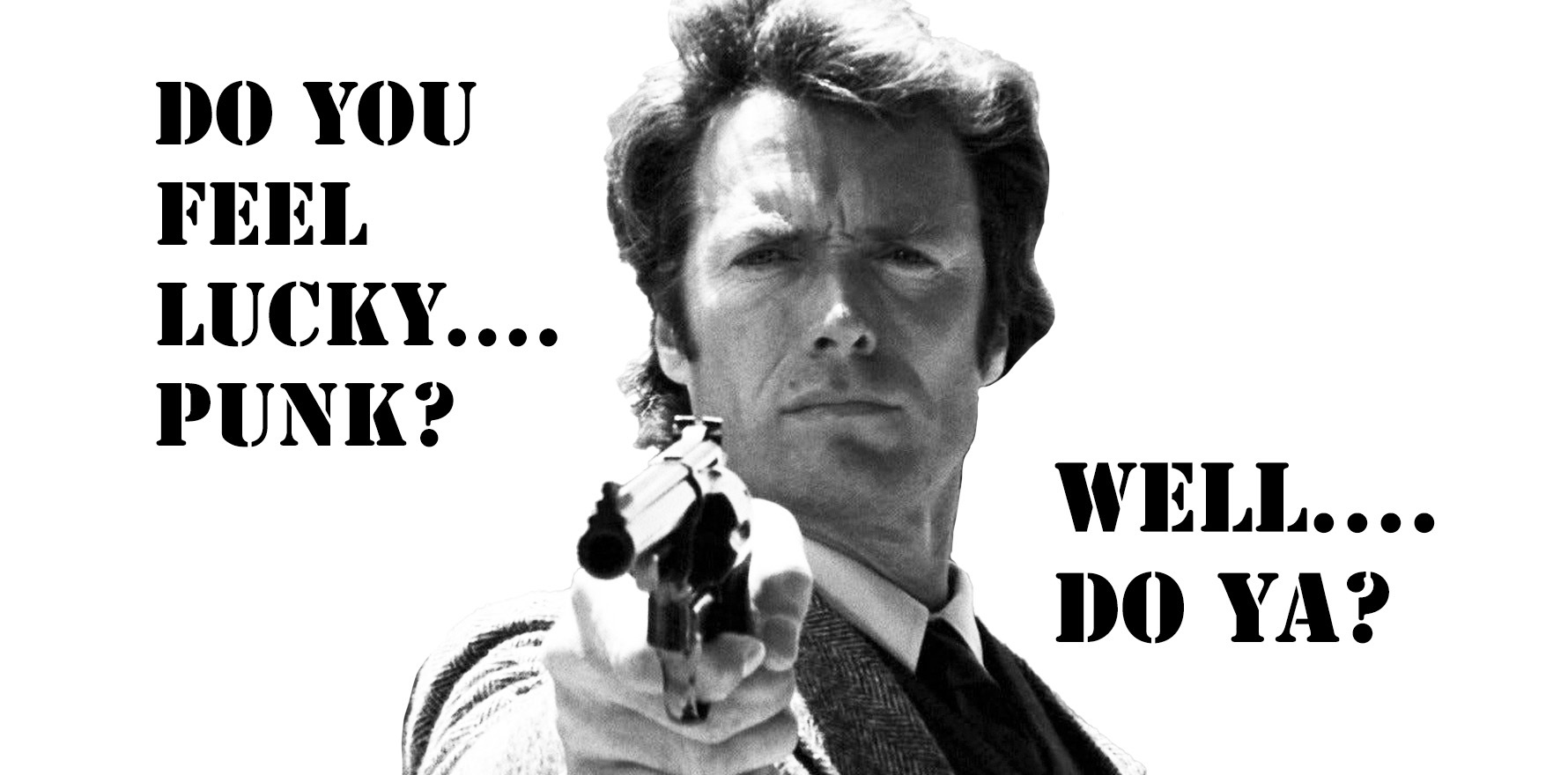

Dirty Harry, revenue officer

The way it’s being sold to practice owners by the SROs is very Dirty Harry.

“I know what you’re thinking, punk. You’re thinking, do these guys even have the manpower to audit me before I can fix up any loopholes in my processes and structure that I currently have? You’re thinking, they haven’t audited anyone in all these years so far in any case. You’re thinking, even if they do start auditing, would they ever get to me given how many they’d have to do? Well, seeing as this here state revenue office is the most powerful tax authority in the land, and seeing as we are now all excited about our a big new revenue stream, if you don’t dob yourself in now, and we do get to you, and audit you going backwards five or so years, such an audit will blow your practice’s commercial viability clean away. Well, punk? What ya wanna do? Go ahead: make our 2024-28 budgets.”

