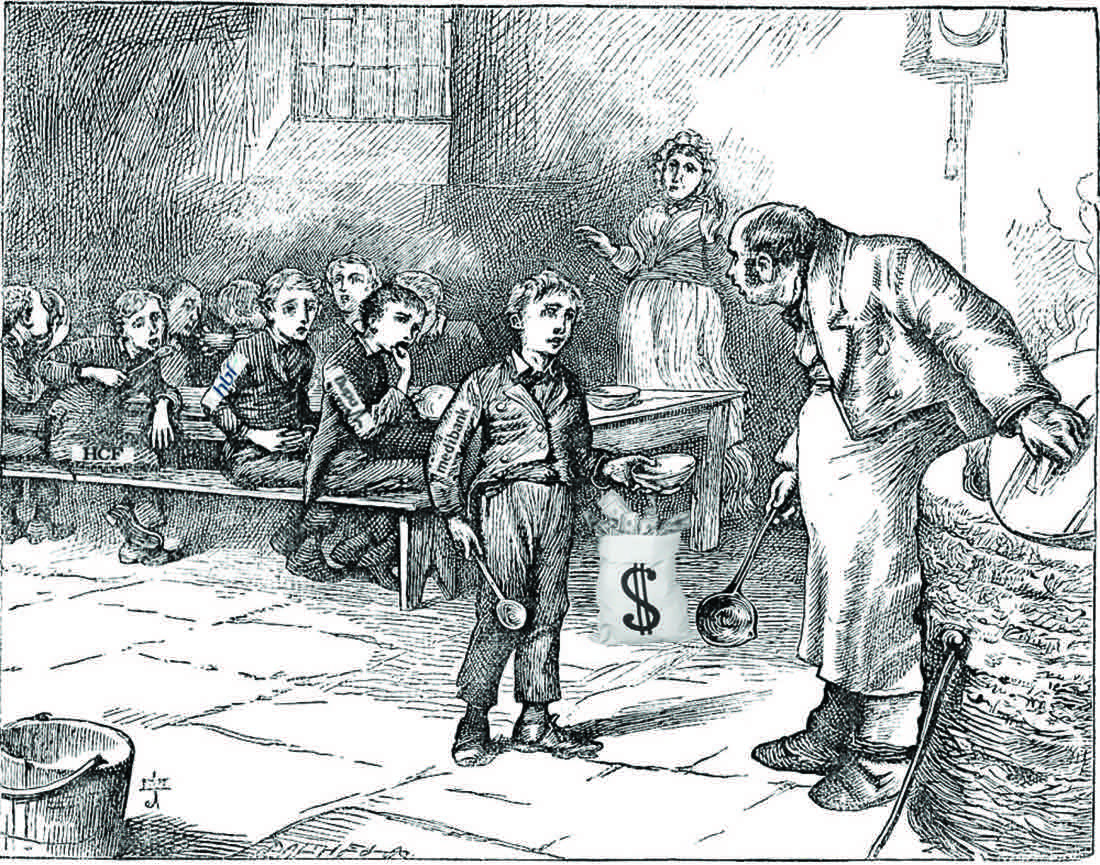

The private health insurance industry is coming for primary healthcare and if we don't get organised it could get ugly

Private health insurers are being quite open and aggressive now about being let back into funding primary care. And if you put aside that they are desperate, out of control and not to be trusted, some of what they suggest makes sense

The front page of our national newspaper, The Australian, last week featured two stories on the private health insurance sector which should have enraged most Australians. Essentially, we had our biggest national newspaper running a roundtable with CEOs from a selection of the private health insurers, and a few ring-ins for PR effect, and what message do you think emerged?

“You can make the system perfectly efficient and premiums will still go up somewhere around 4%. Somehow we need to condition the public to that reality.” That was Gerard Fogarty, Defence Health’s chief executive summing things up for us.

Apparently, Australians just need to grow up and learn to suck it up. Private health insurance premiums are going to go up by at least double the cost of living forever, and there is nothing anyone can do about it. Certainly not the struggling and well-meaning insurance sector. Nothing to see here. No conflicts, no party politics, no inappropriate commercial influence at play. Move on. The greater good has been served. Thank you, Rupert Murdoch, for your hard work with journalism.

If you are rich enough and influential enough, you can get our national newspaper to publish a fluff PR piece on its front page as hard-core news, suggesting the only solution to the impending health insurance crisis (their crisis, not ours) is to get us punters to “just suck it up”. And you can make a collective $1.3 billion in profits each year at the same time.

And this is despite the government subsidising you to the tune of $6 billion a year and your sector being bloated with too many capitally inefficient small players.

You have to suspect that the degree of social, political and commercial dysfunction going on here is somewhere near the stratosphere.

The insurers try every argument to maintain their profitability and existence.

So, almost by accident, we see that some of their efforts are actually directed at sensible system changes: such as the pricing structures around prosthetics, changes to the profiteering of the private-hospital sector, penalising the public hospitals for returning patients which they didn’t fix properly in the first place, and so on.

But this isn’t out of the goodness of their corporate hearts, as the piece in The Australian seems would have us believe. It’s all about shareholder returns (profitability) and sustainability of commercial entities. In other words, they are – quite normally for companies in their position – thinking more about their commercial survival, than the greater public good.

Which does make you wonder, what is the purpose of a private health insurance company?

If you collapsed the federal government 30% rebate tomorrow, it would be interesting to see what would happen. The insurers would say Armageddon, of course. And you’d have to think that there would be a fair amount of slaughter among the commercial players. But you do wonder if real market forces might not kick in. Real pricing signals might actually have some effect, and this might eventually lead to a resetting of the system to the benefit of us all.

Maybe if there was an appropriate short to mid-term safety net for us poor old punters, who would be the most likely collateral damage, it would be feasible.

But that is way too politically risky.

If you’re in the Liberal Party, it would appear you are biologically unable to precipitate such a crisis. At least according to Tony Abbott, who was famously quoted when leader of the party as saying that private health insurance was in the DNA of the party. Which was an interesting way of skirting the economic and social implications of a blind and mindless support of the sector. Not that Labor is a great deal better. Mediscare was born in the depths of cynicism. Who can you trust?

Private health insurance is complex, right? Too complex for us all to accept this sort of palaver?

If you think, as a GP, you’ve got enough problems (you do, we know) without trying to shift this wickedly complex issue into in something that vaguely resembles a better return for the Australian community, yourselves and your patients, here are a few things you might want to consider when deciding whether to expend any energy in this direction.

The insurers are being quite open and aggressive now about being let back into funding primary care. Apparently, they’re pining for the 1960s and early 70s.

The managing director of BUPA, Richard Bowden, is quoted in last week’s article as saying one key to sustainability of the sector is out-of-hospital funding options, specifically, primary healthcare.

“Our influence could be more if we were allowed to interact more directly in terms of funding GPs and specialists outside the hospital setting,” he said.

“Finding a way to get outside the hospital setting is probably the biggest enabler for us to add value and drive change.”

Could this be code for “access new sources of income and new levers for profitability”?

Not withstanding, Bowden’s arguments have some grounding in sound logic for the overall efficiency of our healthcare system. If you are a chronic disease patient, then GPs are recognised as the best chance to keep that patient out of the far-more expensive hospital system, where the insurers mainly play. The insurers point out, quite reasonably, that they should be able to have influence in this essential part of the system if they are to keep overall premiums down.

In market terms, optimising patient outcomes in primary care is potentially the most effective way to rein in costs. Even the RACGP is receptive to this idea. Probably because it thinks this may be a way of getting GPs better paid.

Dr Michael Wooldridge, who served as health minister in the Howard government, and who is generally seen as the architect of the 30% premium subsidy, argued in The Australian article that it was completely ideological to keep insurers from funding primary care.

I guess that is to be distinguished from the “it’s in our DNA” ideology.

It’s very hard to find someone who hasn’t got some form of conflict when thinking about reshaping private health insurance.

Remember, this is an industry that is struggling and desperate to retain a hold on their profits and influence. Letting them into general practice as a single point solution would at the very least, be risky.

The whole of this mess needs to be examined in its entirety to guard against unintended consequences.

By the admission of the ex-chief executive of the Private Health Insurance Administration Council (the PHIA got subsumed by Australian Prudential Regulatory Authority last year), Shaun Gath, private health insurance is “a zero-sum game”.

“You can’t pursue lower premiums without affecting someone down the supply chain,” he says.

Who might that someone be, I wonder?

One thing seems certain, if you let these guys loose on primary care without a very good plan and forethought, GPs and their autonomy are at risk.

I think we can say that given the past few years of MBS rebate freeze, GPs and primary care has sacrificed quite enough already at the altar of improved healthcare cost control.

Of course, the insurers’ “back-to-the-future” primary healthcare strategies should come as no surprise to anyone. They’ve been dabbling at the edges of general practice now for a couple of years. Witness partnerships with groups such as IPN in chronic care management, something that on the face of it is sensible, but could be viewed as simply skirting prohibition on insurers entering primary care.

Some claim what they’ve done already are breaches of the Healthcare Act. And there are plenty of stories of the insurers thinking about vertically integrating – buying into corporate GPs or forming their own version – in order to get some leverage at this end of the healthcare market.

One way to think about insurers and GP involvement in this debate might be to take this issue right back to the ground zero of our possible healthcare cost and funding future.

The main challenge facing the system in the long term is management of chronic diseases, which we all know is going to be complex, continuous and must be co-ordinated over the whole spectrum of care to optimise efficiency.

So, in a very big sense, if the insurers are to remain part of this system it is inevitable that GPs will need to deal with them in some way.

At this stage, things are just a mess of self-interest, politics and the normal short-sightedness you get these days with big corporates who are beholden to short-term investor demands.

Some of the stuff these CEOs are saying they surely don’t really believe. It’s banal, corporate speak. Surely there is a greater purpose in keeping healthcare in good nick for everyone.

We haven’t actually had a proper review of the private health insurance sector for 50 years. I’m discounting the Sussan Ley effort which was announced in late 2015 and promptly disappeared from our radar screens, never to re-surface in any meaningful form.

Given where we are with digital disruption in healthcare, wouldn’t it be time?

Overseas, you do see the private health insurance sector driven by data (not DNA, thank heavens). But that is in the context that funding is mostly premised on outcomes not volume. Outcomes is not how our primary care system is working today.

All these things are connected. Chronic care and medical homes is an outcomes-based funding model. We might even get to funding this initiative one day. And when you start funding to outcomes the power of data and our increasingly connected world come to the fore.

Connectivity, data and outcomes based funding, if we could get there, would change all our lives and the system for the better in a step change almost beyond comprehension. The insurers back such changes for obvious reasons. Opportunity to lever profit. FOr the punter it’s opportunity for lower premiums and better outcomes. The two things aren’t actually mutually exclusive.

But as things stand today with conflict, politics and self interest, such a world seems almost fantasy. The system is so interconnected and complex that the very idea of a “proper review” is overwhelming.

But overwhelming or not, if the sector is not going to be dismantled, which we are going to assume will be the case, at some point in the not too distant future, it’s going to end up being a much bigger player in primary care.

Which is why GPs engaging in the issue on a collective basis, sooner rather than later, is probably a good idea.

And no, you can’t trust them.