This is actually a pretty neatly couched threat if you think about it.

And yet, to listen to the RACGP, you’d swear these state revenue offices were doing everyone a big favour by establishing these amnesties and the college was doing a great job by constantly lobbying them to do it.

Remember, until the announcement this week (RevenueSA didn’t actually announce it, the RACGP did), not even one GP practice in South Australia had been subject to a payroll tax audit.

One very clear effect of these amnesties is immediate fear and anxiety for nearly every practice in a state.

What exactly is the risk if you don’t dob yourself in today, wait a bit, get some professional advice on exactly what is going on, and perhaps, fix what you need to fix to meet any revenue office audit, should it ever come one day?

It’s very hard to know. This is the grey ground of fear that the revenue offices are playing on.

It’s very hard to see how in any way these amnesties are a good thing for GPs (although there is one big owner category exception which we will discuss below).

Think before you leap

Principal at practice advisory firm HealthAndLife David Dahm came out this week and warned all GPs to take a very deep breath before pulling the trigger (Dirty Harry pun intended) on dobbing yourself in immediately.

Dahm has done his usual digging into past legal cases, and checked a few things with lawyers, and has some worrying theories about what could actually happen to a practice that puts its hand up too quickly to apply for amnesty.

The most concerning thing Dahm says (we will publish his full thoughts next week) is that depending on your circumstances, a state revenue office may look at your setup and decide that you don’t actually qualify for amnesty and just put you on a list to work on immediately, which would of course put you on the hook for an audit going back potentially many years.

Dahm reckons that if you read the fine print on the amnesties they aren’t as straightforward as they are being pitched.

He told TMR that the QRO amnesty was “deceptively straightforward”.

“The QRO could easily withdraw an offered amnesty based on information a practice provides them, and if that happens it would be incredibly difficult to retract the information you provided them and you would be immediately exposed.”

An example of where payroll tax amnesty might be refused, according to Dahm, is if the SRO deems that you have engaged what is termed “common law employees”.

“In the absence of carefully written service or independent contractor agreements, your doctors could be deemed to be taxable employees based on a recent full Federal Court ruling on the matter,” he said.

Dahm quotes the case JMC Pty Ltd v Commissioner of Taxation[2023] FCAFC 76 as an example of how this could happen.

Another example of where an SRO might simply refuse to provide amnesty, he says, is in the QRO’s wording that an amnesty will only apply to businesses that are considered “medical centres”.

As straightforward as that seems, Dahm says practice owners need to understand what the QRO defines as a “medical centre”, because how they are set up may not meet that definition.

The QRO amnesty explicitly excludes specialist and allied health practices.

Dahm told TMR that the question of whether you fold to an amnesty offer or not was unfortunately a pretty complex one and that professional accounting and legal advice should be sought first.

He said that in a lot of cases, practices were either already compliant based on their processes, structure, payment flows and contracts, or they would be able to become compliant with not too much work.

“If those practices that aren’t far off compliance got spooked into folding on day one of an amnesty announcement it would be pretty unfair,” Dahm said.

“The way people talk about payroll tax these days, they make it sound like everyone isn’t compliant, but that is simply not the case.

“We work with a lot of practices which are either already compliant, some of which have already navigated payroll tax audits, and others who aren’t far off being compliant.

“People have to stop and think this through.”

The real winners here might be the big corporates (except for one thing)

Having said all this, there is one largish category of practice owners that may end up being much better off if the payroll tax amnesty trend continues to expand.

That category is the big corporates.

Many of the big corporates have for years operated business models which quite openly demonstrated centralised control of their doctor workforces with things like non-competes in contractor contracts, workflow processes with directives on how to optimise billings and patient flow, and even payment flow setups that screamed employees, not tenants.

In the past two years, beneath the waterline, most of these big corporates have been racing to try to adjust all of these issues within their businesses.

Many have issued new workflow directives, changed internal organisational processes, developed new contracts for new doctors which ditch all the incriminating command-and-control clauses, tried to renegotiate contracts with their older doctors (often unsuccessfully) and, of course, done a fair bit of work on how the money flows between a practice and doctors in their practices.

It’s a reasonably open secret that some of these corporates still have a long way to go to pass muster on a payroll tax audit – but that probably is not their biggest problem.

Their biggest problem by far is a payroll tax audit that goes back up to eight years or so.

Because if a revenue office was politically out of control enough to do such an audit on one of the big corporates, it would not matter if that corporate had all its i’s dotted and t’s crossed as far as ongoing compliance of a services entity model was concerned.

Going backwards most of them are dead in the water.

And because they are so big, the potential payroll tax liability, with penalties added, would be catastrophic to the value of these businesses.

So if you’re one of these big corporates sweating on whether a state government will actually have the political balls to have a go at you in an attempt to harpoon the equivalent of a great white whale in back tax liability, what is the one thing you would absolutely kill for?

A payroll tax amnesty that promises if you do a deal to start paying moving forward, then you won’t get a back audit for all your past bad deeds, of course.

If you’re a big corporate, you do not want to be flipping to having to pay payroll tax for all your doctors, for sure.

But if you had to choose between getting an eight-year back-tax bill and only paying it from now on, you’d jump at an amnesty, adjust all your billing settings and costs structures and wear the ongoing new levy.

The big GP corporates are not weak politically.

They probably make up more than 25% of all GP practices these days, or more, and probably even more in percentage terms of the GPs working today.

Taking them on would be a big political deal.

If you did it and succeeded you could instantly kill the entire general practice sector by knocking out so much of it, with a lot of it being in low socioeconomic areas which still do a lot of bulk billing.

This is very probably why we have so far not seen any of the lippy state revenue offices go after these very obvious, very naked and very high value targets.

One big problem would be left for the big corporate to navigate in this scenario: if they fold, what would happen to the individual tax returns for what were once tenant doctors, but going forward would be deemed employed doctors?

It’s a bit of a catch 22 for the big corporates. If they mitigate their state payroll tax problem in the manner described above, the ATO would have a line of sight to come after all their previously contracted doctors for not paying income tax properly.

Who’d be a GP corporate CEO these days?

Winners and losers in an expanded payroll tax amnesty ecosystem

If you believe any of the above hypotheses and step back for a second, some of what is going on in payroll tax amnesties might start to feel like it makes a lot more sense.

The most important windfall in copping to future payroll tax for some of these big corporates is business value and future sale value of their businesses.

Remember, some are owned and operated by private equity. Others by big private health insurers.

Who would buy a big corporate with the potential of a eight-year backward payroll tax case hanging over its head?

Much better for these organisations to take their payroll tax medicine and regear their billing and processes for more revenue from patients with less cost.

The difference between the value of these businesses in one scenario and the other is potentially massive.

So far it’s only Queensland and SA that have offered amnesties. These groups really would need Victoria and NSW to do the same thing before it became viable for them, you would imagine.

But you’d think that NSW and Victoria state revenue offices will eventually buy into this dynamic.

If they did, and the big corporates rolled over, then that’s at least 25% of GP practices paying payroll tax on all their doctors going forward.

That would be a massive win for all the state revenue offices.

It would also solve a pretty big political problem for state governments as well.

On the one hand they want the money, but on the other, they do not want to be the party that single-handedly destroyed general practice.

It makes you wonder: is it really the great lobbying of the RACGP driving these amnesties, or are SROs and state governments looking for a clever way to easily secure more revenue while not being seen to be the bad guys?

What about the independents?

Depending on your size and history, if you are not a big corporate, and therefore it’s not entirely obvious that your business model for, sometimes, decades, has been based on command and control of your doctors, and therefore a backwards audit would likely be ruinous, then you are very likely in quite a different situation.

That situation is going to depend on a whole lot of factors about your current set up and your history.

But there is a very good chance that if you decide to throw your hat into the payroll tax amnesty lottery now, you’re going to come out a loser.

That would occur if you either are already largely compliant or close to it.

If you are able to become compliant two things can happen:

- You get audited and pass in which case you never have to pay payroll tax (although they may be nasty and go backwards to when you weren’t compliant)

- You never get audited because the reality is that unless a state revenue office has a hard lead on you being non compliant, and therefore has good reason to have a go at you, none of them have the capacity or resources to audit everyone properly.

That last point is most likely why they send out what are effectively broad ranging threats, through an amnesty announcement.

They’ll never be able to get to everyone, but if they can scare you enough to self-identify, as these amnesties are trying to do, in a manner they are tricking you into doing all the hard work for them.